“Fueling Growth Through Cost Leadership and Expanding Reach”

About the Company

Krsnaa Diagnostics is a leading provider of radiology, pathology, and tele-radiology services in India. The Company has been instrumental in transforming the diagnostic landscape across the country. KDL offers a comprehensive range of diagnostic imaging services and clinical laboratory tests, playing a crucial role in disease prognosis, timely detection, diagnostic screening, recognition, and monitoring. With operations spanning across 17 states and union territories in the country, the Company operates on an expansive network of more than 1800 centres. The company operates primarily in Four segments:

- Radiology

- Pathology

- Tele-Radiology

- Retail Presence

Investment Rationale:

- The company is well-positioned to capitalize on a growing diagnostic market with higher government healthcare spending.

- Strategic expansion in the B2C vertical through forward and backward integration enhances growth potential.

- A strong business model, strategic investments, and a focus on margin expansion drive robust earnings prospects for the coming year.

History of the Company:

Source: Investor Presentation

Business Segments:

Radiology

The Radiology Segment is one of the highest margin segments, the Company offers a diverse portfolio of radiology services, including various imaging modalities such as MRI, CT scans, X-rays, Mammography, Bone Densitometry, Ultrasound, and Colour Doppler. The Company delivers the services through a network of 1,591 centers across the country.

As of H1FY25, this segment contributed around 45% of the total revenue for the company.

Pathology

The Company offers a wide spectrum of services, covering all major disciplines of conventional and specialised lab services. This includes biochemistry, hematology, clinical pathology, histopathology, cytopathology, microbiology, serology, and immunology. The Company delivers the services through a network of 2,015 centers across the country through a hub and spoke model. Additionally, Krsnaa Diagnostics has achieved accreditation from the College of American Pathologists (CAP), a prestigious recognition as the sole laboratory in India operating under the PPP (Public-Private Partnership) model to receive such certification.

Tele-Radiology

The Company operates India’s 1st NABH accredited tele-radiology reporting hub in Pune. This enterprise is equipped with advanced medico-grade monitors and technology, which play a pivotal role in the company’s operations.

Retail Operation

Krsnaa Diagnostics Ltd. has taken a strategic step to expand its presence in the Retail segment. Currently, the Retail segment contributes only 1-2% of the company’s overall revenue. Leveraging its existing infrastructure and resources in key locations such as Maharashtra, Punjab, Orissa, and Assam.

Geographical Classification

Management

- The company’s management is led by Mr. Rajendra Mutha (Executive Chairman) who has nearly 12 years in the industry of Pharmacy & Diagnostics.

- Mrs. Pallavi Bhatevara, Managing Director of the company, where is involved in the business right from the conceptualization stage to the execution stage like planning, monitoring all activities, and overall business and market development.

- Mr. Yash Mutha is the Whole Time Director of the company, he is a Qualified Chartered Accountant having experience over 14 years and has worked in Big4s and Global Investment Banks.

- The promoter currently has a 27% stake in the business, which is low for the size of the business but considering the fact the company is Private Equity (Phi Capital) Operated hence from the perspective it’s reasonable considering a strong education from IIT, IIM, CA, and other well-qualified professionals are in the management team.

- The company board comprises Experienced Board Members who are qualified Chartered Accountant, MBA grads from Premier Business School who have strong fundraising experience, operational experience as CEO of multiple listed companies, and an additional director appointed who has expertise in Law, which ensures the company’s corporate governance and internal controls are in place, with the highly qualified professionals.

Deep-Dive on the Investment Rationale

The company is well-positioned to capitalize on a growing diagnostic market with higher government healthcare spending.

The company is on the growing diagnostic market currently with an expected market size of US$ 15 billion which is expected to grow at a strong 14% CAGR in the coming 4 to 5 years, fuelled by factors such as the rising prevalence of chronic diseases, growth in geriatric population, demand for preventive tests, and higher penetration of government insurance schemes. The central government has increased its expenditure in healthcare where the expenditure has increased from 64,000 crores in FY20 to currently at 90,000 crores of allocation by the MoHFW (Ministry of Health, Family & Welfare)

The company is well-positioned to become one of the well-known players in the industry with a strong execution for the company where the win in the bid rate has been over 75%, with the Pan India focus where the company in the current quarter has awarded orders where in the coming orders from Odisha and Madhya Pradesh, and expected to additional 45 radiology centers and 731 collection services across the nation.

Strategic expansion in the B2C vertical through forward and backward integration enhances growth potential.

The company’s strategic focus on expanding in the B2C vertical through forward and backward integration enhances its growth potential. Currently, the B2C segment contributes 1-2% of the firm’s overall revenue as of FY24. However, with planned integration strategies, the company aims to unlock significant growth opportunities in the coming years, potentially driving exponential revenue growth.

As part of this strategy, the company has entered into a strategic partnership with United Imaging. Through this partnership, Krsnaa benefits from special financing terms, allowing an initial 10% payment for equipment, with the remaining balance paid in a staggered manner over the next six years. This arrangement not only supports margin expansion but also aids in improving cash flow conversion for the company.

In addition, a partnership with Medikabazaar, India’s largest B2B healthcare procurement and supply chain solutions provider, will enable the company to extend its reach to Tier 2 and Tier 3 cities across the nation. This partnership, valued at over ₹300 crore, aligns with the goal of making healthcare more accessible to all.

With a robust marketing and outreach strategy, supported by strategic tie-ups with existing hospitals and collection centers under the PPP model, the company is well-positioned to scale its B2C vertical faster. Powered by advanced technology and an expanded market reach, the company is poised for significant growth in the next 3-5 years.

Although the segment is in its early stages and no concrete projections are available yet, the company’s strong market presence and strategic initiatives ensure a promising trajectory for scaling the B2C business.

A strong business model, strategic investments, and a focus on margin expansion drive robust earnings prospects for the coming year.

The company operates on an asset-light model following the Hub and Lab Model (HLM). Under this model, the company efficiently provides diagnostic services in Tier 2 and Tier 3 cities. Samples are collected at collection centers and transported to centralized hubs, where they are processed to deliver accurate and timely results to patients.

This approach has allowed the company to scale its business profitably while maintaining a strong PAN-India presence. Strategic investments in Public-Private Partnership (PPP) cancer-focused hospitals further position the company for sustained growth. The company is particularly focused on radiology and pathology within the oncology segment, a key growth area due to the increasing incidence of cancer in the market.

As part of its expansion, the investee company plans to open 2 hospitals starting this year. In the most recent conference call, management indicated plans to invest ₹30 crore for a 23.53% stake in a hospital. Additionally, Krsnaa Diagnostics has become the exclusive diagnostics partner for Apulki Healthcare Private Limited, securing high revenue visibility for the next 30 years in advanced diagnostics, particularly in cancer and cardiac care.

Over the coming years, the company expects to launch more than 10 hospitals, reinforcing its growth trajectory and expanding its presence in advanced healthcare diagnostics.

Risk/Threats

Higher Working Capital Days:

The High working capital days are there as this is business primarily in the B2G business where the working capital has increased massively due to the problems in the cash conversion in some of the government customers, this is a major concern for the business as this the company is reliant on the government any major effect on a collection that deter growth in an organically where the company has to raise working capital loan on top of the lease liability the company has.

Geography Concentration: Another risk the company faces is the risk of geography risk as the company is quite concentrated in the states of Maharastra, and Odisha they do have a presence in other states but concentrate in few states, which makes the company to any regulations changes made in the specific state government could impact the earnings growth of the company.

High Competitive Intensity: The company does face a strong competitive intensity in the business where there are multiple players present in the market such as Thyrocare, Vijaya Diagnostics, and Dr. Lal Pathlabs, These are the major competitors in the listed space and the various players in the industry, even though the Krsnaa is providing 30-40% lower than their major peers in the industry, it’s crucial how then strategically increasing the offering and build a more sustainable and scale model to sustaining the earning growth despite there could be a risk where in a dip in the margins due to competitive intensity in the market, as the Diagnostic Industry faced in FY21-23.

Poor CFO to PAT Conversion:

PAT to CFO has been very lumpy and has been low considering the fact the company is primarily dealing with government bodies where there is a major risk in the cash inflow on the apt time, where the CFO to PAT has been poor in the range of 20-75% over the years predominantly invested in the working capital, especially in the receivables side. Even in the H1FY25, the accounts receivables have increased significantly from 178 Cr in FY25 to 246 Cr in H1FY25.

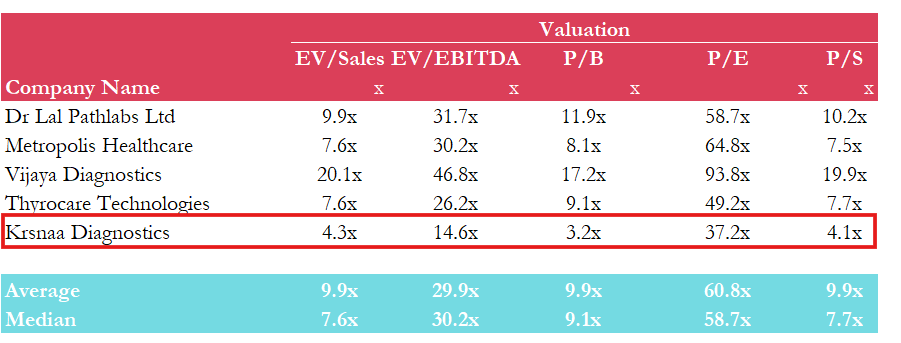

Valuation

As of January 13th, the company’s market capitalization stands at ₹2,682 crores, with a trailing twelve months (TTM) P/E ratio of 37.2. While this may appear expensive from a P/E standpoint, valuing diagnositc companies is often more effective using the EV/EBITDA metric due to their high depreciation costs. In this context, the company’s valuation appears reasonable.

When compared to its listed peers using relative valuation metrics such as EV/Sales, P/E, and P/S, the company is less expensive than the average or median values. With strong earnings growth potential, the company is reasonably attractive relative to its competitors. This is further supported by strong growth drivers, such as increased healthcare expenditure and greater public awareness. Additionally, the company’s focus on building a diversified income stream by transitioning into a B2C model and forming strategic partnerships with hospitals is expected to contribute to robust cash flows.

However, despite these positives, the company faces challenges related to higher working capital requirements, particularly tied up in receivables. Furthermore, the competitive intensity in the market necessitates offering multiple diagnostic solutions to stand out and maintain its position.