Talbros Automotive Components Ltd.

About the Company

TACL has nearly 66 years of experience in automotive components manufacturing. The company offers an extensive range of products covering Two-Wheelers, Three-wheelers, Passenger Vehicles, Commercial Vehicles, and so on. The Company’s diverse portfolio includes Forgings, Gaskets, Heat Shields, and Chassis.

The company has nearly 10 plant locations across the nation, where the company has made JV with global companies to have strong technical expertise on the components to be delivered, where they have nearly 2 JV with international entities. The company is the market leader in the Gasket Division in the country with over 50% market share.

The company operates primarily in Four segments

- Gasket & Heat Shield

- Forgings

- MTCS

- TMR

Investment Rationale

- The company is well poised with strong growth in earnings with a diversified product portfolio and growing order book

- A strong focus on building export revenue with JV with global marquee firms ensures strong revenue growth with margin expansion with a strong focus on EV market.

- The company is reasonably valued considering its strong prospects in the coming year.

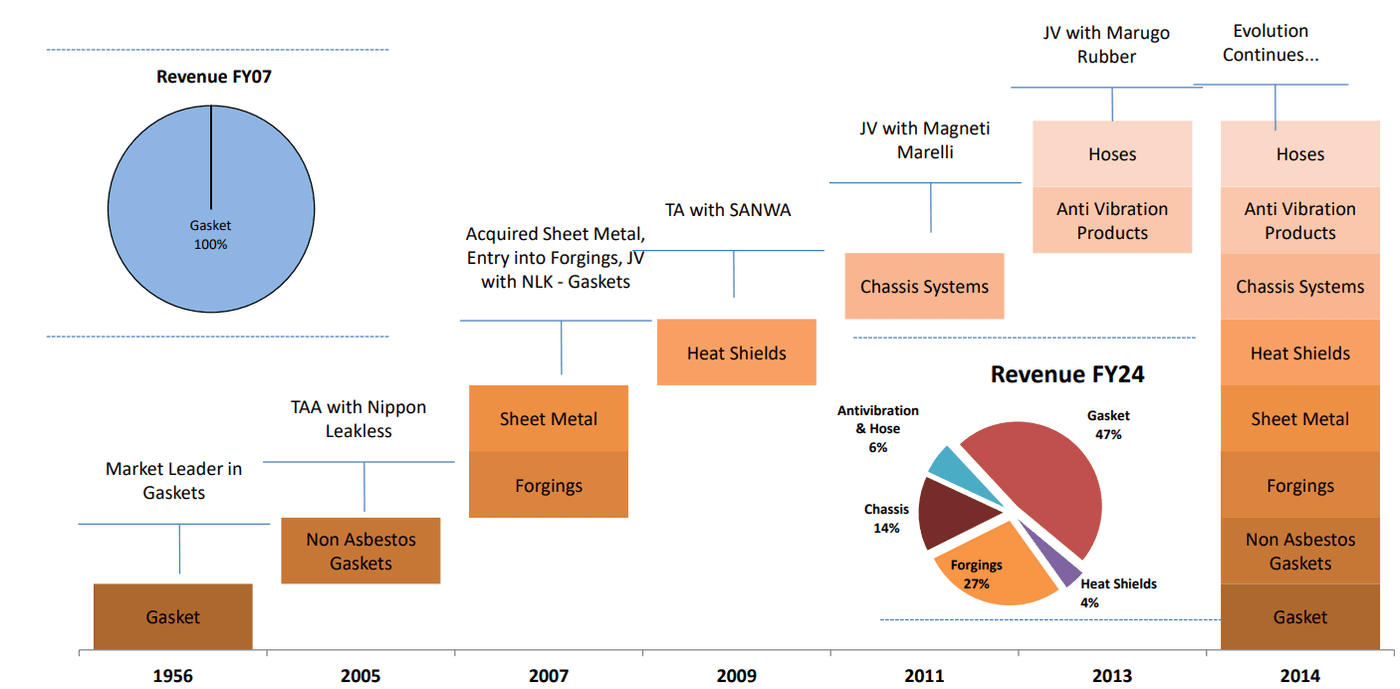

History of the Company

Source: Investor Presentation

Business Segments

Gasket & Head Shields

Gasket serves as a key supplier to major customers like Cummins, Bajaj Auto Limited, John Deere, Volvo-Eicher, Honda, and Hero MotoCorp. The Company is actively expanding into new geographies, targeting LCV, HCV, industrial, and EV segments, leveraging its technological prowess to meet evolving market needs. As of H1FY25, this segment contributes has contributed around 277 crores.

Forgings

Forging Business is another key segment for the company, where the company is the manufacturer and exporter of precision machined components, bolstered by its in-house forging facility. The Company’s clientele spans the automotive, agriculture, and off-highway industries. It has garnered accolades from prestigious entities such as JLRQ, BMW, and Dana, in recognition of its commitment to quality, scalability, and global support. As of H1FY25, this segment contributed nearly 154 crores.

MTCS (Marelli Talbros Chassis Systems)

Marelli Talbros Chassis Systems Pvt Ltd (MTC) is a joint venture 50:50 between Talbros Automotive Components and Magneti Marelli S.p.a (Milano) – A Fiat group company, where this tie-up has been since 2012, Significant share of Control Arms business from Maruti Suzuki and Tata Motors. Products: Control Arms, Front Axle, Rear Axle. As of H1FY25, the revenues have been 68 crores where the majority of the income is from the OEM, which contributes 75% of the total revenue.

TMR (Talbros Marugo Rubber)

The company has made a Joint Venture with Marugo Rubber Industries Ltd (Japan) Global leader in the supply of Anti-Vibration Products and Hoses. 50:50 partnership commenced production in February 2013. 100% Sales to OEMs predominantly Maruti Suzuki. Products: Engine Mounts, Strut Mounts, Mufflers & Hangers, Suspension Bushes, Rubber Bushes, Hoses. For H1FY25, the company has a revenue of 31.6 crores.

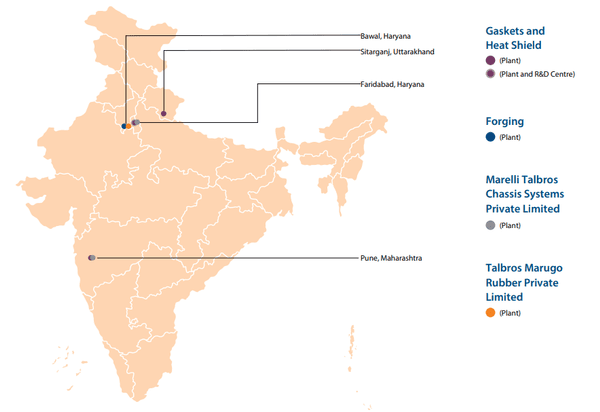

Manufacturing Facilities

The company has nearly 4 manufacturing locations in the State of Haryana, Uttarakhand & Maharashtra, with 10 plant manufacturers across the country.

Geographical Classification

The majority of the Income comes from India which contributed 75% of the total revenue in FY24, Export contributed 25% of the overall revenue in FY24.

Management

- The company’s management is led by Mr. Naresh Talwar (Chairman) who has nearly 20 years in the industry.

- Mr. Anuj Talwar is the Joint MD and has been associated with the company since 2008, where he has rich experience in Corporate Finance, Credit analysis, and the Auto Industry, where he is looking after the performance and business growth of the Company and its Joint Ventures on regular basis.

- Mr. Navin Juneja who is the Director & Group CFO of the company has more than 36 years of rich experience in Finance, Accounts, Treasury, Taxation, and General Management, and has been instrumental in the growth of the JV and managing them.

- The promoter currently has a 58.43% stake in the business, which is reasonable for the size of the business.

Deep-Dive on the Investment Rationale

The company is well poised with strong growth in earnings with a diversified product portfolio and growing order book

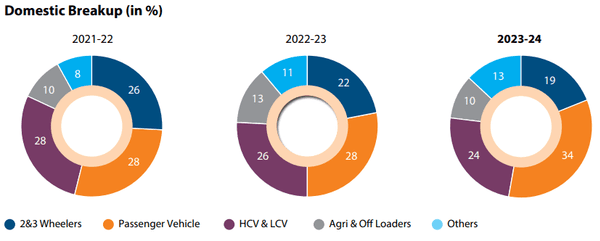

The company is poised to grow its order book in the coming years, with a focus on diversifying its overall portfolio to ensure sustained, long-term growth. By expanding into 2-wheelers, 3-wheelers, commercial vehicles (CV), and other segments, the company aims to reduce cyclicality and protect its business. Furthermore, the company has consistently secured a steady stream of orders, with its order book expanding significantly from ₹400 crores in 2021 to ₹2,400 crores as of H1 FY25. This growth reflects the company’s ability to attract strong interest from the global market, with nearly 45% to 50% of its total order book coming from the export segment.

A strong focus on building export revenue with JV with global marquee firms ensures strong revenue growth with margin expansion

The company has established strong relationships with marquee clients such as Hero, Royal Enfield, Mahindra, Hyundai, KIA, and FIAT. These partnerships position the company well for robust revenue growth across all segments, as these businesses are critical players in the auto industry and are expected to experience significant growth in the coming years. The company stands to benefit from this growth, which will likely enhance margins. Additionally, the company has formed joint ventures with global companies, ensuring that operations maintain high-quality standards.

The company is reasonably valued considering its strong prospects in the coming year.

As of September 10th, the company is trading at a TTM P/E ratio of 22. Given the sector’s strong growth, the company has a PEG ratio of 0.93. The company aims to increase its revenue to ₹2,000 Cr by FY27, representing a projected CAGR of 36%. Additionally, margins are expected to expand by 200 basis points, with EBITDA projected to reach ₹320 Cr to ₹350 Cr in FY27.

Based on these projections, the forward EV/EBITDA is estimated to range between 5.5 and 6, while the forward PEG ratio is projected at 0.18, making the company an attractive investment opportunity.

Risk/Threats

Higher Working Capital Intensity

The company is predominantly in the auto ancillary business, where the company needs to maintain the stock for around 3-4 months as it manufactures 3,500 varieties of gaskets requiring 40 types of raw materials. Around 30% of these raw materials are imported from Germany, the US, and Japan, such imports having 1-2 months lead time for delivery. Hence the company needs to significantly invest both in inventory and trade receivables for the smooth running of the operations.

Competitive Intensity

The company faces strong competitive intensity, particularly in the auto ancillary segment, with numerous players in the forging part of the business. However, it is the market leader in the gasket segment, holding nearly 50% of the market share and maintaining a strong presence since the inception of the business. To sustain its leadership, the company must continually focus on product differentiation and stay aligned with industry trends.

Raw Material Volatility & Foreign Currency Fluctuation

The company faces the risk of raw material volatility, primarily due to its reliance on steel and other commodities that have contributed nearly 60% of the raw material cost, which has caused fluctuations in its margins ranging from 12 to 14%. Therefore, the company must manage this risk effectively to improve and sustain margins increasing their value-added products. Additionally, the company derives significant revenue from exports (25%), making it susceptible to exchange rate volatility, which has not been hedged. This poses a major risk, especially as the company aims to increase its export revenue from 25% to 35% of total revenue.

Cyclical Impact of the End-Industry

The company is operating in the segment of auto ancillary, any major impact on the overall Auto Segeemnt affects this business, especially every business moving towards the EV segment of the market, over the past quarter there has been a slowdown in EV sales, it depends primarily how EV business is going to pan out that would determine the overall growth prospects of the company.

Financial Analysis & Valuation

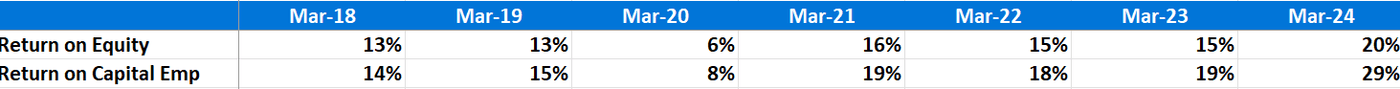

If we can see the ROE of the company, the company has steadily grown its ROE from 13% in FY18 to 20% in FY24, the primary reason they were able to increase the ROE is primarily due to an increase in the Net Profit Margin in the business which has increased from 3% to 14%, this is expected to increase in the coming years with a focus of export income to 25% to 35%.

Valuation

As of November 30, 2024, the company trades at a valuation of ₹1,975 Cr with a P/E ratio of 22.7 and an EV/EBITDA of 12.9. This valuation appears reasonable, given the company’s strong earnings growth prospects. The expected EPS is projected to grow at a CAGR of 35%, driven by a focus on margin expansion. Operating margins are currently at 15%, with an anticipated margin expansion of 100 to 200 basis points over the coming years.

The company’s increasing order book, particularly through its joint ventures with MTCS and TMR, positions it to enhance its earning potential. Additionally, favorable interest rates provide optionality that could further strengthen the offload and agriculture segments. The company’s well-diversified presence across segments supports a sustainable growth trajectory. It boasts a robust executable order book, extensive market experience, and a leadership position with over 50% market share in the gasket segment. The Company took a strategic decision to divest its complete 40% ownership interest in its joint venture entity, Nippon Leakless Talbros, for 81.80 Crores which also gives the company to look to strongly expand its offering with the JV and increase the capacity in the coming years.

Looking ahead, the company is poised for growth across its key segments. A focus on diversification and maintaining a strong market fit ensures stable long-term performance. Furthermore, its collaboration with MTCS in the electric vehicle (EV) segment highlights its strategic approach to tapping into emerging opportunities and reinforcing its growth potential.

Investors should be cautious of the risks, particularly raw material volatility and intense competition in the auto ancillary segment. The company must adapt to market trends while managing the risk of raw material fluctuations. Additionally, with increasing working capital intensity, primarily due to investments in receivables and working capital, the company must be mindful of these factors before making investment decisions.