TD Power Systems: Tranformer-ing Power Generation

The electricity supply in India has improved drastically in the past two decades, with power cuts and load shedding becoming things of the past. While issues remain, the improvement has been huge.

I remember around 20 years ago, when I was visiting a tier 2 city and happened to go to a market in the central part of the city, the footpaths were lined up with small generators, maybe 5-10 Kilowatts or even less. Smaller shops had smaller ones, while the larger shops and the ones running ACs had big ones. Considering today’s fuel prices, small inefficient generators would cost 40-50 INR per unit, while the supply from various state discoms is somewhere around 8-12 INR.

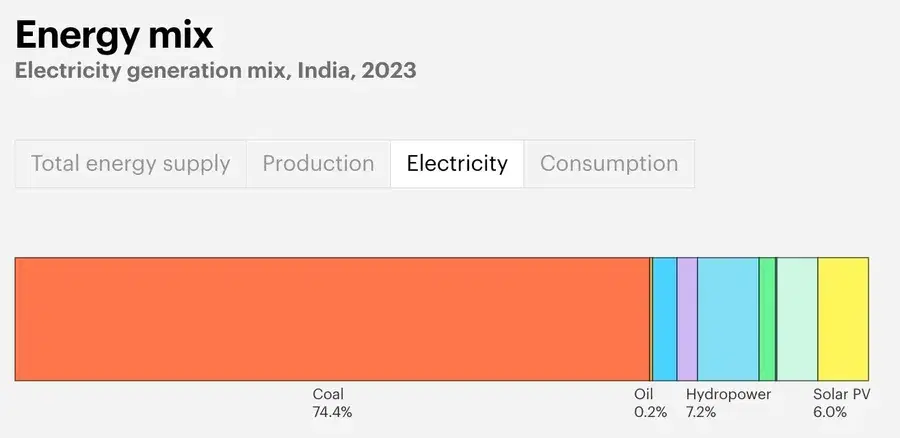

How do countries produce their electricity?

Now we know that most of the energy produced in India comes from coal, and coal can cost as little as 2-3 rupees per kg when sourced at scale. 2 kg of coal will provide the same energy as a liter of diesel. So generating electricity from coal is very cheap, at least for India. Coal is used to heat water to make steam, which runs the turbines to generate electricity. And the agency doing this is NTPC. So there is nearly a 75% chance that the electricity you are using is coming from NTPC.

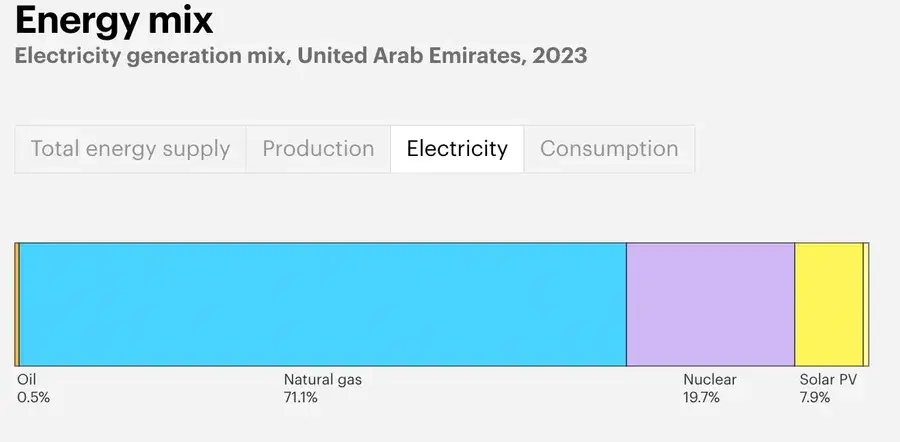

Other countries, such as the UAE or oil-rich countries in the Gulf, have more crude than coal. Hence, it is feasible for them to produce electricity using petro products. Among the petroleum products, in the UAE, natural gas is the most used, accounting for more than 71%.

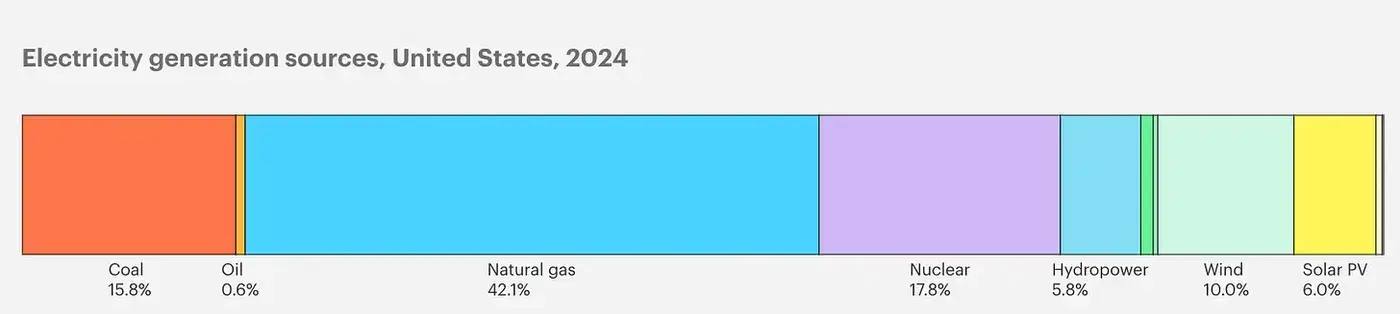

In the case of the US, the energy mix is more diversified, but natural gas still takes up the lion’s share of 42.1%. So the US energy demand is a little more than twice that of India. As a result, a company that has US energy clients can have a larger market than India.

TD Power in Fray

So here’s the deal. What happens is that the US and the UAE generally use big generators with Megawatts of capacity to generate electricity for their grid. A number of these generators in one place are installed, and they form a power plant.

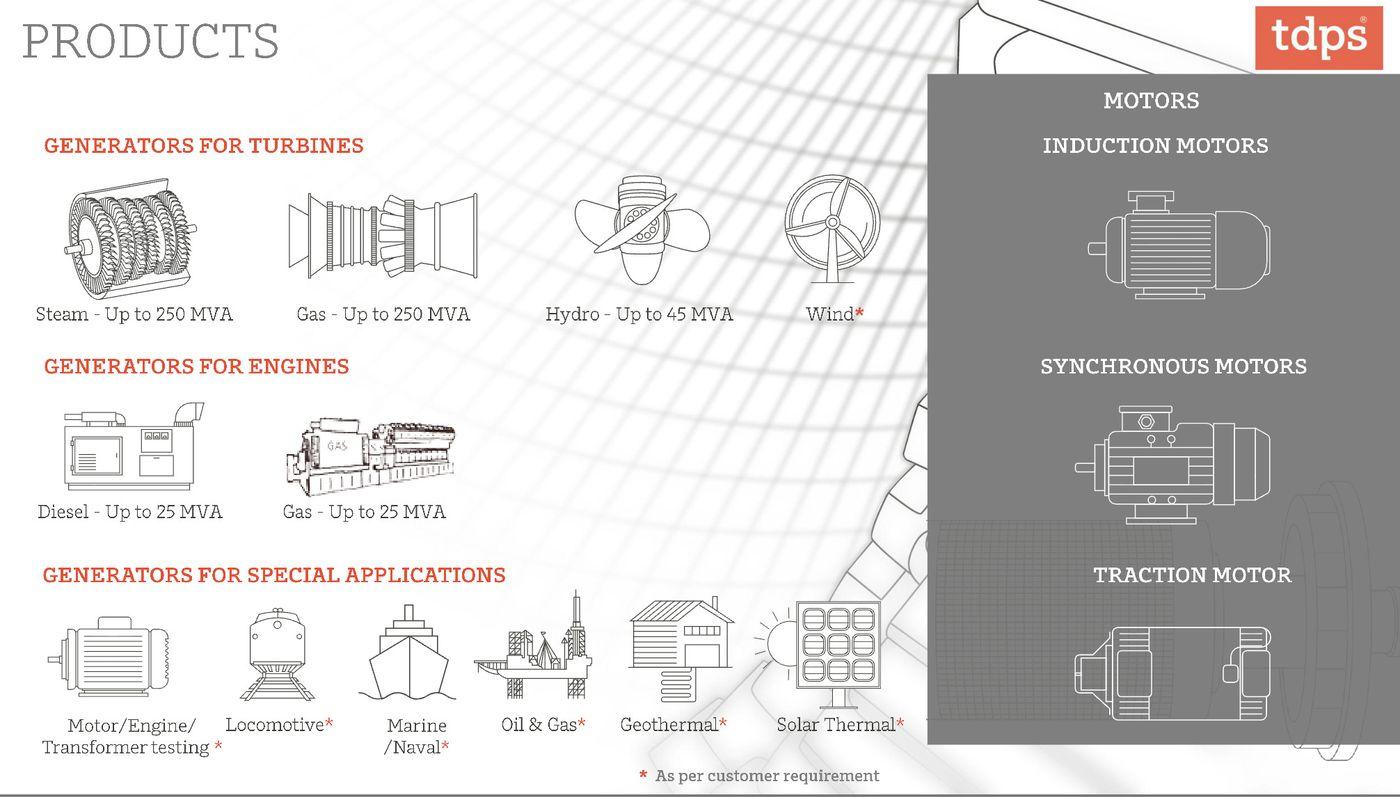

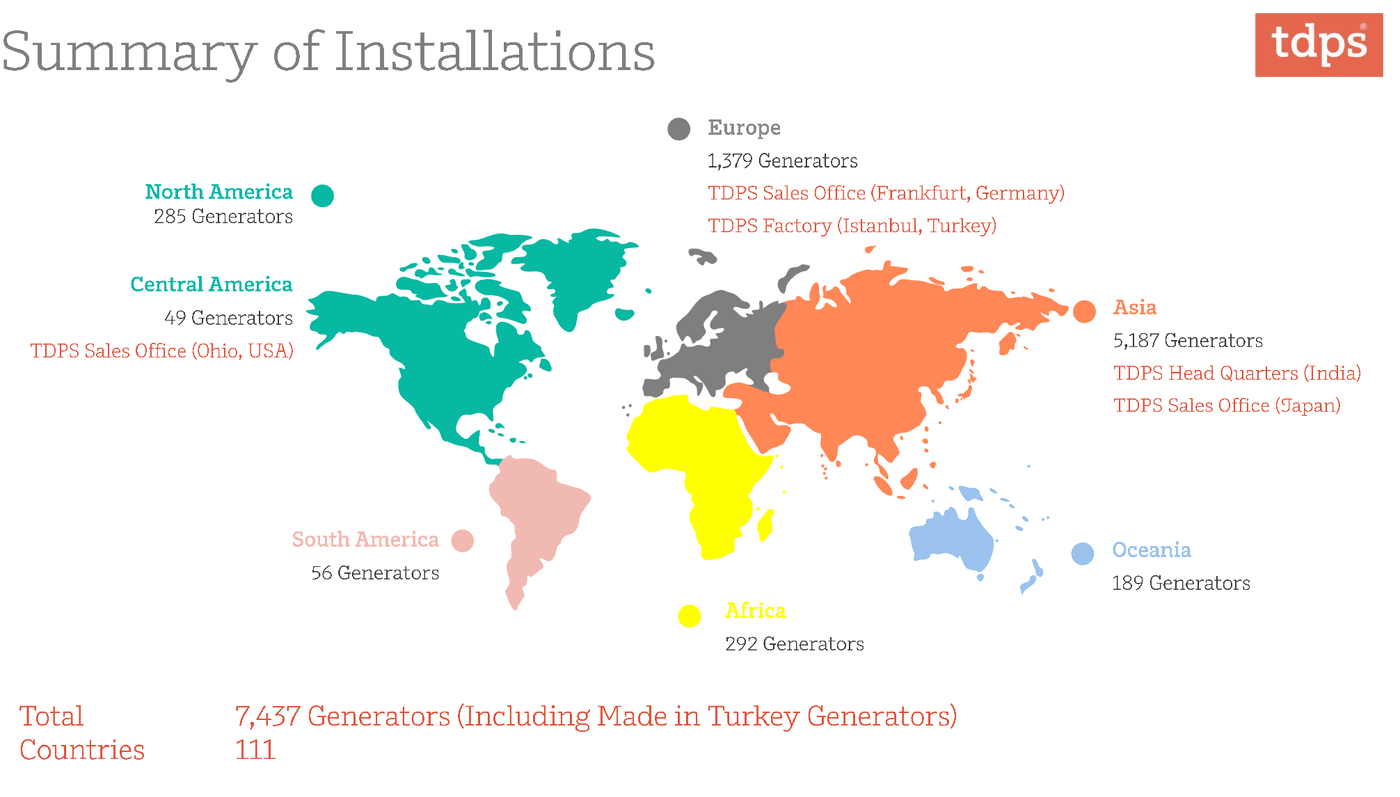

TD Power solution (TDPS) provides generators and motors to clients in India, and US/Europe, including Turkey. While smaller generators are operationally expensive, large generators such as the ones from TD Power can produce electricity comparable to the cost of coal.

TD Power's Clients

TD Power provides generators to power plants, Data centers, gas turbine systems, and fracking wells in India and the US/Europe.

- Fracking wells are more common in the US due to shale deposits. Since the wells are remotely located, the setup carries power generators for different uses and also operates actual well-digging and pressurizing fracking tubes.

- Data Centers use gas turbines as both primary and secondary backup sources. This sector has been growing significantly over the past five years.

- Gas turbine systems can be used anywhere where an electrical grid is not easily available. Most common in remote areas.

Major Clients - Siemens Ltd, GE, Voith Hydro, Alstom, and Triveni Turbine Ltd.

TDPS commands a dominant ~95% market share in the Indian generator segment and holds a ~5–6% share globally

While the US accounts for a lesser share historically, this is set to rise. Europe is a large market that is expected to pick up. The inflation in Turkey has cooled off, and it will help reduce raw material and other costs for the manufacturing done in Turkey.

Order Book

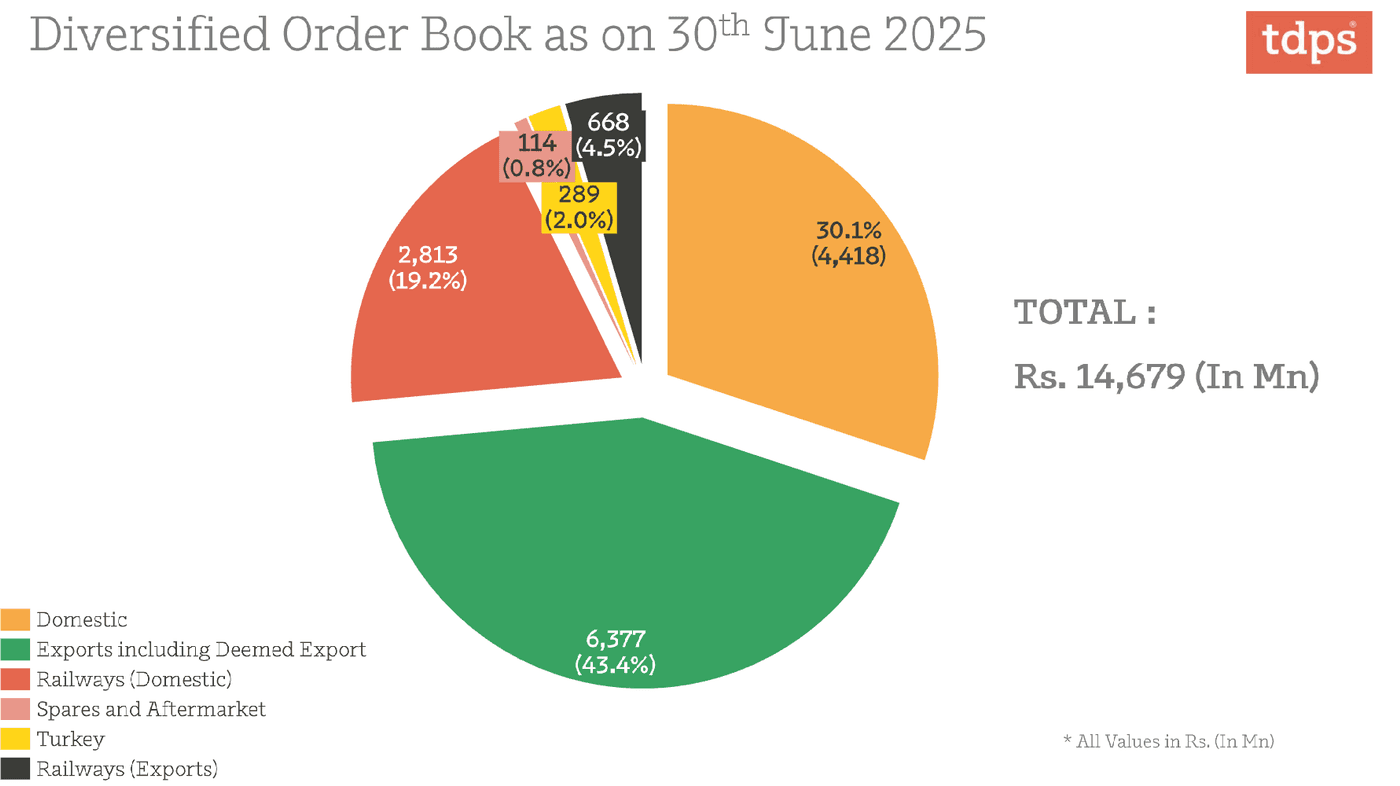

We have discussed US clients, but Indian clients provide a significant revenue too. Indian Railways accounts for nearly one-fifth of the company's total revenue. The company supplies traction motors to both passenger and freight locomotives (engines).

Domestic sales of turbines, generators, and motors account for 30% of the total revenue. All in, the revenue sources are highly diversified.

The Data Centers and How They Affect the Company

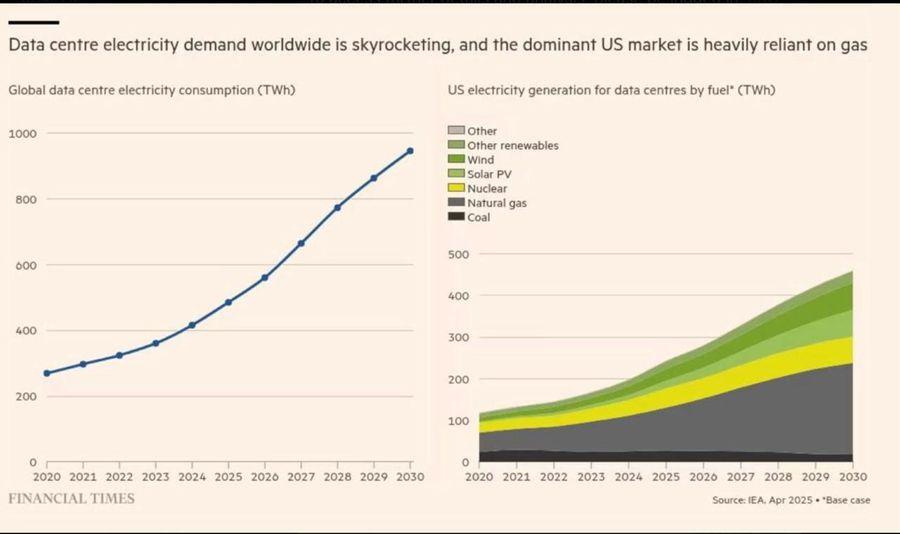

With the advent of AI and the data boom, the demand for a backup source for data centers is on the rise. Gas-powered generators are easiest to set up to provide a good source of electricity.

As per the Financial Times report, natural-gas-powered generators will find a larger and larger share in the energy mix provided to the data centers worldwide, of which the US accounts for somewhere around 40%-50%. Now this is huge for TD Power.

Energy companies in the US are also moving towards natural gas, again. Using natural gas to produce electricity saw a decline over the past few years, but has started picking up after 2021, which coincided with the rise in data centers.

Nearly 80 gas powered powerplants are expected to be built in the US by 2030

Capacity and Expansion

The company has two manufacturing locations:

- Bengaluru

- Istanbul

TD Power Systems has invested 140 crores in its third manufacturing facility in Tumkur, with an annual capacity of ~1,000 machines. The facility is currently under commercial trials and is expected to be operational by the end of FY 2026.

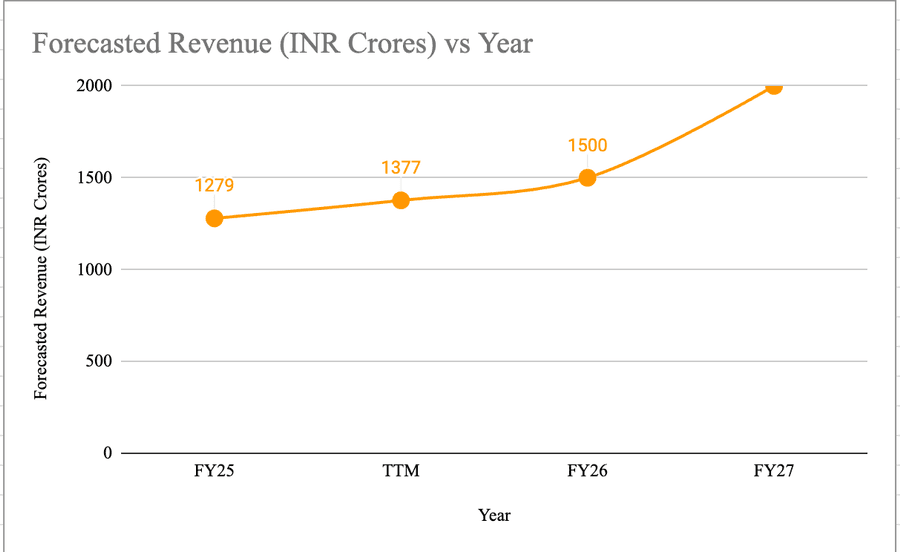

Once commissioned, the new facility will more than double the TDPS’s total capacity from ~800 to ~1800 machines. As a result, the revenue estimates for FY 27 can be upwards of 2000 crores.

Guidance on the Revenue

The current order book for the company, as per the latest presentation, is nearly 1,468 crores. For comparison, the FY25 revenues were 1279 crores. FY26 guidance on revenues is upwards of 1500 crores, which seems reasonable considering that the order book as it is and the fact that new orders from the US are coming in. The management also claims that the clients have asked them to be ready for increased orders.

What works for TD Power?

- Capacity expansion to enhance revenue and growth, which aligns with the enhanced requirements of gas-powered turbines in the US

- Strong export demand for generators, especially in the European Union.

- Nearly 95% share in domestic gas and steam generators

- Strong demand for motors from the Middle Eastern region.

- Wintenssing strong refurbishment and replacement demand from hydro power plants in India

- Manufacturing lead time has reduced from the earlier 7 months to 4 months now.

- Foreign exchange has been significantly hedged using available tools.

- AI-based data centers will see electricity demand tripling in the next three years, as per the US Department of Energy.

Key Risks to Watch Out for

- Promoter holding has decreased from ~59% in FY20 to ~27% in FY26. Not a good sign, but the debt has also not risen much.

- Recent tariffs on India by President Trump can hamper revenues. However, things may stabilize slightly as both countries are in talks.

- The domestic market is still subdued, and the demand is not rising.

- Copper and aluminum prices can fluctuate due to geopolitical tensions.

- The client list is concentrated, with the top 10 clients accounting for more than 70% of the revenues. For example, the whole traction motor business has one client, Alstom.

The Final Verdict

This post talks more about the strategic ramifications and how the company is handling them. The rise of data centers has given the company a new avenue to expand, which is new and is rising very fast. The company has also made a move and is enhancing capacity and commissioning it at a very opportune time. In the next post, we will talk in detail about the financials and how they support the thesis of investment in TD Power.