DEE Development Engineers Ltd - From Pillars to Posts and Pipes

Have you seen a refinery close at hand? If you have not, you must have seen it in a movie or an image like the one provided here. Oil refineries distill crude oil by fractional distillation, which, if simply put, is that they boil the crude oil and the components with differing boiling temperatures and densities are separated at different layers in a big furnace.

Now you would think, what do those pipes crisscrossing the refineries do? Well, they take steam, water, and distilled petro products to and from the furnace(s). These pipes are indispensable to a refinery’s operation.

The 2008 Jamnagar oil refinery expansion project utilized nearly 4,000km of pipes, enough to take you from Kashmir to Kanyakumari and beyond.

However, these pipes are not the same and differ in dimensions as well as in the material used, which depends on the fluid they carry. Some would need high-temperature protection, while some would need protection from chemical corrosion. Pipes like these are not just used in refineries but in nearly every manufacturing unit. This week’s coverage will talk about DEE Development Engineers Ltd, or DEE in short, a company that is in the business of making pipes.

What does DEE do?

Established in 1998, DEE designs and fabricates complex piping systems, pressure vessels, and heat exchangers. It is India’s largest player in process piping by installed capacity. Types of pipes made:

- Piping Spools

- Modular Piping (Skids and Modules)

- Induction Pipe Bends

- Industrial Pipe Fittings

- Wind Turbine Towers1

- Pressure Vessels

The company makes pipes for:

- Powerplants-Main Steam, Hot Reheat, Cold Reheat, Feed Water & Bypass lines in different grades of Carbon Steel, Alloy Steel & Stainless Steel.

- Refinery and petrochemicals, as we talked earlier.

- Fertilizers & Chemicals and Biorefineries.

- Sub-sea pipes - especially treated to prevent saltwater corrosion

- Marine and offshore rigs - The likes of Bombay High and Deepwater Horizon.

Manufacturing Facilities

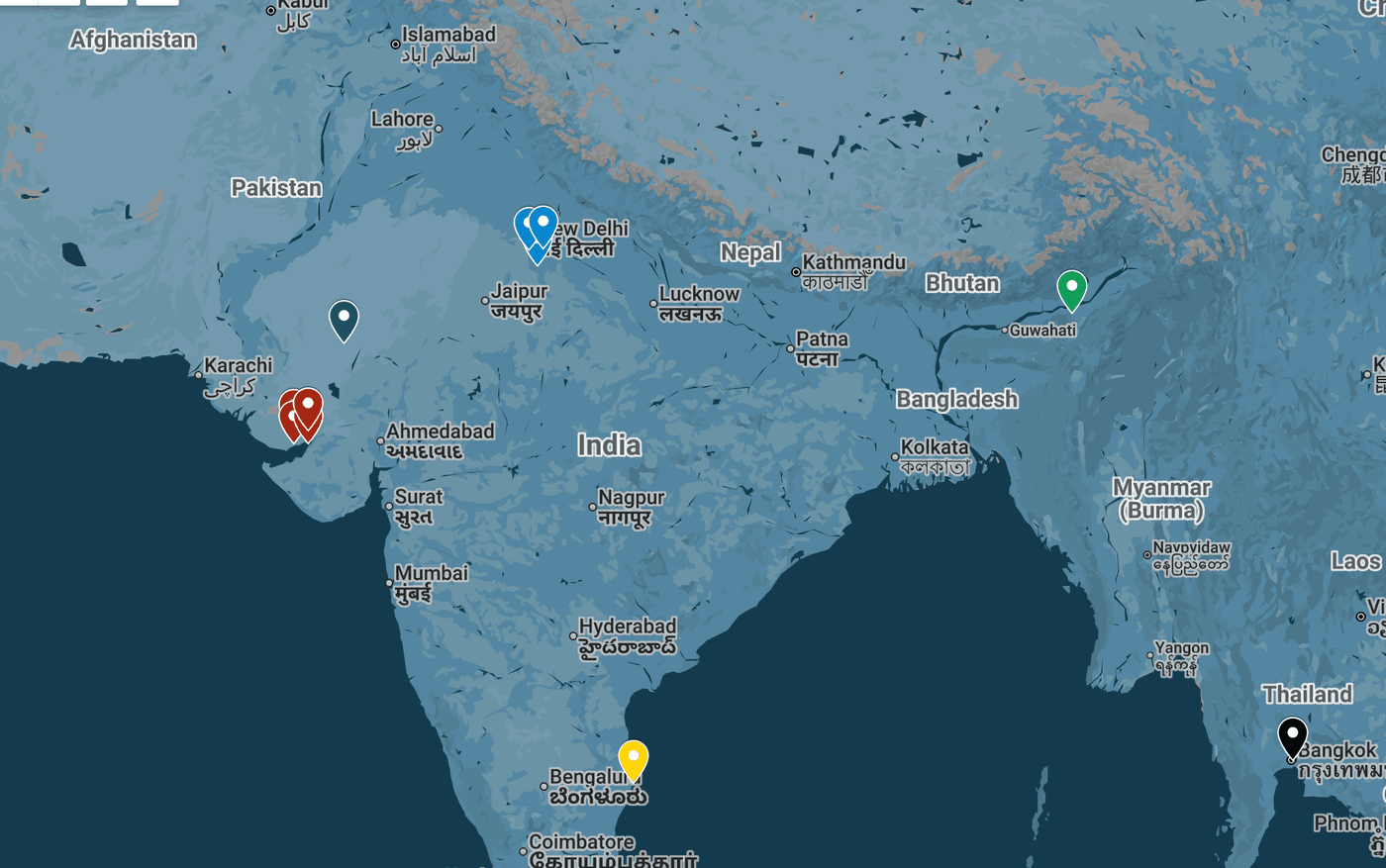

DEE operates 7 manufacturing units across India and Thailand. In India, it has:

- Three facilities in Palwal (Haryana) account for a total of 36,000 MTPA

- Multiple units in Anjar (Gujarat), including heavy fabrication plants, for a total of 51,000 MTPA

- Additional units in Barmer (Rajasthan) and Numaligarh (Assam).

- Internationally, it has a large unit in Bangkok (Thailand) and an engineering facility in Chennai.

- The current total installed capacity of the company is 112,500 MTPA, with nearly 15,000 MTPA ready to be commissioned this month.

Recent and Near Future Expansions

- The company commissioned its new Anjar Facility II (15,000 MTPA) as per a press release on 8th September 2025, which is a nearly 13.4% increase in its capacity from 112,500 MTPA.

- It is also expected to commission a high-wall seamless thickness pipe plant for backward integration by January 2026 at Anjar. These expansions will raise total capacity to 127,500 MTPA. A capex of 139 Crs was incurred in FY23–FY24.

Order Book:

- The company reported ₹63.2 crore in new orders in Sept 2025

- Total order book stands at ₹1,308 crore as of Sept-end

- For the ongoing FY 2026, total order inflow stands at ₹598 crore with an execution of ₹518 crore.

- Punjab biomass tariff extended 10 years; ₹7.47/unit rate continues pending court decision.

Order Fulfillment Timeline

The company generally has an order completion period of 6–18 months. The power sector projects are shorter and are completed in under 12 months, and oil & gas projects take longer. DEE has a strong order book and is fully packed for FY26 and partially for FY27, with a strong order pipeline for FY27. The guidance for FY26 order flow is around 1,600–1,700 Cr, with a minimum order book of 1,000 Cr maintained consistently.

Financials:

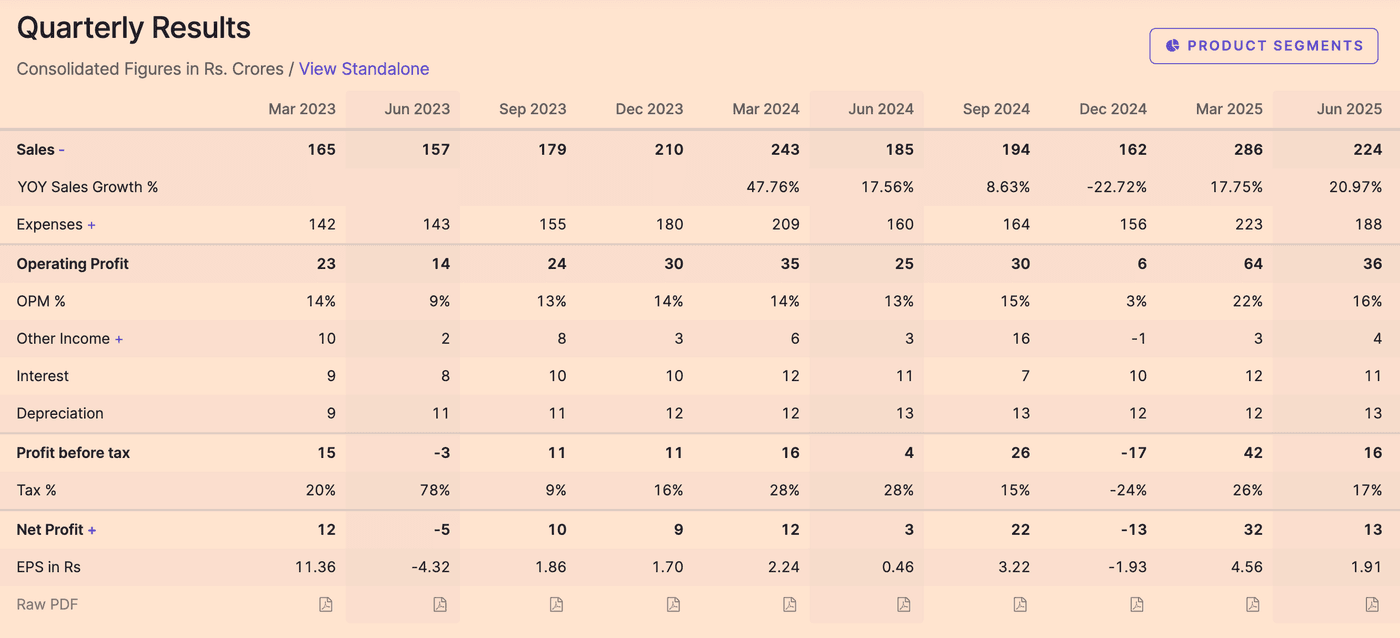

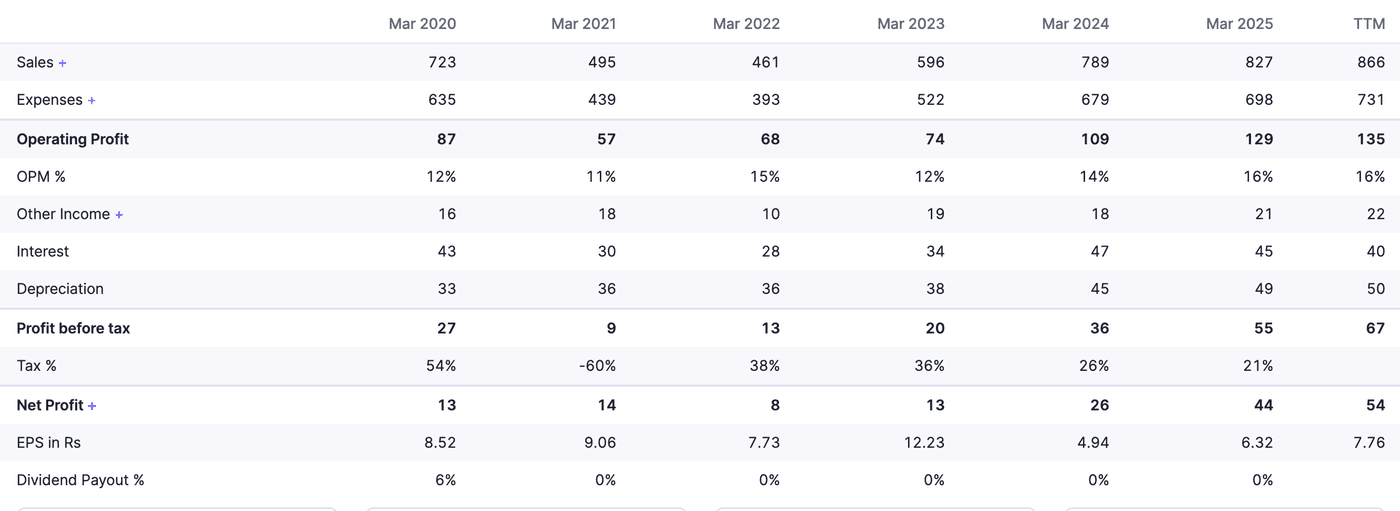

One would agree, DEE does not look flashy on paper. If you examine the quarterly sales and profits over the past three years, both have been quite volatile. Volatility is not good as it increases risks. We need some kind of stability.

But quarterly results do not account for seasonality. And Companies like DEE can be seasonal due to the demand of clients. Let’s have a look at the annual results.

The annual results show some stability, but if we consider the results after 2020, the company has seen a growth of 13.69% CAGR. This might be a good growth, but not good enough for a small-cap.

Guidance from Order Book

Ok, so then let’s have a look at how the order book works.

- Total order book stands at ₹1,308 crore as of Sept-end

- The guidance for FY26 order flow is around 1,600–1,700 Crs.

- A minimum order book of ₹ 1,000 crore is consistently maintained.

- Order fulfillment time of 6-18 months.

- FY26 cumulative order inflow ₹598 crore; execution ₹518 crore

Can we forecast revenue using these metrics from the order book? Let’s see:

- Guidance for the FY26 order flow of 1,600–1,700 divided by the average order fulfilment of 12 months (average of 6-18 months), yields us annual revenues of 1,600–1,700 Crs.

- A minimum of ₹ 1,000 Cr order book consistently will lead to similar annual revenues. Just to be safe, using the minimum value here.

- The order book at ₹1,308 crore, which needs an average of a year to fulfill/complete, so the revenue guidance is similar to 1,300 Cr annually.

- With order execution of ₹518 crore for half year, this could result in total annual revenues of more than ₹1,000 crores.

- Guidance on revenue from the August con-call puts it at ₹1,300 cr. While the con-call estimates some revenue hit due to reduction of tariffs, this has been stayed from the High Court, and hence the earlier higher rate of ₹7.47 will remain. Hence, the guidance on ₹1,300 cr stands solid.

Using the metrics here, we can see revenue anywhere between ₹1,200-1,300 Cr for the next year. This is a good jump over the previous year’s revenue of ₹827 Cr. Our calculations confirm management guidance on revenue, and it is expected to remain in the same range. This lends stock a significant upside potential.

Clientele:

The clients include Reliance Industries, Mitsubishi Heavy Industries, Toshiba, JSW Power Systems, Man, John Cockerill, Nooter Eriksen, and Honeywell, among others. The company has established relationships with large companies that provide regular orders. Gaining new customers is not easy, as the industry has a high entry barrier. What it means is that the client companies tend to stay with their suppliers for a long period of time due to the bespoke solutions provided.

Industry

The Indian process piping solutions market is expected to register a CAGR of nearly 6.1% between FY2023 and FY2030, which is based on a Dun & Bradstreet (D&B) report. This growth rate is equal to or even less than the Indian GDP growth rate. Not a good industry to be in, but then a company can do well if it outperforms its peers.

Things to look out for in the Balance Sheet

The balance sheet indicates a growth in assets, which can be a good sign. This comes mainly from:

- Inventories tripling in the past 4 years (184cr to 585 cr)

- Receivables jumped by a quarter in the last annual report.

- CWIP is increasing, from 66cr to 148cr, which shows the company is engaged in operations and CAPEX.

- Investments in plant machinery have seen a steady increase, which further points to stable operations.

All these indicate the company is working towards fulfilling orders, and inventories are expected to show up in the revenue in the near future.

Latest Quarter Revenue

As per the press release on Oct 7th, Q2FY26 revenue stands at ₹294 cr, which is an increase of nearly 52% QoQ, indicating a strong revenue stream.

Looking at half-yearly results, revenues for H2FY26 have seen an increase of 37% HoH. The quarterly increase lends credence to the revenue guidance for FY26.

Non-financial positives

As we stated earlier, the company may not appear financially strong on paper, but it does not behave like an average company. Due to high entry barriers, clients are harder to onboard, but they also have limited options. Some of the important aspects that we need to look at include:

- Punjab biomass tariff extended 10 years: One of the plants, Muktsar Biomass Power Plant, was contracted to supply electricity for 20 years, which expired recently. The power purchase agreement has been extended for another 10 years by the state discom.

- The company has another plant in Punjab, Abohar, Fazilka district, that provides electricity to the state discom using biomass from farms. Recently, the Punjab government had slashed the tariffs from ₹7.47 to ₹5.67 per unit. DEE went to the high court and obtained a stay on the order, and the ₹7.47/unit rate continues pending court decision. The expected revenue hit has been withheld at least for some time. There is still some risk, but as usual with the court cases, it can drag on for a long time.

- Expanding to green energy, hydrogen-powered, foraying into electrolyzers. With push from governments in India as well as outside it, the company is actively working on gathering a piece of the pie of high-growth industries. Based on different research, these industries are expected to yield a double-digit growth rate, with the growth rate for electrolyzers being somewhere between 50% to 90% CAGR over the next five years.

- Doubling plant capacity in the recent past and future shows that the company is bullish on growth.

- Promoters hold 70% of the stocks, which means that they have skin in the game, and with their stake in the company high, they should work for the better.

Activity ratio and conversion cycles:

If I could draw your attention to the increase in inventory and cash cycles over the past 4-5 years, we can see that the company needs to be more efficient as inventories have piled up and days inventory have risen to nearly two years (738 days). This can be an operational nightmare if you need two years to sell your products.

However, piling up inventories also provides support for revenue in the future. With specific orders made for each client’s requirement, there’s a low risk that the clients will not pay for the inventory. 585 cr worth of inventory will translate into 585 cr or more worth of revenue, depending on the margins in the industry.

The Final call - Light at the end of the pipe!

The company does have some promise and has some risks, and we cannot just pass it on as an opportunity due to its potential. Major benefits can be summed up as:

- Regular orders with the order book increasing and the company updating orders each month.

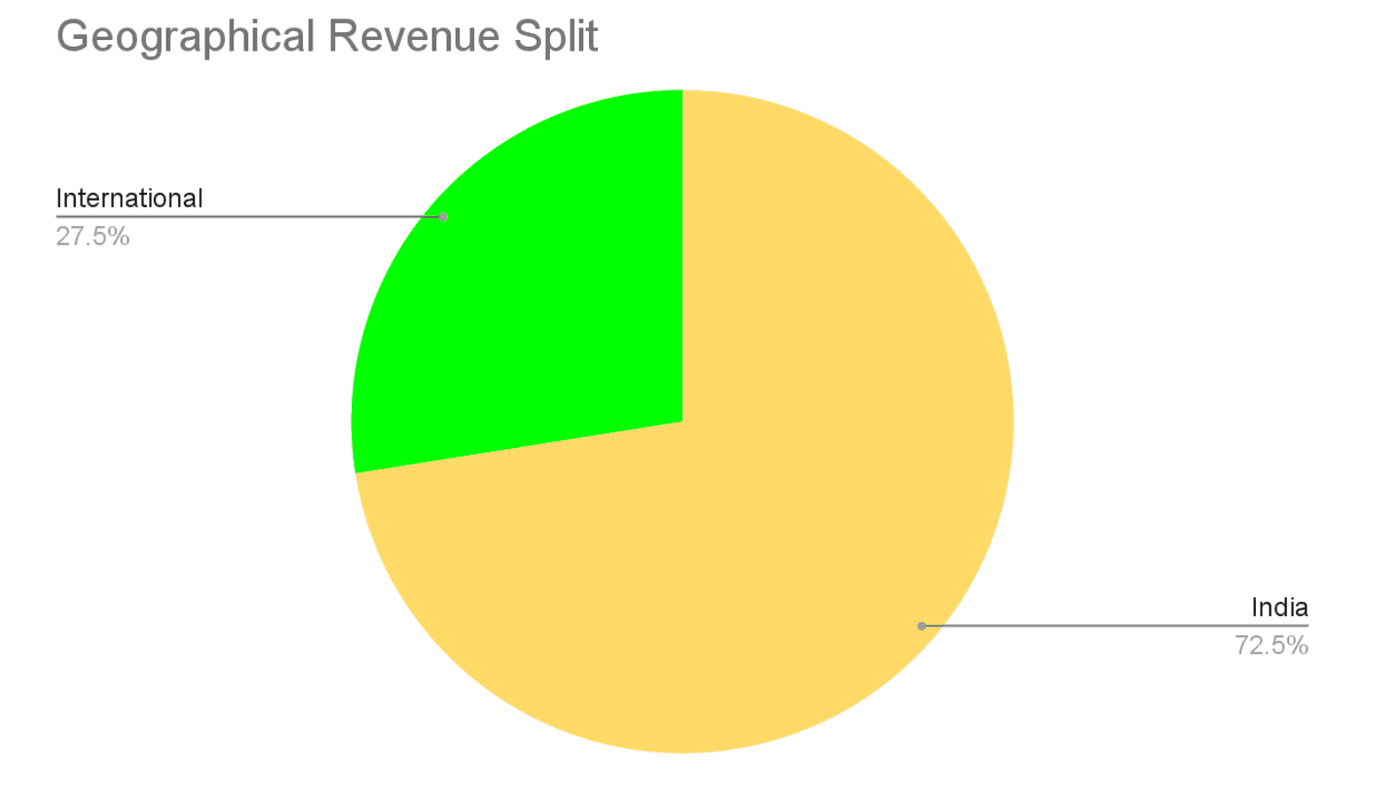

- Regular and long-term relationships with large clients in India and outside India.

- Expanding operational capacity to enhance revenues.

- Financials, though not very strong, seem to have stabilized.

- Promoters hold 70% of the company, good for the skin in the game argument.

Some of the issues that need immediate attention:

- Operational efficiency by reducing the inventory cycle.

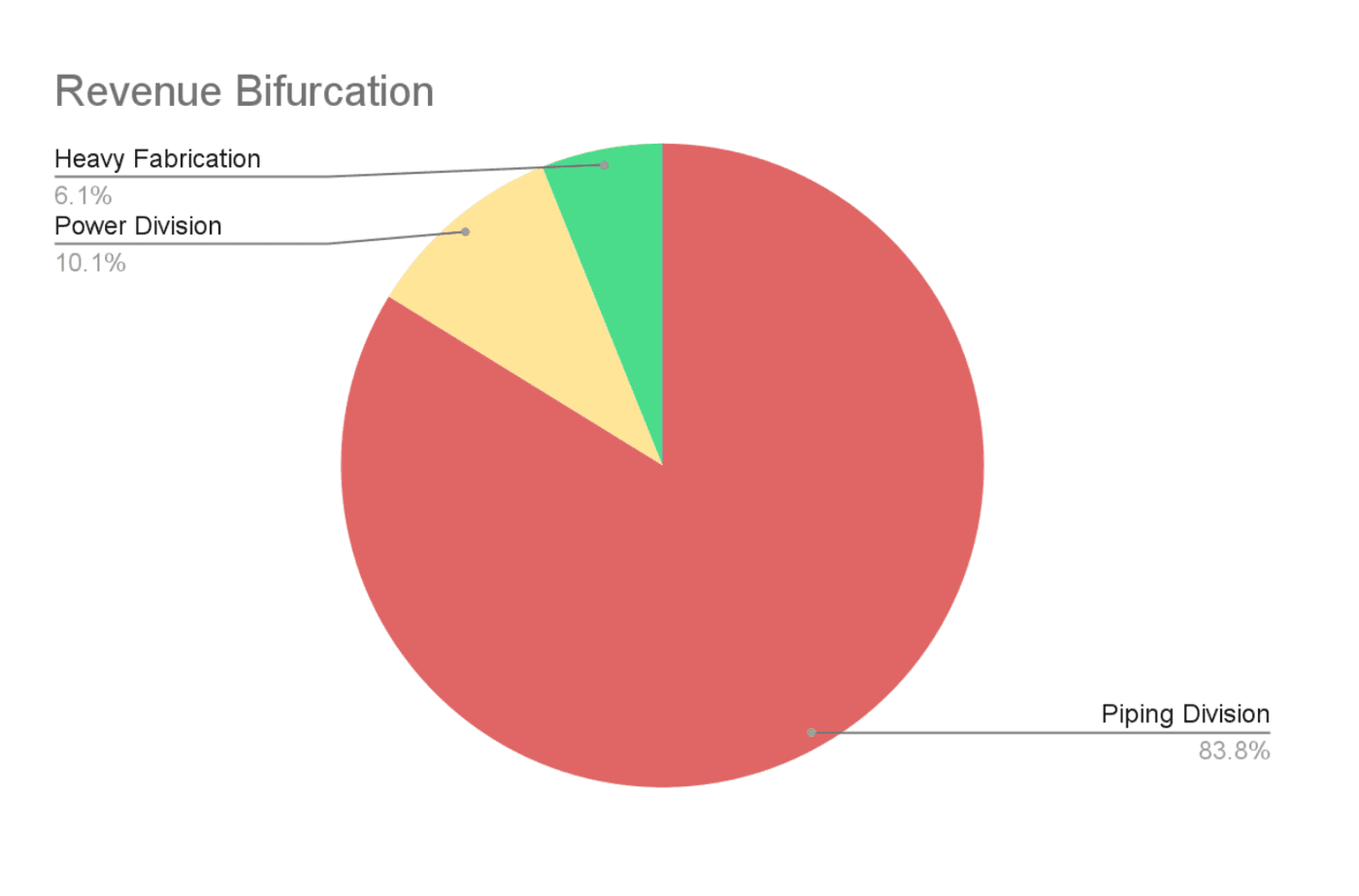

- Diversification to other industries is happening, but needs more work as nearly 5/6th of the revenue still comes from one industry (piping).

- Industry growth rate is not very charismatic, and hence, diversification becomes more important.

- There can still be pressures from the US tariffs recently imposed on India. The company needs to look at new clients in developing parts of the world.

Ethica: Your compliant investment pipeline tool

Ethica works on an investment thesis that brings you selected Shariah-compliant stocks based on deep research into operations and financials for the company. With SEBI-registered analysts, we aim to make sure, we do a full due diligence on any given stock we recommend. For this stock, the team has taken up:

- Financial due diligence- Checking the financials, order book, con-calls, and other details to make sure claims from the promoters/management are not without any basis.

- Deep dive into the industry- How does the industry work for the company? And how does the company stand in the industry? These are two important questions that need to be asked before analyzing a company.

In the age of AI investing, you still need a human to tell you something that an algorithm will never find out. For example, revenue guidance for DEE needs to be checked with non-traditional means, which an AI algorithm cannot do unless it is trained so. The team at Ethica uses the newest available tools available but still checks for good investment opportunities using a human brain.