GHCL: Value, Volatility, and the Solar Glass Megatrend

This morning, you probably did something so routine that you didn’t give it a second thought.

Maybe you wash your hands with soap. You washed your clothes with a detergent. Maybe you cleaned your dishes with a cleaning liquid.

But inside that soap bar, that detergent powder, that cleaning liquid, is a humble white chemical called ‘soda ash’, so invisible that most of us never think about it.

The Unnoticed Ingredient in Your Daily Life

To most of us, soda ash is just another chemical that helps in cleaning your clothes, softening hard water, making your soap foam better.

And that’s exactly where most people stop thinking about it.

But here’s what’s fascinating: that same humble white powder isn’t just used in soaps or detergents. Its applications go well beyond this.

Soda ash (sodium carbonate) is, one of the most widely used industrial chemicals in the world. It’s used in glass manufacturing, water treatment, papermaking, food processing, and countless household products.

And here’s the critical part: glass manufacturing accounts for majority of all soda ash usage in India, and glass is becoming essential for industries everyone recognizes. From smartphone screens to solar panels.

So here’s where the story gets really interesting.

Think about it for a moment.

India needs to more than double its solar capacity in just five years.

But, what most people don’t realize about this solar revolution: You cannot build solar panels without solar glass. And you cannot manufacture solar glass without soda ash.

Solar glass isn’t just ordinary glass. It’s a specially engineered material that must allow maximum light transmission while providing durability and protection for solar cells. And the key ingredient that makes all of this possible? “Dense soda ash”.

Now, here’s where a specific company enters this story, and why its next move could be one of the most strategically timed bets.

GHCL Limited

India’s second-largest soda ash producer with a 26% market share

The company currently operates a soda ash manufacturing plant in Sutrapada, Gujarat, with an installed capacity of 1.2 million tonnes per annum.

But that’s just the present.

GHCL is preparing to make a massive strategic bet:

And here’s the strategic masterstroke.

The new plant will feature a large dense soda ash facility particularly for the solar glass manufacturing, the exact grade and quality required for manufacturing solar panels.

The timing? Perfect.

While everyone watches flashy solar companies and panel makers, GHCL will quietly supply the one critical ingredient that makes it all possible.

Maybe it’s time to look deeper into this story

The GHCL Story: A 40-Year Journey

Let’s rewind to 1983.

The Beginning

On October 14, 1983, GHCL (Gujarat Heavy Chemicals Limited) was incorporated as a joint sector initiative. The Gujarat Industrial Investment Corporation (GIIC) joined hands with GTC Industries (formerly Golden Tobacco Company) and Dalmia Dairy Industries to create something India desperately needed: a self-reliant soda ash manufacturing capability.

In April 1988, GHCL’s plant at Sutrapada in Gujarat started its operations. The initial capacity stood at 4.2 lakh tonnes per annum of soda ash, both light and dense varieties.

The Diversification Experiment: Spreading Across Industries

Through the 1990s and 2000s, GHCL wasn’t content being just a chemical company. Management spotted adjacent opportunities.

The company ventured into salt production with the ‘Sapan’ brand, eventually operating 3,500 acres of salt works.

The early 2000s brought even more aggressive diversification.

The company made a bold move into textiles. GHCL entered spinning with 65,000 spindles that eventually grew to 140,000. A home textile plant came up.

A refined sodium bicarbonate plant started operations, adding another chemical product to the portfolio.

By 2009-2015, GHCL was essentially running three distinct businesses: chemicals, textiles, and consumer products.

On paper, it looked impressive. In reality, it was complicated.

The Strategic Pivot: Refocusing on Chemistry

Running textiles, chemicals, and consumer products simultaneously meant fragmented management attention, complex capital allocation, and diluted strategic focus.

GHCL’s core strength had always been chemistry; almost 40 years of operational expertise, technical know-how, and market leadership in soda ash.

So the company made a decisive call: double down on chemicals.

Soda ash capacity increased to 9.75 lakh tonnes.

By 2019, GHCL achieved a remarkable milestone, it became India’s largest soda ash manufacturer at a single location with 11 lakh tonnes capacity.

But GHCL wasn’t done simplifying.

The Great Unbundling: Separating to Succeed

Between 2021 and 2023, GHCL took the bold step of unwinding its diversification.

First, the home textile business was divested in FY22.

Then,

On April 1, 2023, GHCL completed a historic demerger. The entire spinning business was separated into a new listed entity called GHCL Textiles Limited.

This wasn’t a distress sale. This was strategic separation.

The management realized that chemicals and textiles were fundamentally different businesses requiring different management teams, different capital strategies, different growth trajectories. Each deserved independence.

Positioning for the Future

Today, GHCL operates at 12 lakh tonnes soda ash capacity and 120,000 tonnes sodium bicarbonate capacity from its Sutrapada facility. The consumer products division continues manufacturing edible salt, honey, and spices under the ‘i-FLO’ brand.

But here’s what makes it positioned for the future.

Remember that solar glass story from earlier? The one where India needs to more than double its solar capacity by 2030.

GHCL simplified its business structure and sharpened its strategic focus precisely as solar glass emerged as a meaningful new demand source for soda ash.

The massive Kutch expansion we discussed earlier; the ₹6,500 crore bet that will nearly double capacity wasn’t a random decision.

And now, as India’s green energy revolution unfolds, the company stands ready with expanded capacity, technical expertise, and strategic clarity.

By now, you might assume that GHCL is purely a commodity chemicals company. But that’s not entirely true.

The company also deals in a few other products which, although contribute only a small portion to its overall business, are still worth noting, because GHCL’s future might not remain limited to just a commodity chemicals.

Let’s break down GHCL’s business segments.

GHCL’s Business Segments: Breaking Down the Business

The Simple Truth

After all the diversifications and divestitures, here’s the blunt reality: GHCL makes approximately 98% of its revenue from one core business: chemicals. Specifically, from one critical molecule: soda ash.

This isn’t a diversified conglomerate anymore. This is a focused chemicals company.

The Chemicals Segment: Where Nearly All the Money Comes From (98% of Revenue)

Soda Ash (Anhydrous Sodium Carbonate): The Core Business

Soda ash alone contributes over 95% of GHCL’s standalone revenue. In FY25, manufactured soda ash products generated approximately ₹3,012 crores out of the company’s total revenue of ₹3,273 crores.

GHCL operates a 1.2 million tonne per annum soda ash manufacturing facility in Sutrapada, Gujarat. India’s largest at a single location with 26% domestic market share.

This soda ash goes into everything we discussed earlier: detergents, soaps, glass manufacturing, water treatment, metallurgy, and increasingly, solar glass for India’s solar revolution.

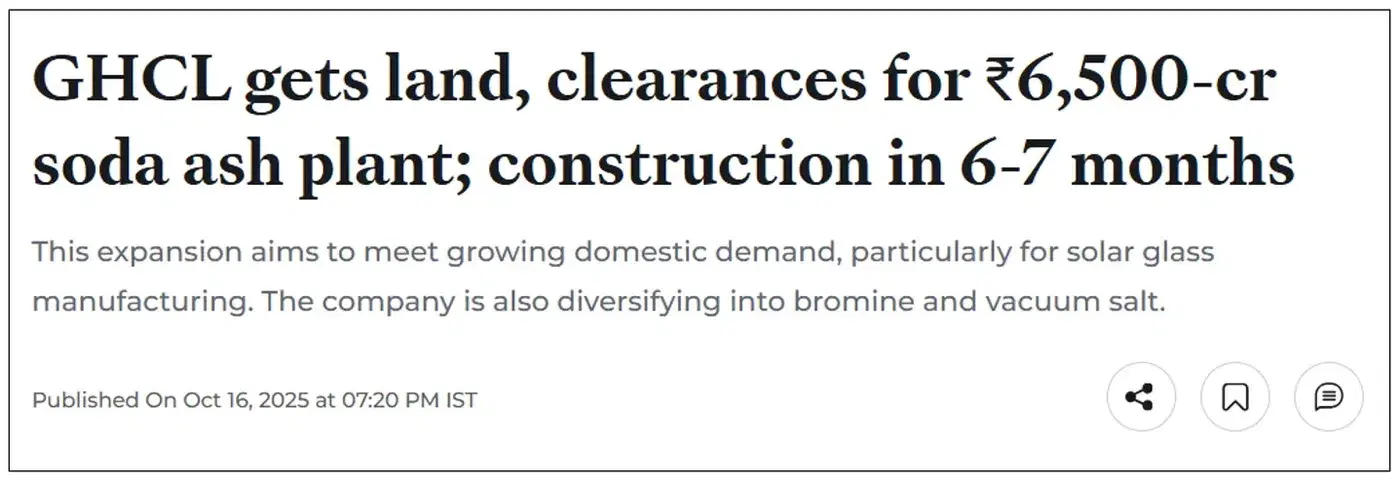

But here’s what gets most retail investors excited: the ₹6,500 crore greenfield expansion in Kutch.

GHCL MD RS Jalan in an exclusive interview with PTI said,

“Almost all major formalities have been completed, environmental clearance has been obtained, a major part of the land has already been purchased. At this point of time we have not started the physical activity of this, but hopefully in another 6 to 7 months we will be able to start the activity.”

Environmental clearance arrived in December 2024. Construction starts within six to seven months. When complete by 2030, this new facility will add 1.1 million tonnes capacity, nearly doubling GHCL’s total production to 2.3 million tonnes annually.

The Value-Added Derivatives

But GHCL isn’t just a commodity chemical company anymore. It’s strategically layering higher-margin products on top of its soda ash foundation.

Sodium Bicarbonate (Baking Soda)

GHCL recently doubled capacity to 120,000 tonnes per annum.

This product finds applications in food processing, pharmaceuticals, fire extinguishers, etc.

While small in revenue, it captures more value from its core soda ash manufacturing capabilities by producing downstream derivatives.

Bromine & Derivatives

This is the exciting part.

GHCL is constructing a bromine production facility with 2,800 tonnes capacity, commissioning expected by H2 FY26 (around Q3).

Initial capex is modest at ₹150 crores as part of the broader ₹300 crore diversification investment.

Here’s why it matters: bromine commands 40%+ Operating Profit Margin, far higher than commodity soda ash.

Applications span flame retardants, water treatment, oil and gas drilling, and agrochemicals.

GHCL is already evaluating bromine derivatives to move even further up the value chain.

The company’s new salt field acquisition at Zara Zumara in Kutch, spanning approximately 17 lakh tonnes of annual salt production capacity, will provide the critical raw material base for this bromine expansion.

Vacuum Salt

Simultaneously launching by H2 FY26, GHCL is setting up a 170,000 tonne per annum vacuum salt facility.

The clever part?

It harnesses waste energy from existing soda ash production, near-zero incremental energy costs. Management calls it “green vacuum salt.”

This high-purity salt targets FMCG, pharmaceuticals, and food processing.

Expected annual revenue potential: ₹200 crores combined with bromine, starting FY26.

Raw Materials & Backward Integration

GHCL secures industrial salt from its 3,500-acre Vedaranyam salt works in Tamil Nadu and the newly acquired Zara Zumara salt field in Kutch. Much of this salt is captively consumed within the company’s own soda ash and bromine manufacturing processes, though excess production is sold externally.

Similarly, GHCL secured limestone mining rights in Junagarh, Gujarat, providing backward integration for a critical raw material in soda ash production. This vertical integration strategy reduces input cost volatility and strengthens supply chain resilience.

The Consumer Products Segment: The Small Side Bet (~2% of Total Revenue)

Edible Salt & Honey Brands:

GHCL sells branded edible salt under ‘i-Flo’ and ‘Sapan’ brands, primarily in South India. FY24 consumer products revenue was approximately ₹378 crores (1.2% of total revenue). It also markets jujube honey under the ‘i-Flo’ brand.

While marginal in revenue, this segment provides stable, non-cyclical cash flows and retail brand presence.

However, management’s strategic focus remains unambiguously on the chemicals business, particularly the massive soda ash expansion and the bromine-vacuum salt diversification.

The Strategic Picture:

Here’s what’s actually happening: GHCL is doubling down on its core soda ash strength with a massive capacity expansion at exactly the right moment, while intelligently layering high-margin specialty chemicals (bromine, vacuum salt) on the same infrastructure.

That’s smart capital allocation.

But strategy on paper means nothing without financial backing.

And, that’s where the numbers tell the real story.

Let’s stop talking strategy and examine the money. Revenue trends, profitability, cash generation, return ratios, debt levels, these numbers reveal the truth.

Let’s dig into GHCL’s financial performance.

The Financial Story

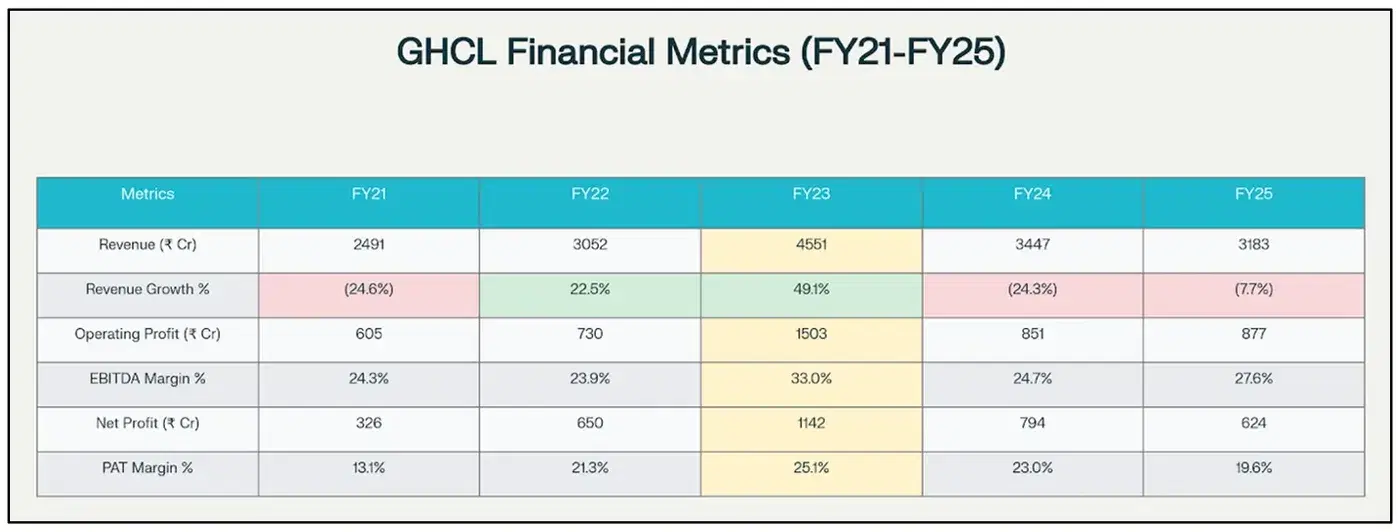

The FY21 financial figures serve as the appropriate starting point for understanding the financials.

Because, from FY21 onwards there were many events happened within as well as outside the company.

FY21: The Pandemic Trough

In FY21, COVID-19 destroyed demand for glass, detergents, and industrial chemicals.

And so, GHCL’s sales dropped by 24.6%. But, Operating profit margin held at 24%.

FY22: Recovery Kicks In with Leverage

In FY22, as the world started to recover, the demand also started rising. And revenue jumped 22.5%.

But profit surged 37.7% to ₹449 crores (excluding exceptional items), growing much faster than revenue. This reveals operating leverage at work. GHCL’s fixed cost factory, built years ago, was now running at higher volumes. Same infrastructure, much better utilization.

FY23: The Super-Cycle Peak

This is where the story gets dramatic.

Revenue jumped 49.1%. Operating profit more than doubled, with operating margins hitting an extraordinary 33%, exceptional for a commodity chemical company. Net profit more than doubles.

What happened? Perfect convergence.

Ukraine war disrupted European soda ash. Chinese capacity constraints tightened global supply. India’s solar revolution created new demand for dense soda ash. Prices skyrocketed. Volumes remained strong. Every factor aligned at once.

FY24-FY25: The Correction Reveals Character

Then reality arrived; and this is where you separate wheat from chaff.

Since 2023, China has added over 10 million tonnes of soda ash manufacturing plants, and because of this, the Global market flooded with over supply, prices of soda ash crashed.

And its results started showing from FY24 onwards.

In FY24, revenue dropped by 24.3%. Operating profit collapsed by 43.4%. Operating profit margins compressed to 25% but remained respectable during a major downturn. Net profit fell by 47.4%, but profitability persisted despite revenue collapse.

Also, in FY25, revenue declined further to ₹3,183 crores. But something remarkable happened: operating profit recovered to ₹877 crores with margins improving to 28%. Net profit increased 7.6% to ₹591 crores.

Beyond P&L

But profitability alone doesn’t guarantee execution capacity. The balance sheet reveals the real story.

Debt Elimination

The net debt reduction was started way earlier from FY17 onwards. And from FY17 till FY25, the company has repaid almost 92% of its debt. That is a significant reduction. More importantly, GHCL holds ₹446 crores in cash against ₹119 crores in borrowings; a net cash position of ₹327 crores.

A commodity chemical company, after surviving two brutal downturns, now sits with a net cash balance sheet. This isn’t luck. This is deliberate financial discipline.

Cash Position: Strategic Breathing Room

GHCL’s cash position strengthened dramatically, boosted by strategic moves. The FY24 cash surge to ₹492 crores came from the divestment of its home textile business in FY22 and spinning division demerger in FY24, which simplified operations and strengthened the balance sheet. These weren’t desperate asset sales, they were disciplined simplification.

The P&L shows GHCL survived the cycles. The balance sheet reveals it’s positioned to be ready for the next one.

But financial strength and management discipline are only part of the story.

Behind every decision stands a management team executing the strategy. Their backgrounds, track records, and visibility into market dynamics matter enormously.

Which brings us to the next question: Who is making these decisions? What’s the leadership quality?

Let’s examine the management team behind GHCL’s strategic moves.

Meet the People Behind GHCL’s Moves

The Man Who Lived Through It All

R.S. Jalan: GHCL’s Managing Director since 2006. He’s a Chartered Accountant who joined the company in 2002, which means he’s seen everything: the diversification experiments, the textile ventures, the commodity super-cycles, the crashes.

And here’s what matters: Jalan doesn’t panic.

When COVID hit in 2020, he didn’t slash investments recklessly. When commodity prices peaked in FY23, he didn’t get greedy and overextend. When prices collapsed in FY24-25, he did something counterintuitive; he increased capital expenditure to ₹315 crores.

That’s not gambling. That’s understanding commodity cycles deeply enough to invest during weakness.

The Backbone

Backing Jalan is Raman Chopra, CFO and Executive Director (Finance), a rank-holder CA with 17+ years at GHCL. He manages treasury, taxation, and ensures the balance sheet stays fortress-strong. Before GHCL, Chopra evaluated financial performance across Dalmia Group companies, so he understands industrial businesses intimately.

Then there’s Neelabh Dalmia, Executive Director for Growth and Diversification, who’s been overseeing strategic expansions since 2005. He’s the guy behind the bromine project and the upcoming Kutch expansion; essentially, GHCL’s growth engine.

The operational muscle comes from N.N. Radia, President and COO (Soda Ash), who maintains the factory’s 95% capacity utilization rates. That’s manufacturing excellence, keeping a chemical plant running efficiently year after year.

The people running GHCL seem quite capable.

However, on any journey, a captain and he’s ship will encounter both supporting winds and stopping storms.

Let’s now examine those supporting winds and stopping storms that lie ahead on GHCL’s path.

The Catalysts and Crossroads: What Could Make or Break GHCL’s Story

Here’s the honest truth: GHCL’s expansion story is compelling, but compelling stories don’t guarantee returns. The difference between opportunity and outcome depends entirely on what actually happens next.

So let’s separate the real catalysts from the wishful thinking, and then look squarely at the risks that could derail everything.

The Strengths & Opportunities: What Could Drive GHCL Forward

Solar Glass Demand: The Main Event

This is the heavyweight catalyst that powers the entire thesis.

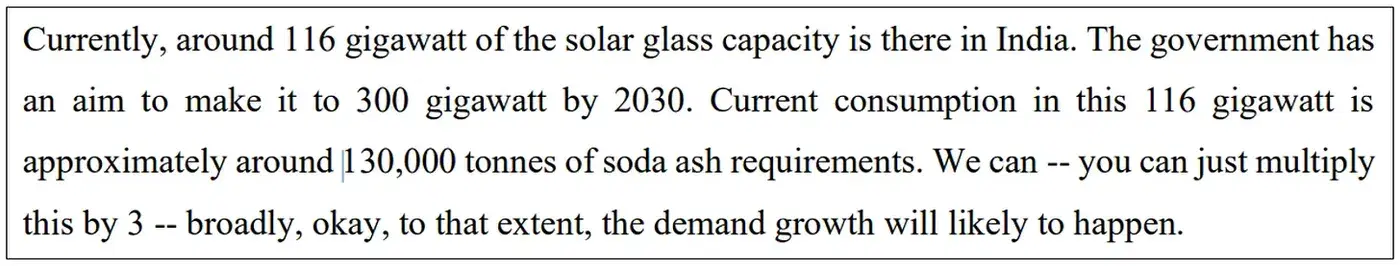

India’s solar capacity is projected to triple from around 119 GW today to 300 GW by 2030. That’s not aspirational. The government has committed policy, subsidies, and infrastructure. Solar panel manufacturers are already investing billions. The trajectory is locked in.

And here’s what makes it matter for GHCL: India’s 116 GW of installed solar capacity requires approximately 130,000 tonnes of soda ash annually for solar glass alone. When India reaches 300 GW, that demand jumps to roughly 350,000 tonnes per year.

That’s a threefold increase in soda ash demand from just one application.

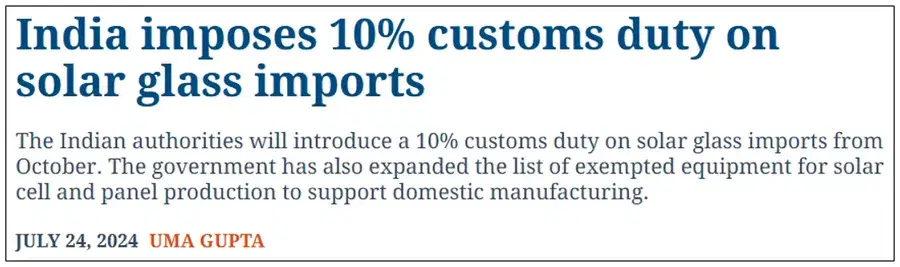

The government has already signalled its support.

The government has already signalled its support. A 10% import duty on solar glass and the Production Linked Incentive scheme are already active, encouraging domestic solar glass manufacturing. The bottleneck isn’t demand anymore. It’s supply. GHCL is positioning itself to be a critical part of that supply chain.

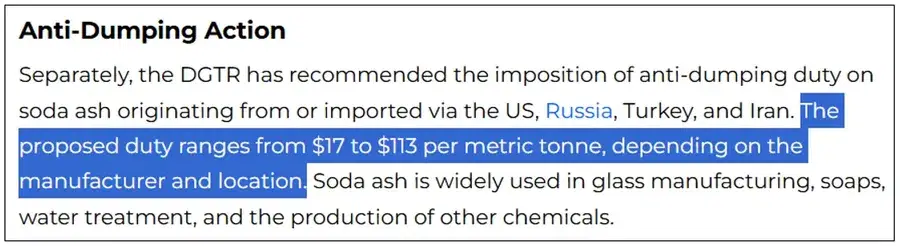

Anti-Dumping Protection Levels the Playing Field

India’s Directorate General of Trade Remedies has initiated anti-dumping investigations against soda ash imports from the US, Russia, Turkey, and Iran. Recommendations suggest duties ranging from $17–$113 per tonne for five years.

The government has already extended a Minimum Import Price mechanism of Rs 20,108 per tonne through December 2025. Final anti-dumping decisions are expected by year-end.

If duties materialize, cheap Chinese and Turkish imports face real friction. This doesn’t eliminate competition, but it levels the playing field. For a domestic manufacturer like GHCL, policy protection during demand expansion is enormous.

Breaking Free from Commodity Cyclicality with Bromine and Vacuum Salt

GHCL isn’t betting its entire future solely on soda ash. The company is deliberately diversifying into higher-margin specialties.

Bromine derivatives command 40%+ EBITDA margins compared to low-teens for commodity soda ash. A 2,800 tonne bromine facility is launching by H2 FY26. More importantly, management is exploring bromine derivatives, moving further up the value chain into even more specialized chemicals.

Simultaneously, a 170,000 tonne vacuum salt facility launches by H2 FY26, harnessing waste energy from soda ash production at near-zero incremental cost. Combined, bromine and vacuum salt will contribute approximately ₹200 crores in annual revenue initially, with bromine derivatives potentially adding ₹300+ crores of EBITDA within years.

These products represent liberation from pure commodity cyclicality. When soda ash prices crash, these higher-margin businesses cushion the blow.

EV Battery Production: The Quiet Opportunity

Global lithium demand is expected to triple by 2030, reaching 3 million tonnes from 650,000 tonnes in 2022. India is becoming a major EV battery manufacturing hub, with companies investing billions in battery cell production.

Soda ash plays a critical role in lithium carbonate production. As India’s EV sector scales, this adds incremental soda ash demand that GHCL’s expanded capacity can capture another revenue stream independent of traditional glass and detergent applications.

The Weaknesses & Threats: Where This Story Could Unravel

Structural Cost Disadvantage: The Permanent Handicap

This is the uncomfortable reality management rarely emphasizes in presentations, but it haunts the entire business model.

R.S. Jalan himself acknowledged this:

“One disadvantage India has is that it doesn’t have natural soda ash. That natural soda ash is almost half the cost of synthetic soda ash. This challenge will continue.”

India has no natural soda ash deposits. China, the US, Turkey, and Kenya possess vast natural trona reserves, cheap and abundant. GHCL manufactures soda ash synthetically using the Solvay ammonia process, requiring limestone, salt, and ammonia.

The cost differential is brutal.

Natural soda ash costs approximately $50 per metric tonne. GHCL’s Solvay process? Around $250 per tonne. That’s a $150–200 per tonne structural disadvantage compared to natural producers, and it’s not cyclical. It’s permanent.

No amount of operational excellence can bridge a $150–200 per tonne handicap baked into the production process itself. When global prices collapse, natural producers sustain profits at prices that devastate Indian synthetic manufacturers.

Chinese Overcapacity: The Dumping Threat

In an interview with NDTV Profit, RS Jalan itself said that,

“China has around 45% of the global capacity. Against 80 million tonnes of the total global capacity, they have around 38 to 39 million tonnes of the capacity. And obviously, China has some major role to play in the global scenario,”

China controls 45% of global soda ash capacity and has added over 10 million tonnes since 2023. This isn’t organic demand; it’s structural overcapacity.

India’s soda ash import share has doubled from 15% to 25–26% in just a few years. When China has overcapacity and weak domestic demand, it floods global markets with cheap exports. Even if anti-dumping duties arrive, they won’t fully shield domestic producers from relentless Chinese capacity discharge.

Policy Uncertainty: The Anti-Dumping Mirage

Anti-dumping protection isn’t guaranteed. Government policy shifts.

Even if duties are imposed, they can be challenged internationally or modified through negotiations. Until final notifications are published, GHCL faces pricing uncertainty.

If anti-dumping duties don’t materialize, or arrive at insufficient levels, GHCL’s profitability assumptions collapse. The company is banking on policy support; policy is inherently unpredictable.

Commodity Cyclicality Tail Risk

What if by the time GHCL’s capacity goes live, soda ash enters a structural bear market?

What if solar glass demand disappoints?

What if prices remain depressed at $150–200 per tonne, making the ₹6,500 crore capex underwhelming on returns?

Soda ash is cyclical. GHCL has navigated cycles before, but returns depend ultimately on pricing. No operational excellence overcomes extended periods of structural oversupply and depressed pricing.

Now, as you have looked at the complete scenario of what is GHCL? What does it do? What it is planning to do? And also, What will be the catalysts and risks?

The only question that might arise in your mind is’, “ Does this company present a compelling investment opportunity?

And so, let us now examine GHCL’s investment thesis.

GHCL’s Investment Perspective: Cheap Commodity With Hidden Quality?

Why Most Investors Miss These kind of Opportunities

Most people hear “commodity chemical” and immediately dismiss it. Cyclical business. Vulnerable to price crashes. Flooded with cheap imports. They price in permanent mediocrity and move on.

That narrative was true, but not always.

The Bull Case: Three Forces Aligning

Here’s what’s actually happening. Three powerful tailwinds are converging simultaneously at this company.

First, India’s solar revolution is creating structural demand for soda ash. We’re not talking about temporary demand spikes. We’re talking about nearly 3 million tonnes of additional annual soda ash demand over the coming decade, a secular shift. Solar glass requires soda ash. Solar capacity is tripling.

Second, GHCL’s expansion timing is almost perfect. Capacity is doubling from 1.2 to 2.3 million tonnes by 2030, exactly when the market will desperately need it. This isn’t growth for vanity; it’s capacity arriving at the precise moment demand peaks.

Third, the company is escaping pure commodity dependence. Bromine and vacuum salt are bringing higher margins and more stability. Combined, they’ll contribute meaningful revenue, reducing exposure to soda ash cyclicality.

The Bear Case: Real, But Manageable

Yes, the headwinds are real.

GHCL’s synthetic production method carries a permanent $150–200 per tonne cost disadvantage compared to natural soda ash producers. That’s structural, unfixable. Chinese overcapacity continues flooding markets. India’s import share has doubled to 25–26%.

The critical lynchpin is anti-dumping duties. If those duties fail to materialize or prove insufficient, margins compress back toward 15-18% ranges. Under that scenario, the entire expansion thesis becomes economically questionable. GHCL would still execute the capex, but returns would disappoint.

Single-product dependency, 92-95% of revenue from soda ash remains a concerning concentration despite bromine diversification efforts. Diversification takes time to scale meaningfully.

The Base Case: Gradual Strength, Steady Build

GHCL doesn’t need fireworks to win. This is a story of steady progress, not headlines.

First, earnings compound at a measured pace, roughly 15–20% CAGR through FY30. Nothing flashy, but consistent execution and market discipline drive this growth. GHCL continues to benefit from its established soda ash position as India’s consumption climbs.

Second, solar demand plays out slowly but surely. Every new solar glass plant adds a small layer of incremental volume, helping GHCL’s expanded capacity find a natural home. The structural solar wave isn’t explosive yet; but it’s building, and GHCL is positioned to serve that rise.

Third, margin protection holds up moderately. With anti-dumping duties likely staying in place against low-cost imports, profitability doesn’t collapse even in tough years. Add to that the gradual contribution from bromine and vacuum salt, two verticals quietly cushioning margins and diversifying revenue; and GHCL’s growth path looks resilient, if not spectacular.

The Bottom Line

GHCL isn’t a home run. It’s a calculated bet where tailwinds (solar demand, timing, diversification) meet real headwinds (structural costs, Chinese capacity, policy uncertainty).

The question isn’t whether this is perfect. It’s whether the catalysts outweigh the risks at current valuations.

That’s an honest investment thesis.

Ethica Invest: Your humble Ethical Investing partner

At Ethica, we see investments like GHCL’s soda ash quietly essential, overlooked, but powering entire industries. Our Shariah-compliant process digs deep, blending discipline and discovery to uncover real value beneath the surface. SEBI-registered analysts go far beyond the numbers, dissecting financials, management talk, and order books, much as a chemist decodes the true potential of soda ash.

But the Ethica edge is more than data. We study industry trends and a company’s real standing, searching for strengths that endure change just as soda ash’s worth is revealed in the factories it supports and the glass it creates. Even as AI scans the surface, it takes genuine human judgment to spot opportunity, reading between lines and validating management outlooks like GHCL’s.

With Ethica, each stock in your pipeline is as sound as the “humble white powder” well-researched, resilient, and ready for the future.

Disclaimer: This article is not investment advice or a recommendation.