Ingersoll Rand - The Assembly Man

“You can have it in any color, as long as it is black.”

Henry Ford quipped this about the Ford Model T. Now, Mr. Ford was instrumental in providing the world with the first fully practical and commercial model of the assembly lines, which are very common today. In around 1925, there were nearly 15 million Model Ts on the road, mostly in the USA, and they accounted for nearly half of the total cars globally.

Ford Motor Company produced 9,000 to 10,000 cars a day. This was possible due to a fast-moving assembly line, which was still crude when compared to modern assembly lines. A Model T can be completely assembled in 93 minutes.

Ford would have wanted to further reduce this time. And any company would like that. The thing was that black paint on cars dried fastest, and even if it was shaving off a minute, this meant that nearly a hundred more cars could be produced each day. That’s why you could have a Model T of any color as long as it was black.

Transforming Production

The assembly line helped change the game, somewhat similar to the industrial revolution about two centuries ago. It led to enhanced efficiency, faster turnaround time, reduction in cost, and enhanced consumer consumption like never before. Before the assembly line, a Model T used to take nearly 12 hours, against 93 minutes to produce.

Today, assembly lines are much better and smarter, and with the help of AI, tech has been better than before. While the Ford assembly line was mostly a conveyor belt, assembly lines today can fully replace humans to a large extent, if needed. This also helps with the production of hazardous products like chemicals or something that might explode.

To replace humans, assembly lines are integrated with pneumatic tools and arms that work like Robots. Something like the one below, but can also be less complex and carry out fewer amount of movements.

A pneumatic system can house a small air compressor in its arms itself, or if more power is required, an air compressor can be larger and housed outside the system and connected with a hose. Like the ones used with a car wrench that you might have seen when you go in for scheduled maintenance.

Now, this might have got you thinking, why are we giving you a class on pneumatics when mechanical arms work just fine and have been used for a long time? Classic mechanical arms are good, but pneumatics offer some advantages:

- Speed: Pneumatic systems have faster response times, leading to higher production capacity.

- Precision: Positioning control and precision can be programmed, and are much accurate than human hands.

- Simplicity and reliability: They have fewer complex electrical components than mechanical arms and are hence easier to design, install, and maintain. They are also resistant to mechanical wear and tear.

- Cost-effective: They are cheaper as they work on free atmospheric air and have reasonably priced components.

Ingersoll Rand: The Pneumatic Expert

Ingersoll Rand is primarily engaged in manufacturing air compressors for industries and assembly lines, along with providing ancillary services for the same.

The brands owned by the company work mainly on air and fluid pneumatic systems. Remember, the hissing sound when the train stops. That’s vacuum filling with air to release the brakes, and an air compressor will work to recreate the vacuum again to engage the brake when needed. Ingersoll Rand, through its brands, makes brakes for trains, too. Its brands include

- NASH - Vacuum Pumps for different industrial uses

- CompAir - Large Industrial Compressor, can be customized

- Gardner Denver - Also makes air compressors for industrial uses.

- ARO - Pneumatic and diaphragm pumps for industrial use.

- Thomas- Smaller compressor pumps

- Milton Roy - Valves and metering pumps.

- EMCO Wheaton - Loading arms for industrial use.

What these brands have in common is that they work on air or fluid compression. And compression needs an air compressor, which the company manufactures for many different kinds of uses. They have a diversified portfolio of air compressors for different industries.

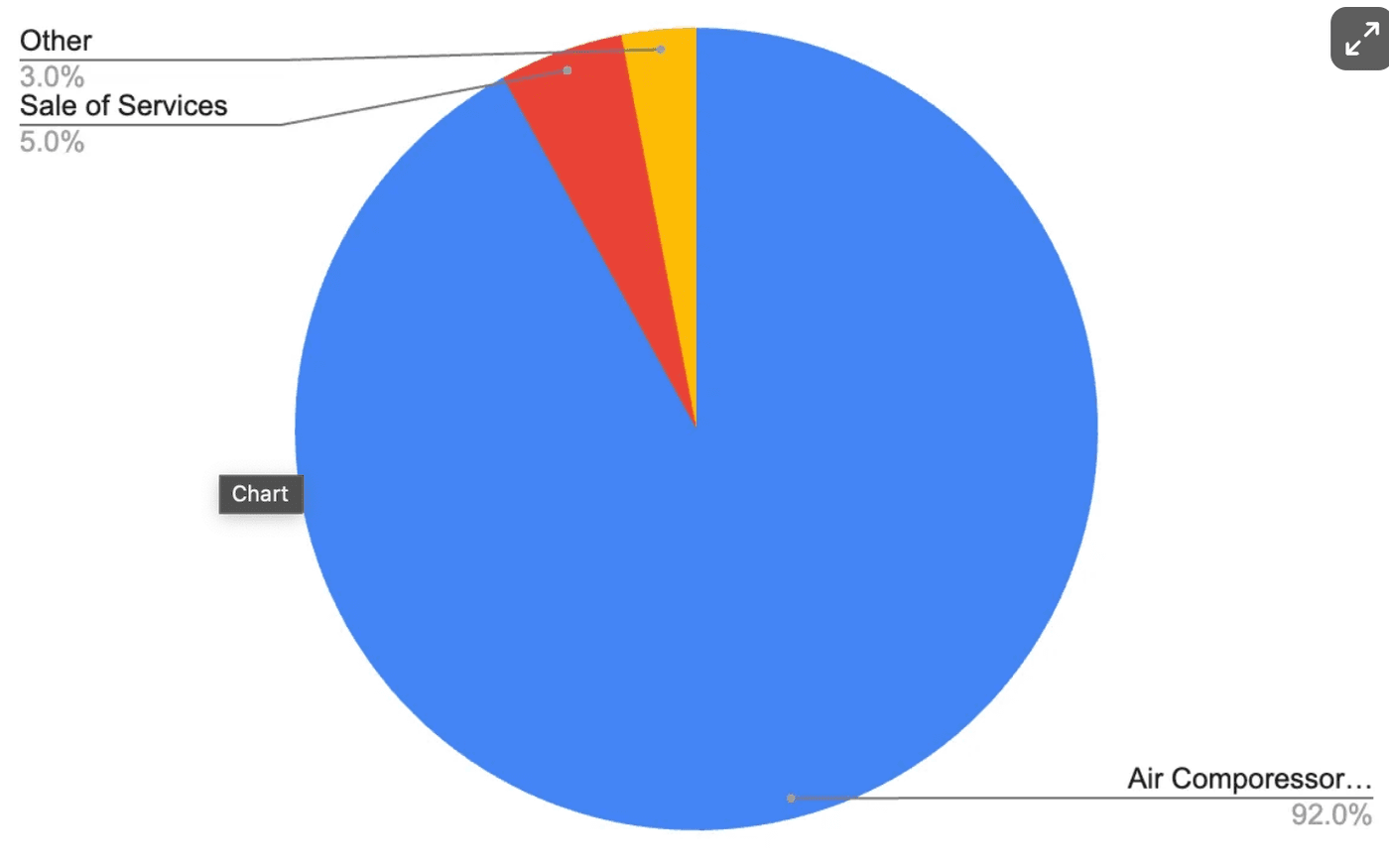

Ingersoll Rand derives nearly 92% of its revenue from selling air compressors and related products.

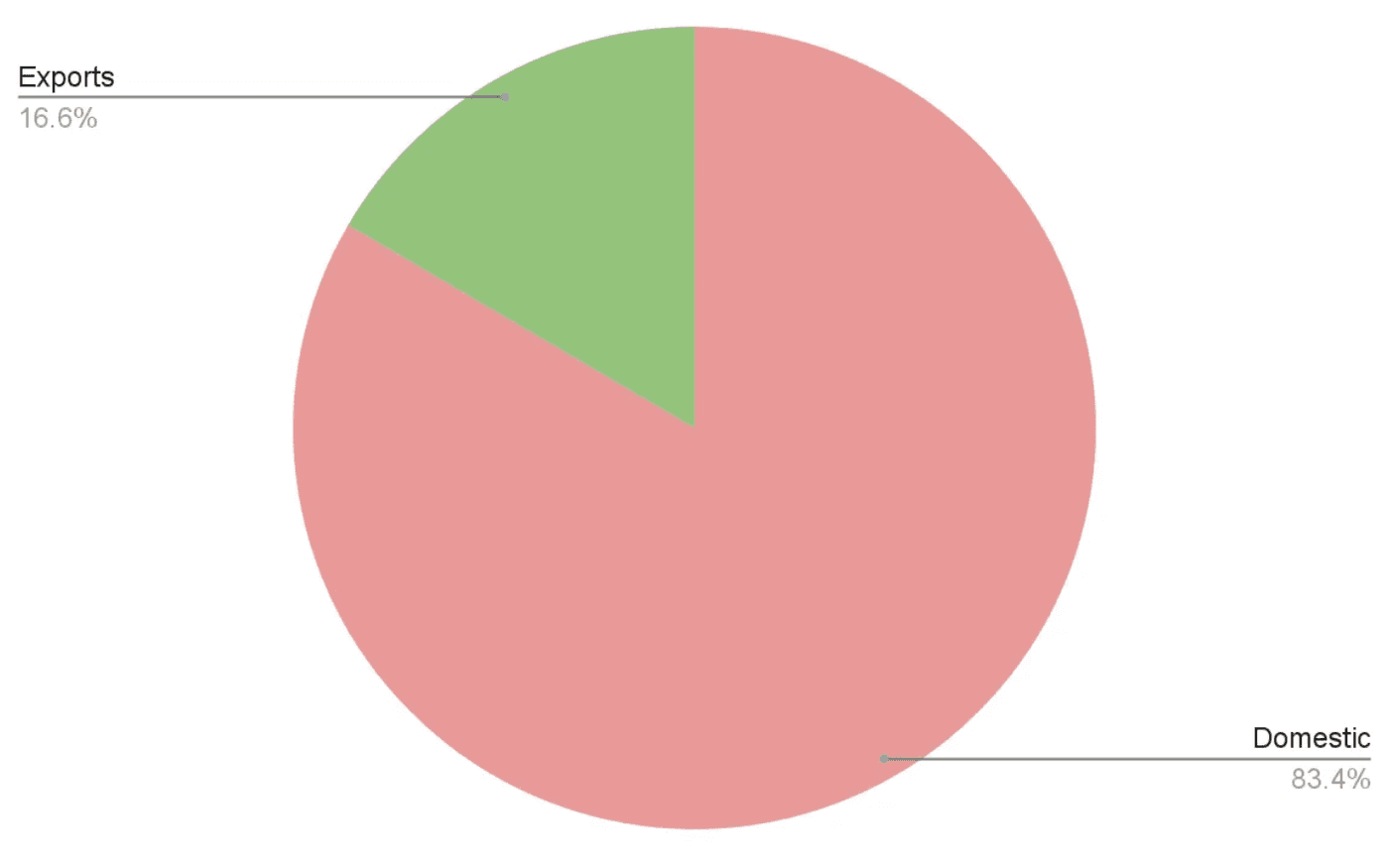

Most of the sales are made in India, while the rest is exported.

Strategic Landscape

The Air Compressor market in India is expected to grow at a CAGR of 6.2% from 2025 to 2033. This corresponds with the annual GDP figures in India. The market is not a fast-growing one, but Ingersoll Rand holds nearly 50% of the total market share, and that makes it a dominant player. Major competitors include Atlas Copco, Elgi Equipments, and Kirloskar Pneumatic Company.

Ingersoll Rand derives technological and R&D support from its US parent and is privy to the latest developments in the market. A significant minority share of its sales comes from the US parent. However, the market is competitive, and the company needs to innovate to survive. Barring Pharma, most of its supplying industries are unpredictable and cyclical.

Other risks that the company faces include:

- Low-cost imports from manufacturing powerhouses like China have been putting pressure on players in India as well as the US.

- In India, unauthorized copies of products are also hitting the bottom line of the company.

- Pricing of raw materials such as steel, aluminium, and copper remains volatile.

- Lack of skilled manpower for engineering, as well as installation and repairs, remains.

Operational Capacity

The company manufactures nearly 10,000 compressors on a monthly basis. A new plant is being set up in Gujarat with a cost of 170 crores and is expected to start operations at the end of fiscal 2026. This will enhance the capacity by 50% to 15,000 compressors in a month.

Human Capital

The company runs lean and has only 537 employees. There is no major change in no of employees over the previous year. This signifies a tight-knit unit of workers and is a testament to the efficiency of the company.

Financial Performance

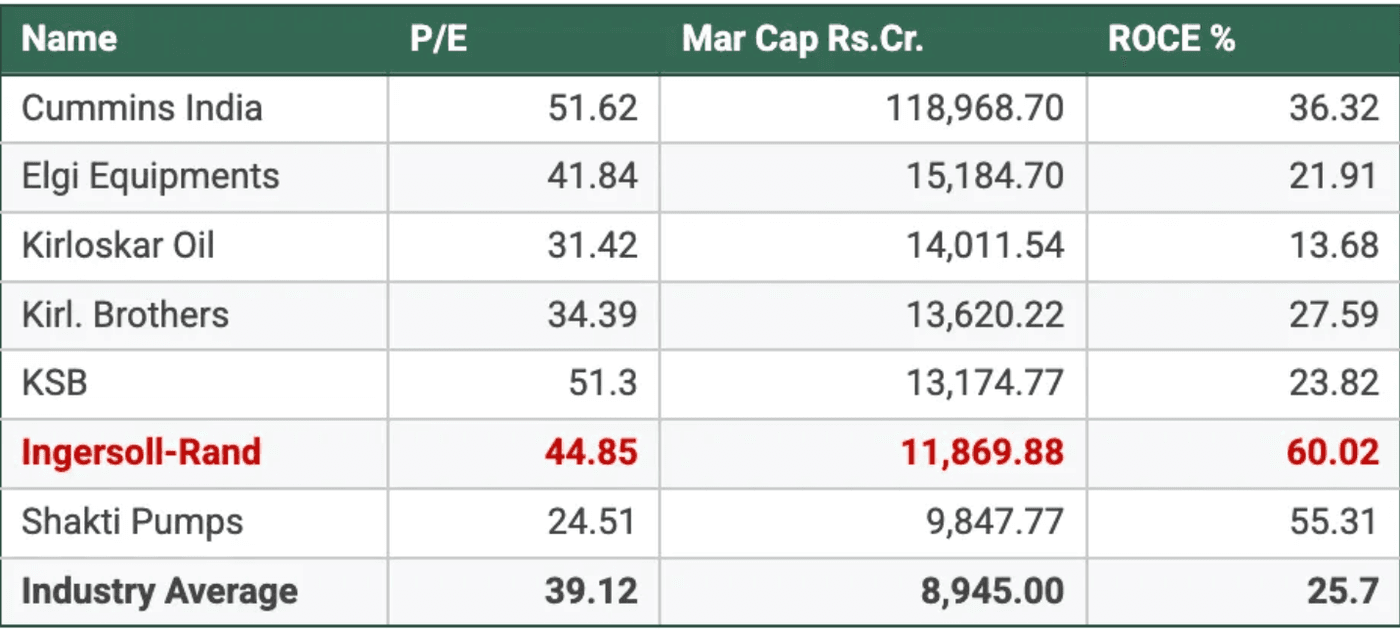

Okay, so before we begin with revenue and other profitability measures, let’s take a look at two performance ratios and compare them, and see how Ingersoll Rand stacks up against its peers in the industry. Except for Cummins, the companies have similar market caps, and hence it makes more sense to compare them.

From this table, we can make out two things at least:

- PE for Ingersoll Rand is near the industry average, which is good to have. It would have been better if it were below the average, since it would have signified a much higher potential for stock increase. Historically, the stock has traded at a maximum P/E ratio of 68.9 in May 2024. Hence, there is some juice left.

- ROCE is much higher than the industry average and more than its competitors. This is a good sign and explains a higher P/E ratio as investors are still getting a much higher bang for their money.

Revenue/Sales

Sales have generally seen an uptrend, but the uptrend post-COVID has been steeper. This is a good sign for a company, especially in a competitive market with a large number of players.

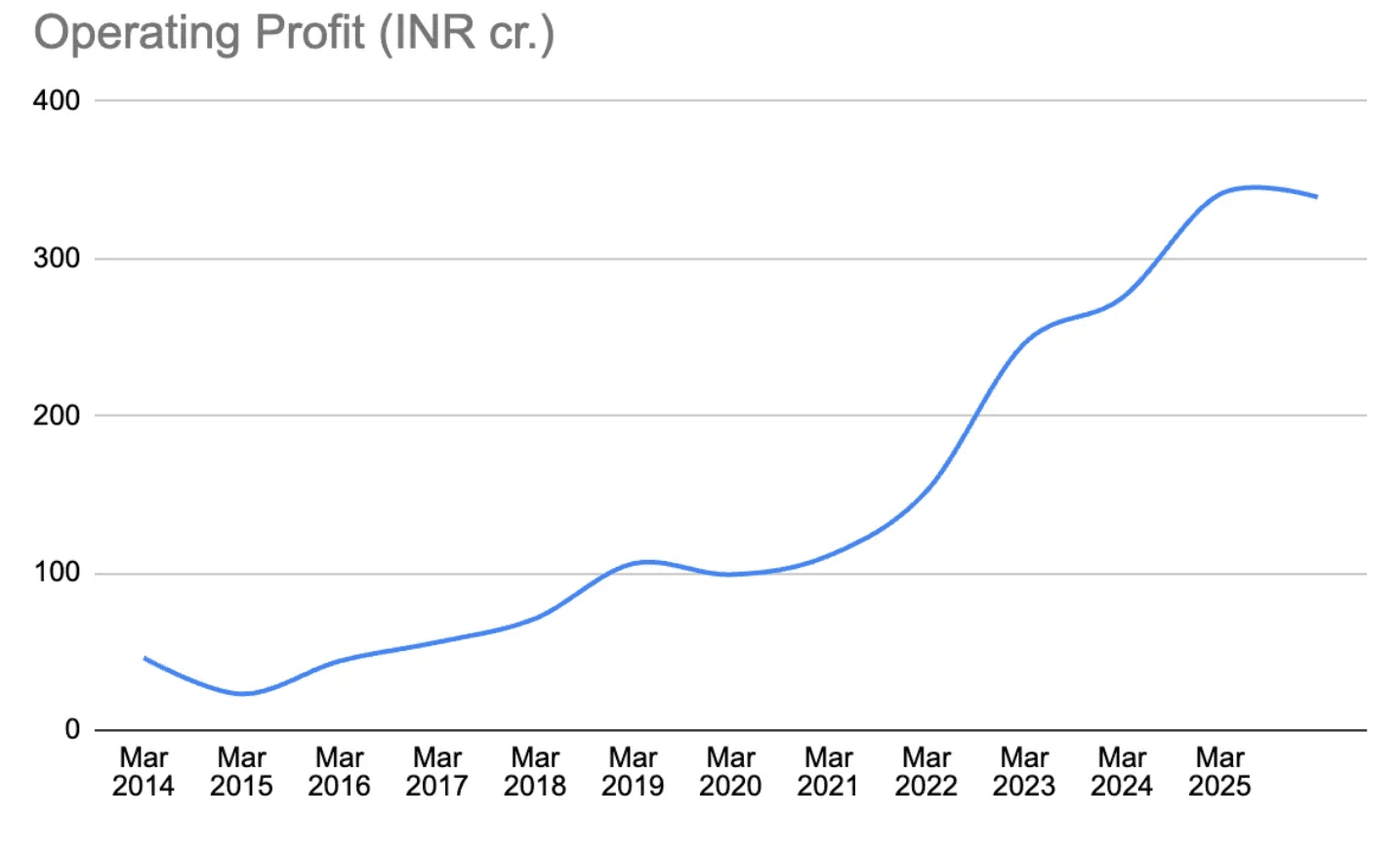

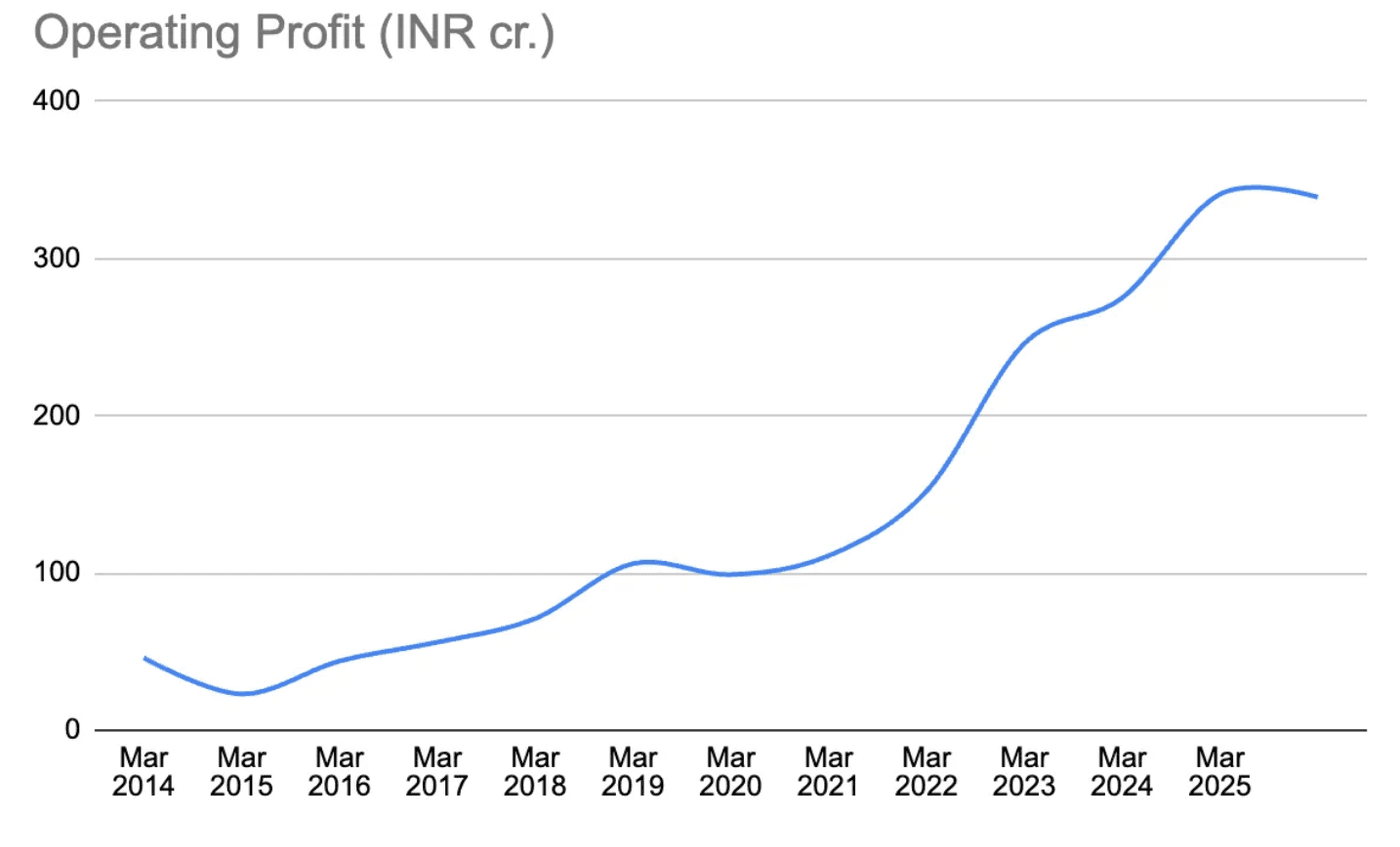

Operating profit has also seen an uptrend, but this trend has been steeper than the revenue, indicating efficiency in operations and reduction of expansion vis-à-vis sales. So it makes it necessary to further analyse how the costs have been over the years.

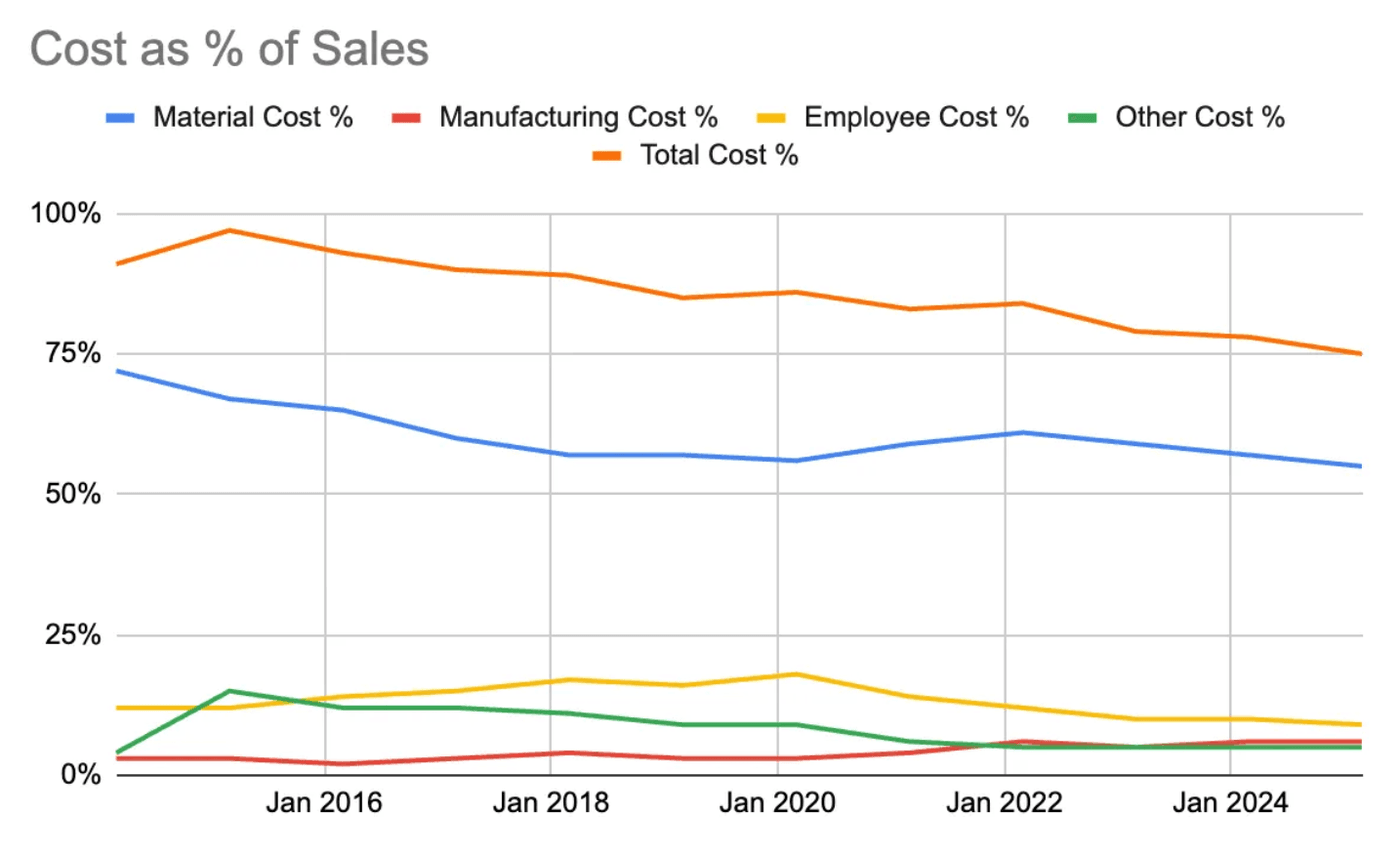

Costs as a percentage of total sales have seen a downtrend, which is good and signifies efficient use of resources. This also means that the company has been able to pass on the increase in the price of raw materials to the customers. This ability leads to higher profit margins in the long run.

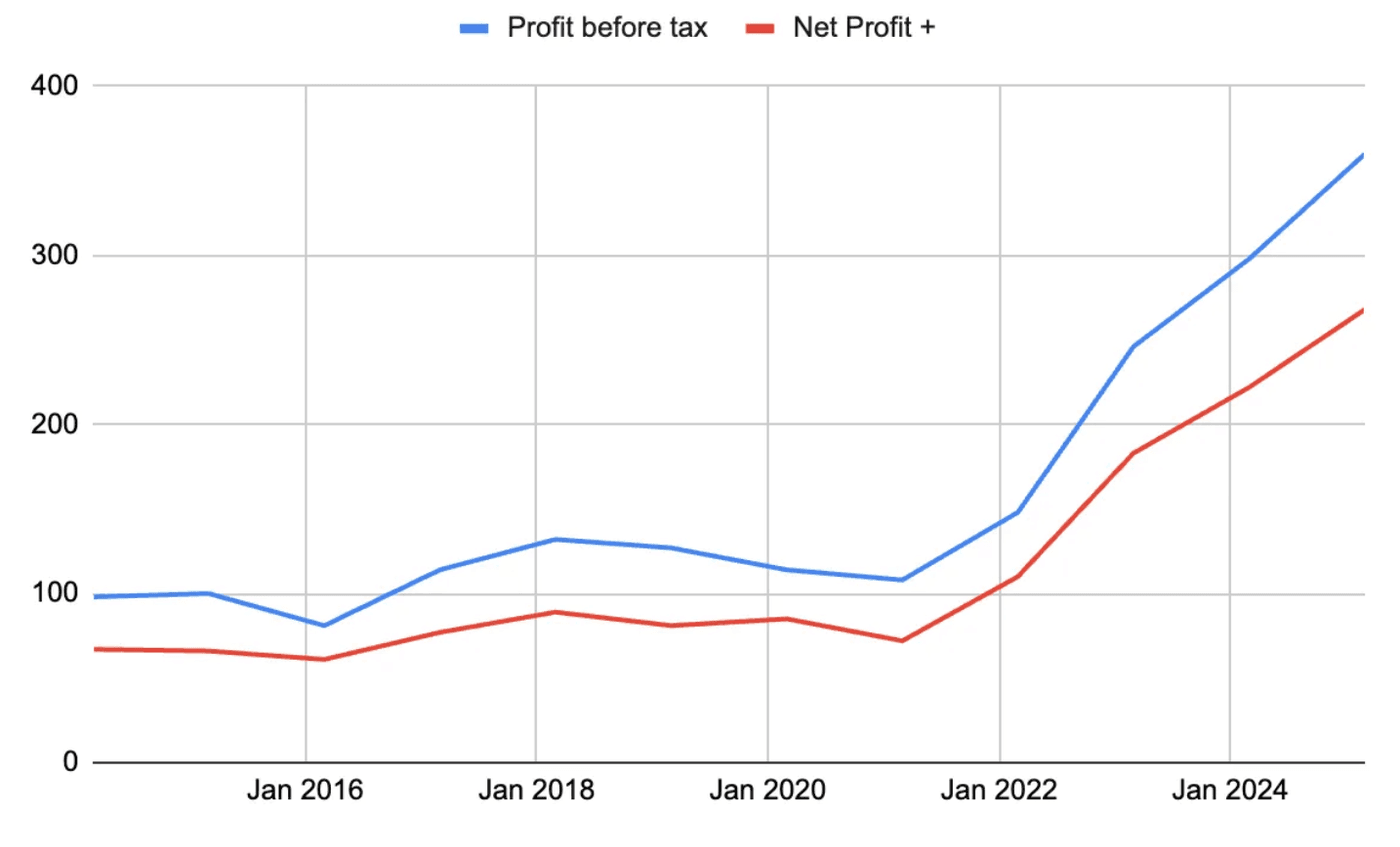

Net profit has also seen an uptrend and mirrors the trend seen in sales and other income levels. It would be good to see CAGR increases for different profit levels.

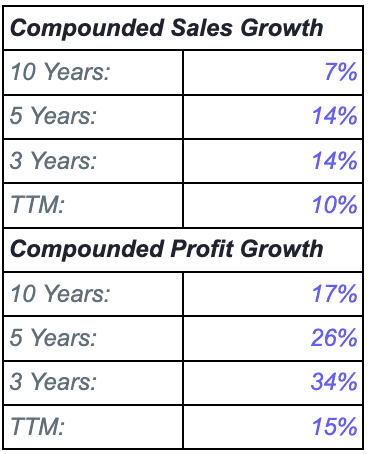

Compounded Sales Growth

Profits have seen a higher increase than sales because expenses and taxes have generally trended downwards. Tax planning has been good, too.

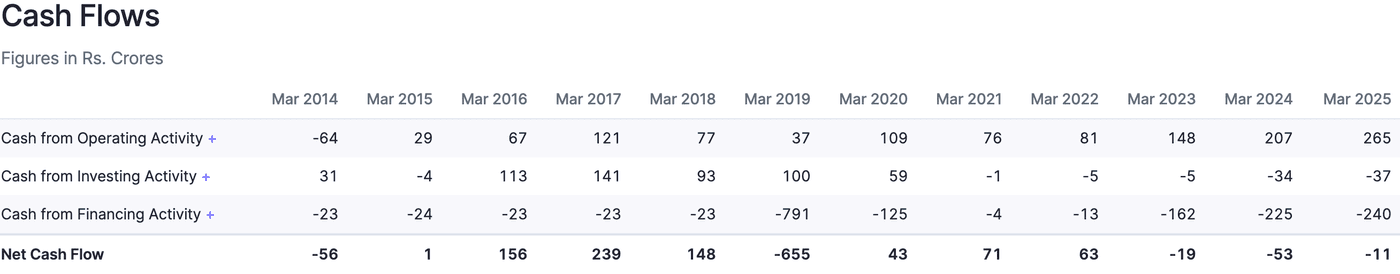

Cash Flows

The company has not seen significant net positive cash flows recently.

- Operational cash flows have been positive, which is a good sign.

- Investing cash flows have been negative, mainly due to investment in fixed assets. This is understandable since the company is setting up a new plant and also upgrading machinery.

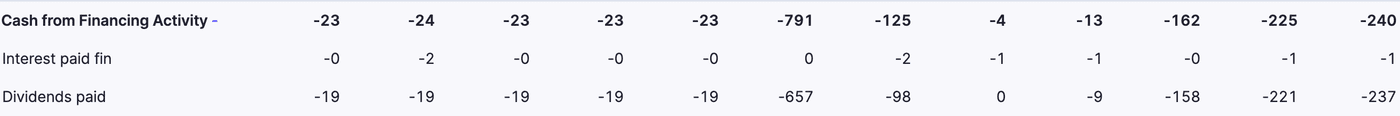

- Financing cash flows have been negative mainly due to the disbursement of dividends. Not a good sign for a company, and might indicate fewer investment opportunities. The reasons provided in the notes to financial statements are just reasonable, but do not inspire confidence.

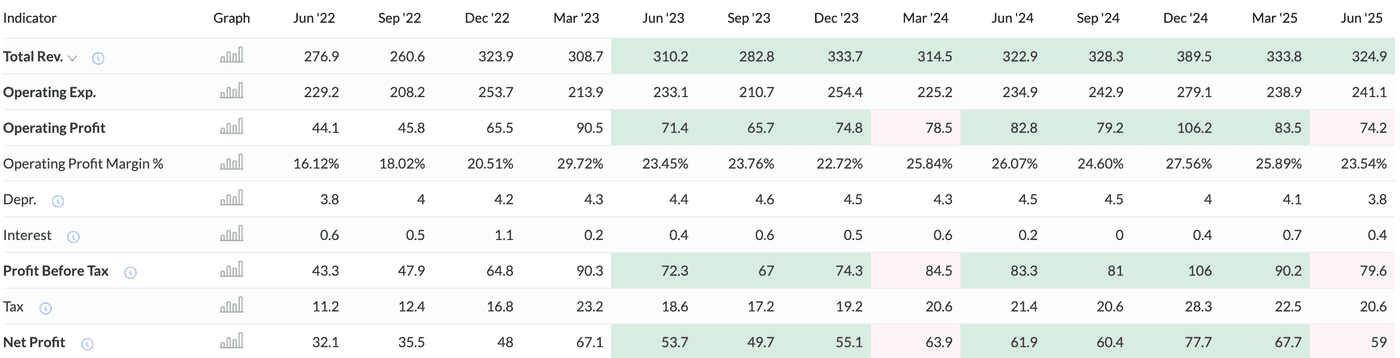

Quarterly Results

It is important to talk about quarterly results for the company, as the latest quarter saw a slight decline in revenue and profits. While the revenue did not fall QoQ, increased operating expenses led to a fall in profits QoQ for the Q1 FY 2026.

The company also does not provide order book value in order to make estimates about the revenue. However, the revenue for the holding company did increase 5% which can be a good sign for the next quarter, i.e., Q2 FY 2026.

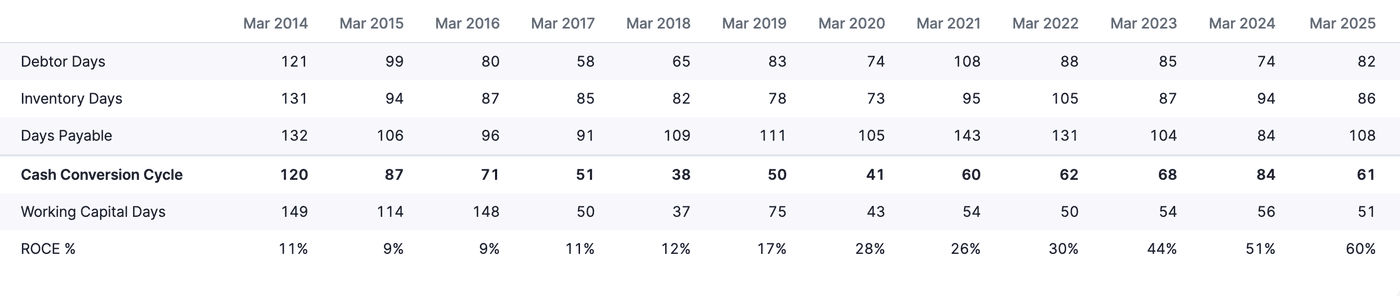

Efficiency Ratios

- Cash conversion cycle has improved and has halved in the past decade, again signifying efficiency.

- Working capital days have also reduced significantly.

- ROCE has increased significantly, a good sign for the investors. We have seen it earlier, too, that the company has among the highest ROCEs in the industry.

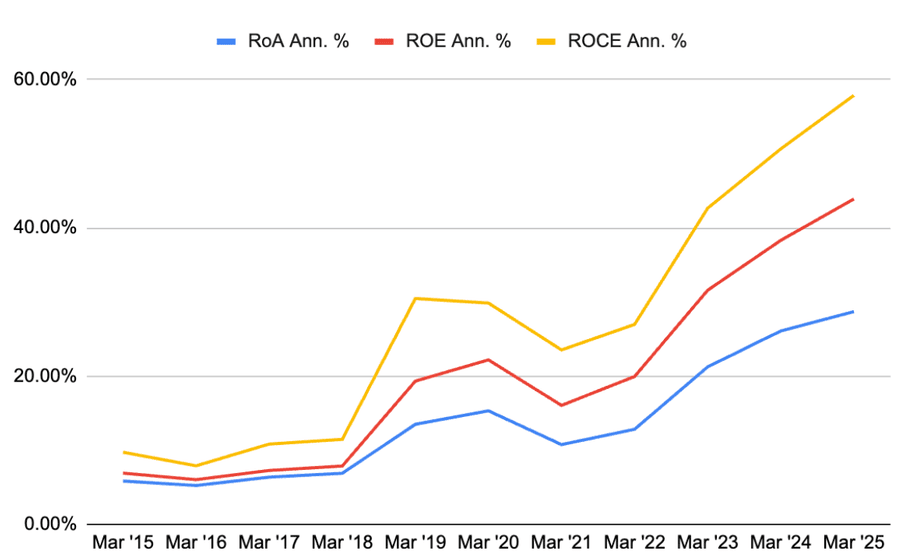

Profitability Ratios

The profitability ratios have been improving and have seen an uptrend, indicating good financial performance for the company.

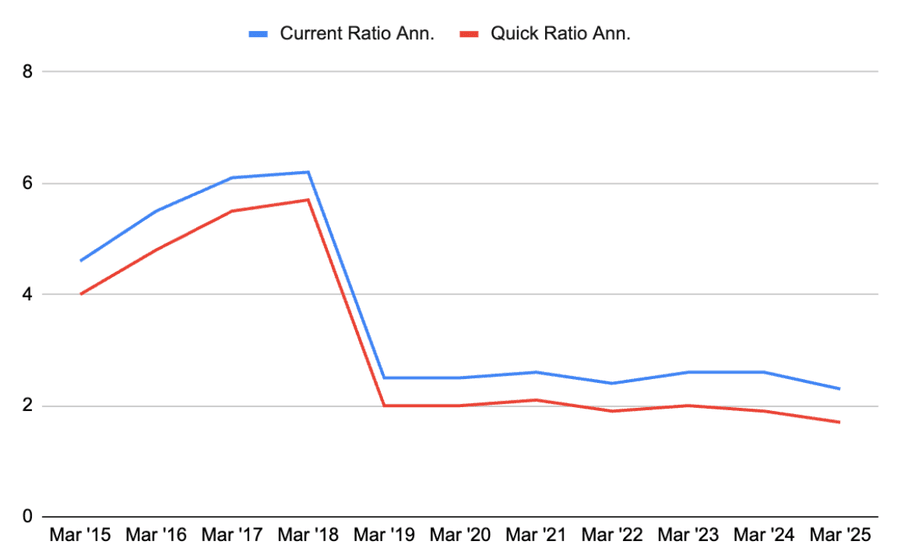

Liquidity Ratios

The liquidity ratios have deteriorated, but this seems to be a result of the payment of dividends, which requires a major cash outflow. The company seems confident with the ratios at present, and there is always an option of short-term borrowing to meet any unexpected need for cash.

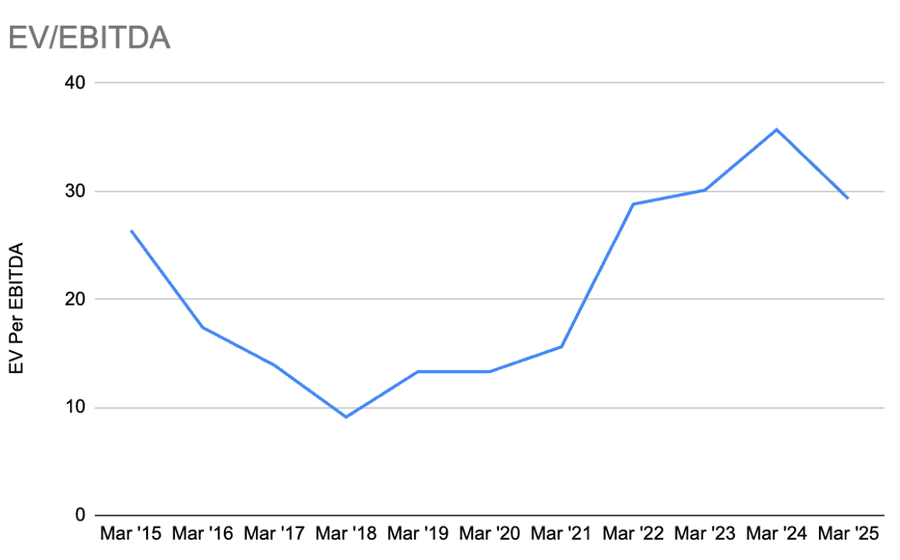

Enterprise Valuation

EV/EBITDA has trended upwards, but has fallen in the previous two years. Somewhere around 30 seems to be a spot where stock has a lesser risk of plummeting. Now this measure does not indicate high growth in stock as the recent quarter results were a slight decrease over the previous quarter. But again, we need to look at TTM figures and figures for the whole FY 2026. A good Q2 might provide a good upshoot in the stock.

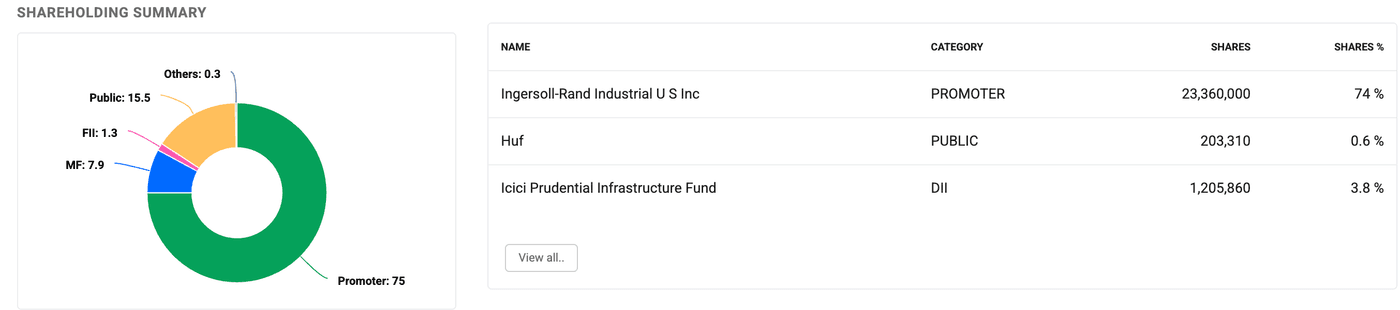

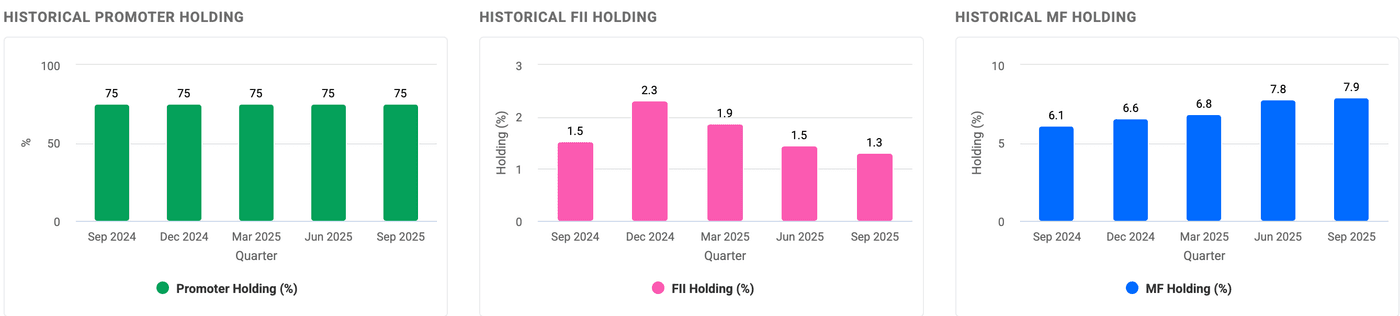

Shareholding Pattern

Promotor holdings have remained constant, indicating confidence of promoters in the company, a good sign for investors.

FII holdings have decreased slightly, but have been more than made up for by Mutual fund holdings, indicating confidence in the company. Mutual funds with large research and financial analysis assets are likely to make good investment decisions on a stock.

Compressing the Good, the Bad, and the Ugly

The stock has potential, and while we wait for Q2 results, a lot of analysts and traders would be doing the same. The good news for the stock is:

- Zero debt

- Strong cash-generating ability of the business

- Efficiency has improved over the past years.

- ROCE is improving, and profits are improving on an annual basis.

- PE ratio and EV/EBITDA are slightly higher but lower than historical highs.

- Mutual funds have been increasing shareholdings recently.

The bad news for the stock includes:

- Costs are growing for long-term projects due to volatility in raw materials.

- PE is higher than the industry PE

- Valuation ratios are higher than the industry average.

- Fall in quarterly revenue.

The ugly news is that the company has a high valuation based on market cap and a low public shareholding percentage. This makes it more susceptible to insider trading.