6 September 2024

By Majid Ahamed

About the Company

The e-waste collection, disposal, and recycling company offers comprehensive services for recycling electrical and electronic equipment (EEE) waste, such as air conditioners, refrigerators, laptops, phones, washing machines, fans, etc.

They are committed to managing large volumes of EEE waste and are capable of extracting all components from electrical items, including precious and semi-precious metals like copper, aluminum, iron, and more.

The company operates primarily in three segments:

- Electronic Recycling (70% of revenue)

- Service Charges such as EPR consultancy, disposal service charges, etc. (17% of revenue)

- Refurbished Electronic Items (13% of revenue)

Electronic Recycling:

The Electronic Products that cannot be refurbished, such as those that are obsolete or irreparably damaged are channelized to the dismantling unit, which involves collecting, sorting, dismantling, and recycling electronic products to recover useful materials like copper, Aluminium, Iron, Plastic, Zinc & Brass Scrap, etc. along with safe disposal of the hazardous elements recovered during recycling. Further, they provide Data destruction services and IT Asset Disposition services through Data Degaussing, Hard disk Shredding & Software Data destruction to ensure the security of confidential information on devices of the customer as data stored on IT assets must be securely erased to prevent unauthorized access or data breaches.

Extended Producer Responsibility Services (EPR) and other Consultancy Services:

Extended Producer Responsibility (EPR) is a policy approach in waste management where manufacturers, producers, or importers of products are obligated to take responsibility for the management of the products they introduce into the market, especially after those products become waste. EPR programs typically involve the collection, recycling, and disposal of products at the end of their useful life. Further, they provide other services, such as data destruction services. In order to protect data from being compromised, before loading the E-waste components for transporting to the recycling facility for recycling, the facilitators make sure to do all data destruction at the customer’s site only. This is especially important for devices like computers, smartphones, and storage devices.

Refurbished Electronics:

The Electronic Products that are still functional but outdated and require minor repairs are refurbished. It involves replacing defective components, updating software, and thoroughly cleaning the device to remove any signs of wear or damage, for which they have an in-house dedicated team. Once refurbished, these items are often sold at a lower price compared to brand-new products, making them a popular choice for budget-conscious consumers. They refurbish items like laptops, Desktops, etc. They have refurbished 7279 products, 9375 products, and 27184 products in F.Y. 2021-22, F.Y. 2022-23 and F.Y. 2023-24 respectively.

The Offer & Proceeds of the Issue

The company is looking to raise capital of around 51.2 Crores in total in the IPO, of all of them 51.2 Cr is the fresh issues where this amount would go inside the company’s reserve, in which 2.57 Cr is allotted for the market makers or dealers, and the remaining 48.6 Crores is giving for the public and institution to subscribe.

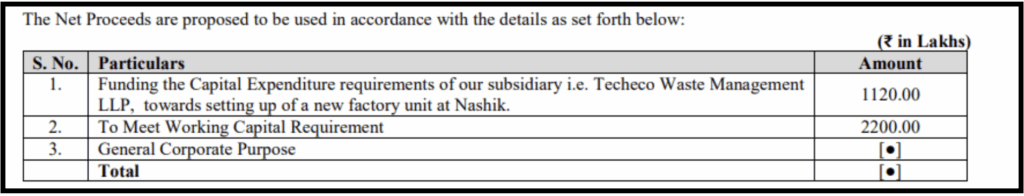

The fresh issue money will be allocated as follows:

- The company plans to spend ₹11 crore on capital expenditure, which involves investing in long-term assets with benefits extending beyond one year, particularly in its subsidiary, and for setting up a new factory unit in Nashik, whereby Lithium Battery Recycling Plant is proposed to be set up which will be used to recycle waste lithium batteries, such as cellphone laptop battery, cylindrical battery, EV battery, soft battery pouch, scrap leftover material of cathode, etc. and finally to get black mass, copper and Aluminium.

- An additional ₹22 crore will be allocated to meet the company’s working capital requirements, as it needs higher working capital for inventory and trade receivables.

- The remaining funds will be used for general corporate purposes, including but not limited to operating expenses, initial development costs for projects other than the identified ones, strengthening business development and marketing capabilities, and addressing contingencies.

Valuation

The company is targeting a market capitalization of ₹194 crore, with a P/E ratio of 28.4. In comparison, peers such as Eco Recycling trade at a TTM P/E of 106. The company’s revenue from operations has grown by 58% year-on-year, while profits have increased by more than 150% YoY. With strong tailwinds in the sector, the market opportunity for the industry by 2032 is projected to be in the range of US$5-6 billion. In such a large market, competition is intense, making it crucial to see how the company leverages its brand and scales its operations across different states to drive growth.

The company is also expanding into battery recycling, where the market size is expected to exceed US$1 billion by 2030. With a focus on EPR services and tightening regulations in the recycling business, the market size for organized players is expected to grow. The company is well-capitalized to take advantage of these opportunities going forward.