Sigachi Industries: The Pill Filler

One cannot be sure if the data support this contention, but pills or tablets are larger in India than in the US. I realized this when I got one of my friends to get me a pain reliever for my mother’s arthritis. The contention is that some of the brands in the US work better than the Indian brands due to better quality checks. So when the tablet arrived, my mother was a bit skeptical because of the smaller tablet size. I had to assure her that it works the same, if not better than, the usual OTC formulations available in India (Crocin, Calpol, etc).

Now, both tablets in India and the US contain 500 mg of paracetamol, which is half a gram or 0.5 g, but the weight of the tablets can be significantly higher, i.e., more than 1 g. So why would they enhance the weight?

Well, the reason is that different compounds are added to the actual working drug to make tablets more practical. This practicality can be based on how easily it can be ingested or how the medicine needs to be administered into the body. A large number of times, the additives include various cellulose-based derivatives. These derivatives have four major uses:

- Binders and Fillers: They hold the compound together and provide structural integrity. Most commonly used in microcrystalline cellulose (MCC).

- Controlled Release (Ethers): also made up of cellulose, and are used for sustained release tablets such as Aspirin/Disprin.

- Thickening Agent: (Sodium Carboxymethyl Cellulose (CMC)): used in creams to thicken them and is also used as a coating on tablets. Coating on tablets allows a smooth surface for easy ingestion.

- Dispersing Agents: Some cellulose-based compounds are used to disperse medicines fast. For example, SOS pills for a heart attack.

Now this is one thing you might have noticed, and may now, if not earlier. The meds for say, allergies are smaller in size, such as Avil or Levocetrizine ones. While paracetamol is medium-sized. On the other hand, antimicrobials are larger in size. This happens because anti-allergic medicines need to work fast and have to be absorbed fast, so any additions are not needed, while the antibiotics need to be released slowly so as not to damage the organs, and hence more filling agents and thus a larger size.

Sigachi Industries

Sigachi Industries is one of the largest manufacturers of cellulose-based extracts that go into medicine. The company has been in operation for 36 years and has also diversified its product base.

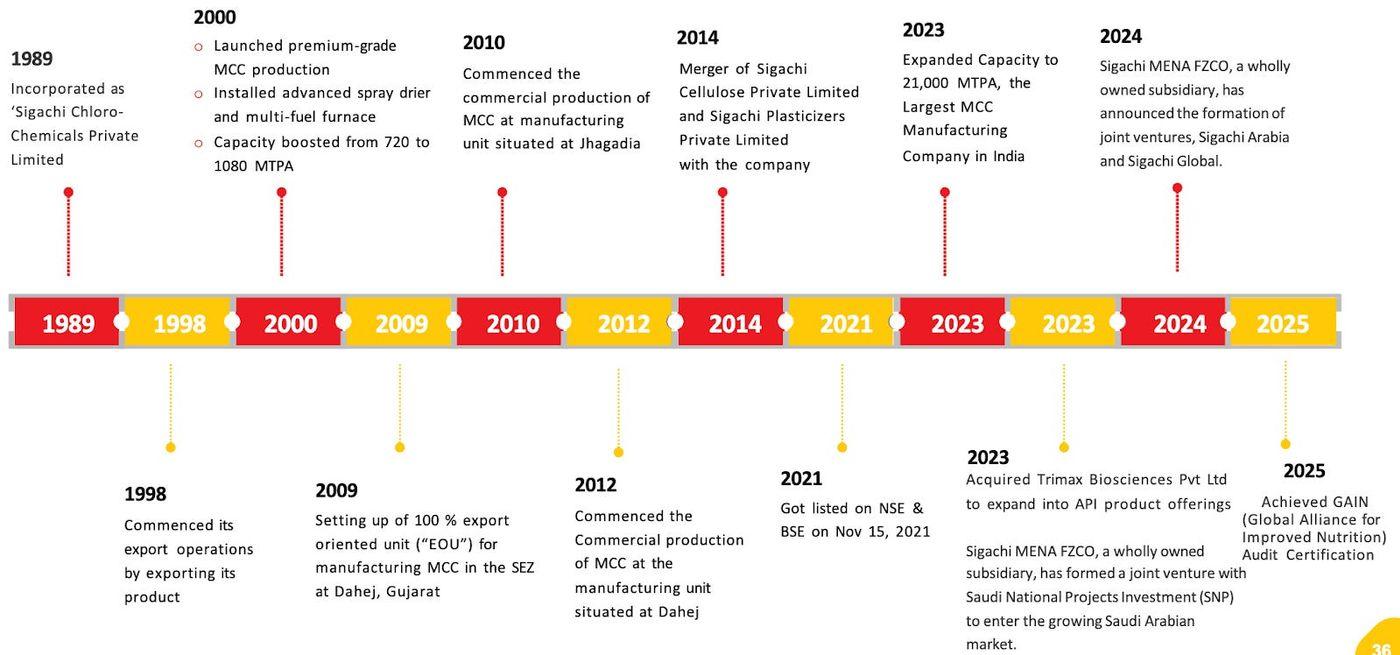

The existence can be traced back to 1989, while the MCC production took off in 2000. Capacity addition in 2009 and 2010 made it a force to be reckoned with. In 2023, the company became the largest producer of MCC in India with a capacity of 21,000 MTPA

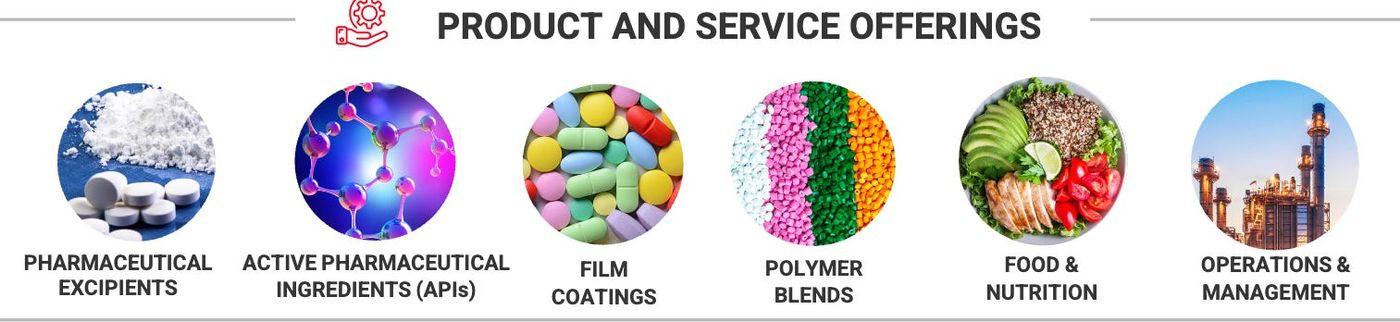

In addition to cellulose-based excipients, it is also involved in the manufacture of:

- Active pharmaceutical ingredients: These are the actual medicines acting to relieve a condition or symptom.

- Other polymer blends for controlled release of medicines.

- Food and nutraceuticals.

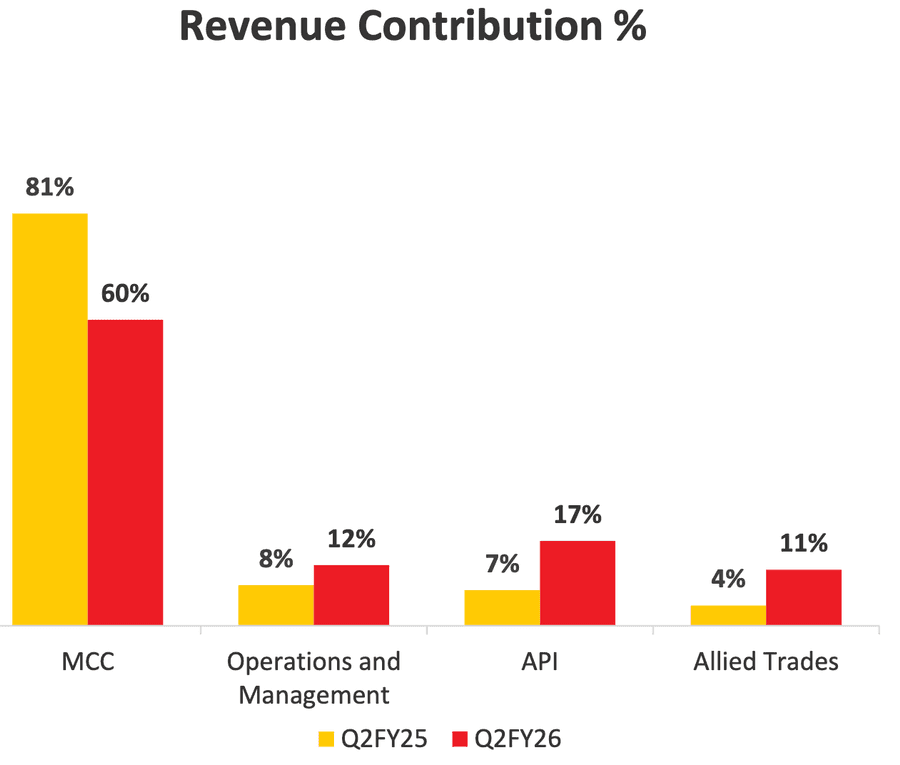

The revenue contribution for major products has changed over the last year due to the Hyderabad plant explosion. MCC has seen a decrease, but the decline has been cushioned by shifting production to plants in Gujarat as a backup.

In all, the company offers its manufacturing services to more than 500 customers across 65 countries, a truly diversified clientele.

The company employs more than 1,800 people in its locations across the globe.

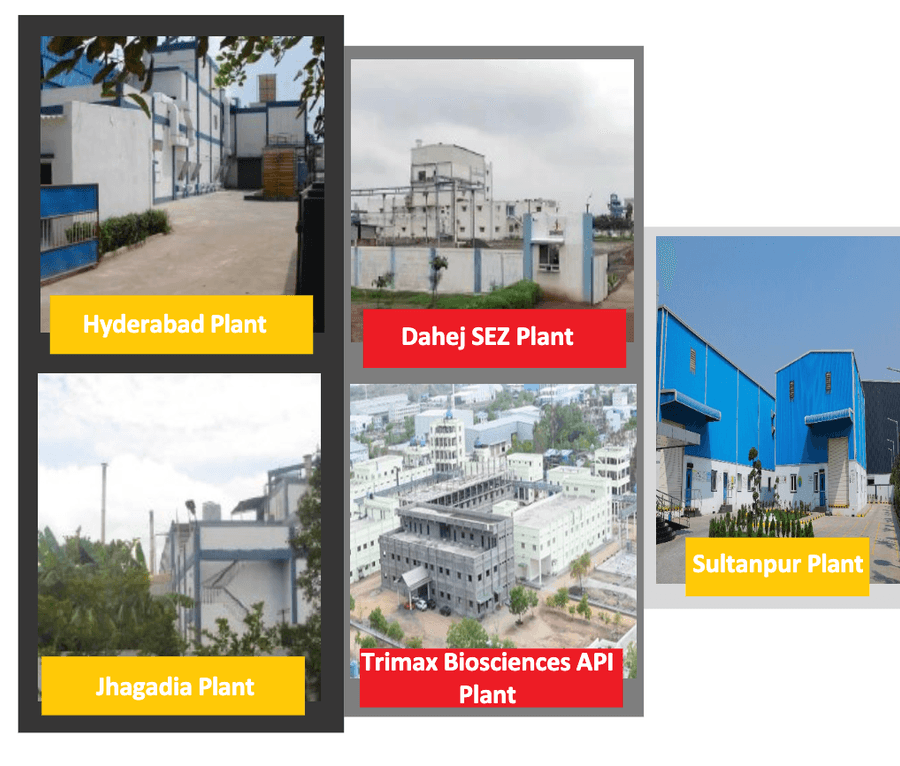

There are five manufacturing facilities located at Hyderabad, Sultanpur, Jhagadia, Dahej & Raichur, providing a geographical presence across India.

The current operating capacity is 18,000 MPTA, and the company produces more than 100 different types of products.

In addition, the company has certifications from EXCiPACT, WHO-GMP, GMP, SGMP, HACCP,

The EDQM CEP, FSSAI, USFDA, and ISO 9001:2015 certifications attest to the quality of its facilities and manufacturing processes.

Hyderabad Accident

On June 30th, 2025, a powerful blast occurred at the Sangareddy (Hyderabad) plant that killed 46 workers, with 8 remaining missing. This was sad for the workers and their families due to the sheer number of casualties.

The unit is expected to be non-operational for at least 180 days.

The news reports and the FIR filed about the incident indicate criminal lapses on the part of the company, and any lapse that leads to a loss of lives cannot be condoned. While the company has been able to shift production elsewhere, we wait for the government investigation to determine the actual cause. However, there have been reports of employees requesting safety measures and the replacement of faulty equipment.

-900x737.png&w=3840&q=75)

Microcrystalline cellulose (MCC) is one of the major products for the company, and before the Hyderabad accident, it accounted for at least 80% of the total sales. The Hyderabad unit was responsible for more than 30% of the production of MCC last year, based on actual production volumes, and was operating at near full capacity.

With the unit going out of operation, part production has been shifted to Dahej and Jhagadia in Gujarat. This has cushioned the drop in revenue to a large extent and attests to the resilience of the company.

Research and Development

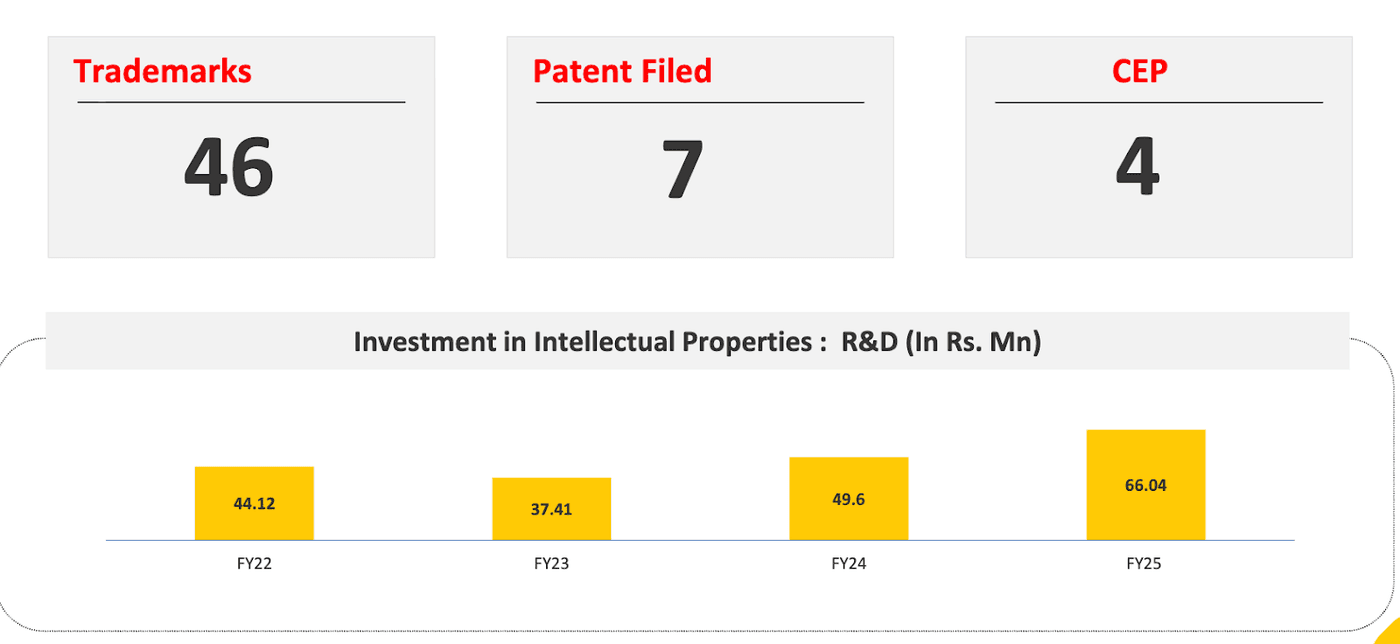

Sigachi has been investing in R&D to diversify its revenue sources since more than 4/5th of its revenue comes from MCC.

The company has invested more and more each year into R&D, with nearly 6.6 crores in FY 2025. Investments have yielded 7 patents to date in addition to 4 CEP certifications. Patents can lead to API formulations that can be commercialized.

A new API R&D facility at Hyderabad is operational and is not affected by the blast. It is expected to enhance R&D facilities and output.

Is revenue concentration in MCC a risk for Sigachi?

Not really. MCC is used by nearly every drugmaker, and therefore, the customer base is highly diversified. It ranges from large to small players alike. MCC is similar to having a steel company that makes only steel ingots. However, these are used by nearly every industry, so the company is not at risk unless the whole pharma industry declines.

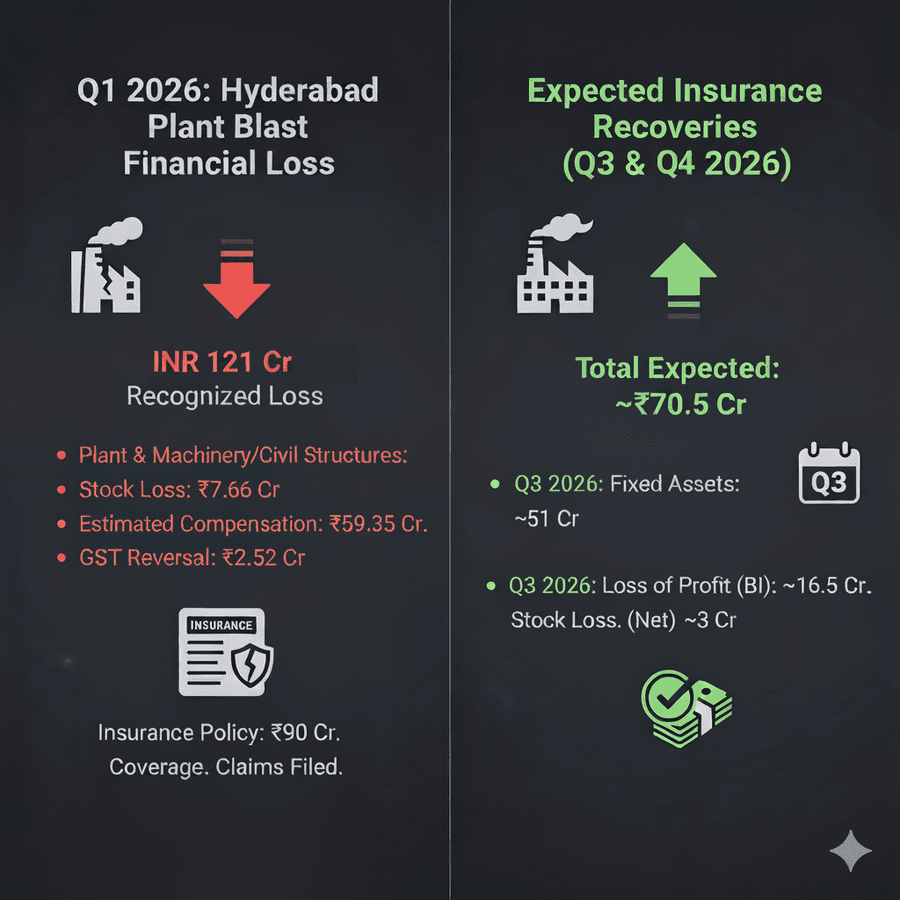

Hyderabad Incident: Financial Loss and Recovery Details

Before beginning with a detailed financial analysis, let’s see the financial impact of the blast at the Hyderabad plant. In Q1, 2026, a loss of 121 crores was recognized in the income statement, which included:

- Plant & machinery/civil structures - INR 51.48 crores

- Stock loss INR 7.66 crores

- Estimated compensation INR 59.35 crores

- GST reversal INR 2.52 crores

The company had an insurance policy that covered 90 crores, so claims were filed. Out of these expected recoveries, which are likely to be recognized in Q3 and Q4, 2026, include:

- Fixed assets of nearly Rs 51 crore (expected Q3)

- Loss of profit (12-month business interruption): ~Rs 16.5 crore (expected Q4)

- Stock loss: ~Rs 3 crore net.

Strategic Landscape: Pharma Industry in India

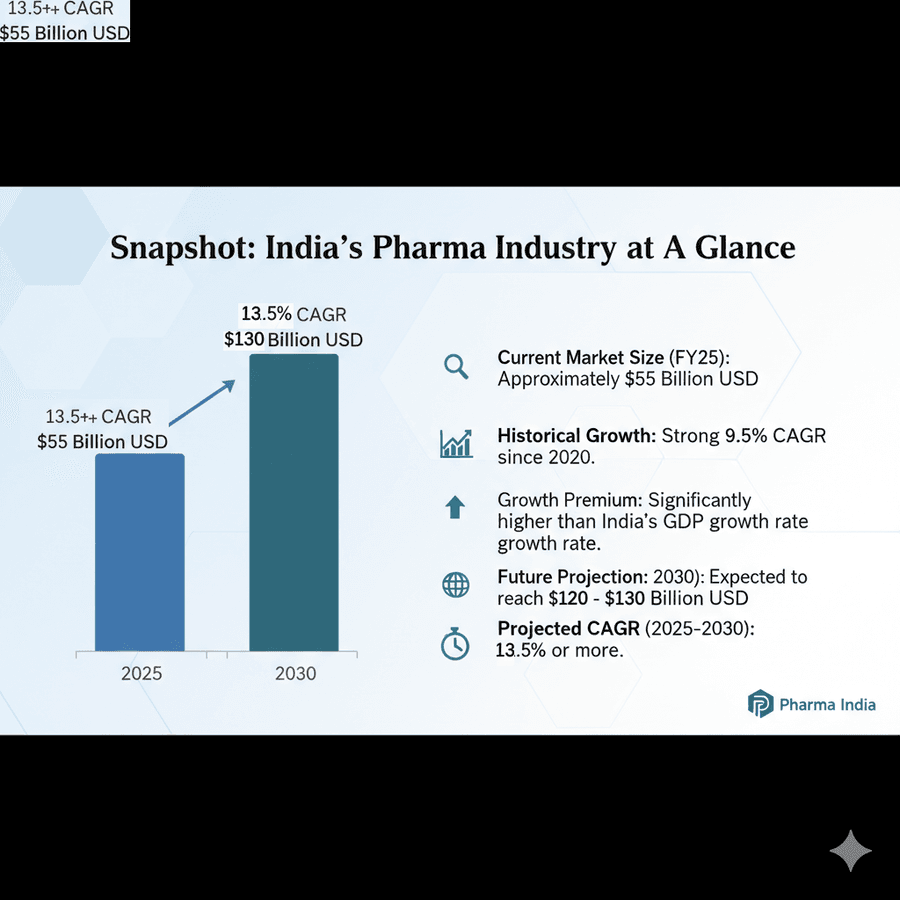

The pharma industry in India is known for its high growth, which is near double-digit growth. The Industry has grown at a 9.5% CAGR since 2020, which is much higher than the GDP growth rate of India. The total pharma industry was around $55 billion USD in India. This is expected to grow to $120-$130 billion by 2030, which is a CAGR growth of 13.5% or more if we average it out. This bodes well for Sigachi as it is likely to mirror similar growth.

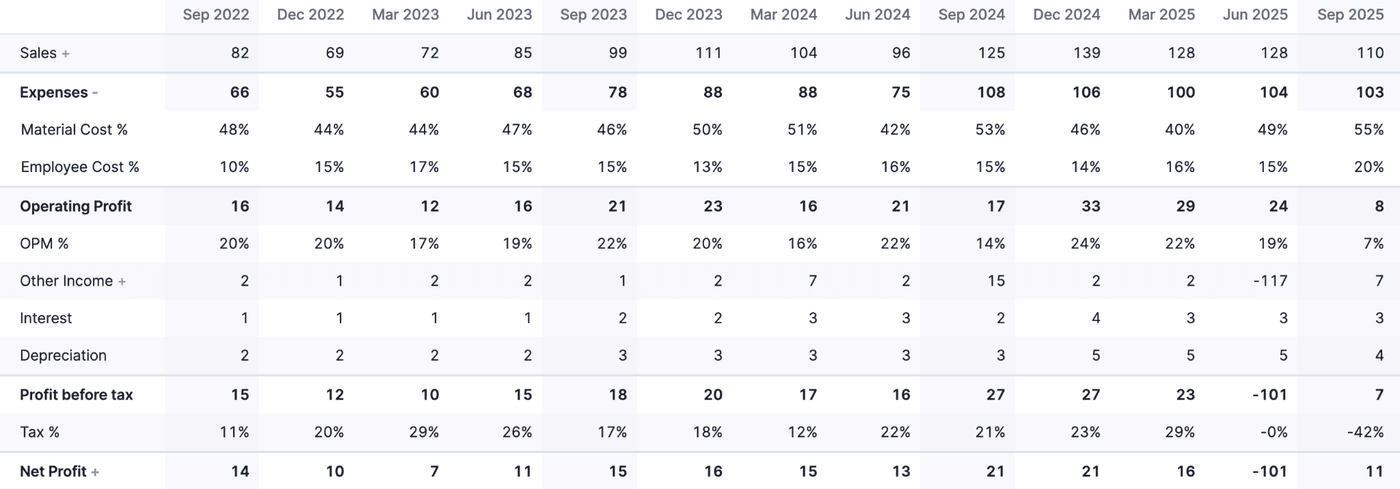

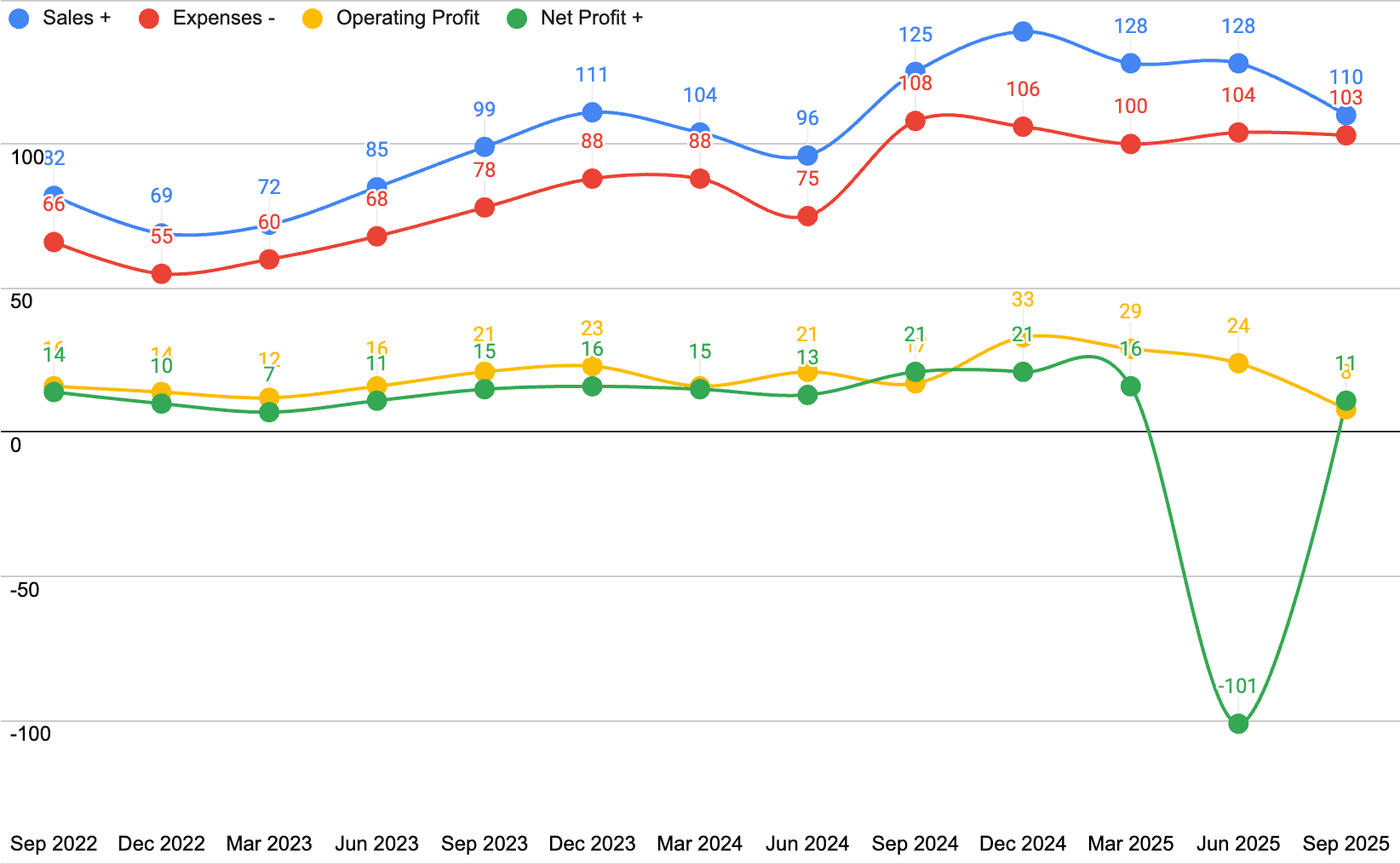

Quarterly Results

The revenues as well as profitability have been affected by the Hyderabad incident. The full loss has been recognized in Q1, 2026, and therefore, the net profit is highly negative. Loss in revenues is significantly cushioned.

A graph may help you understand this better.

As we have seen, more than half of this loss of ~70.5 crores is expected to be recovered in the near future. Any recoveries will be recognized as profit in the income statement. What I like is that the management recognized the loss completely in one quarter.

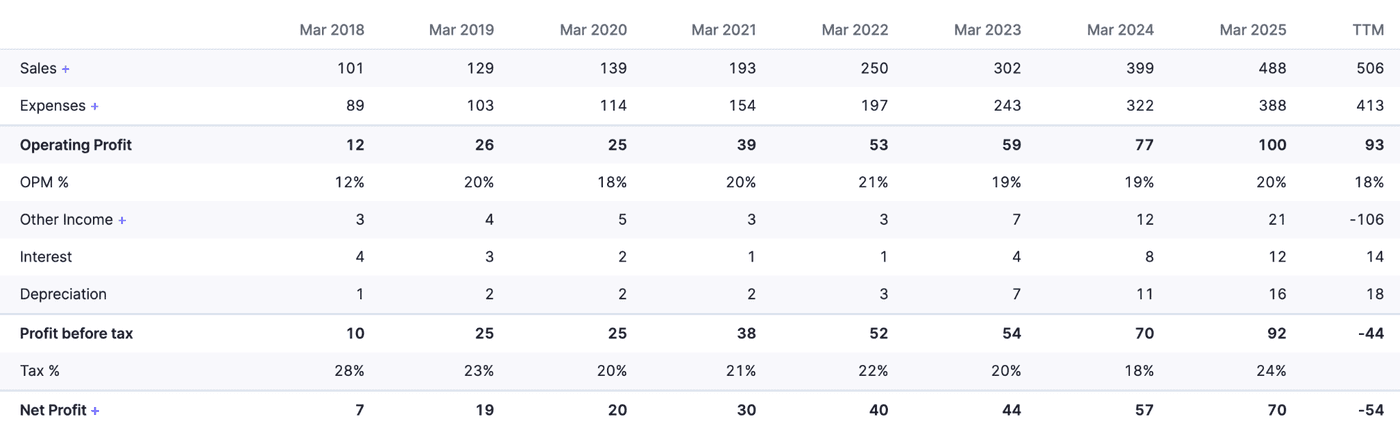

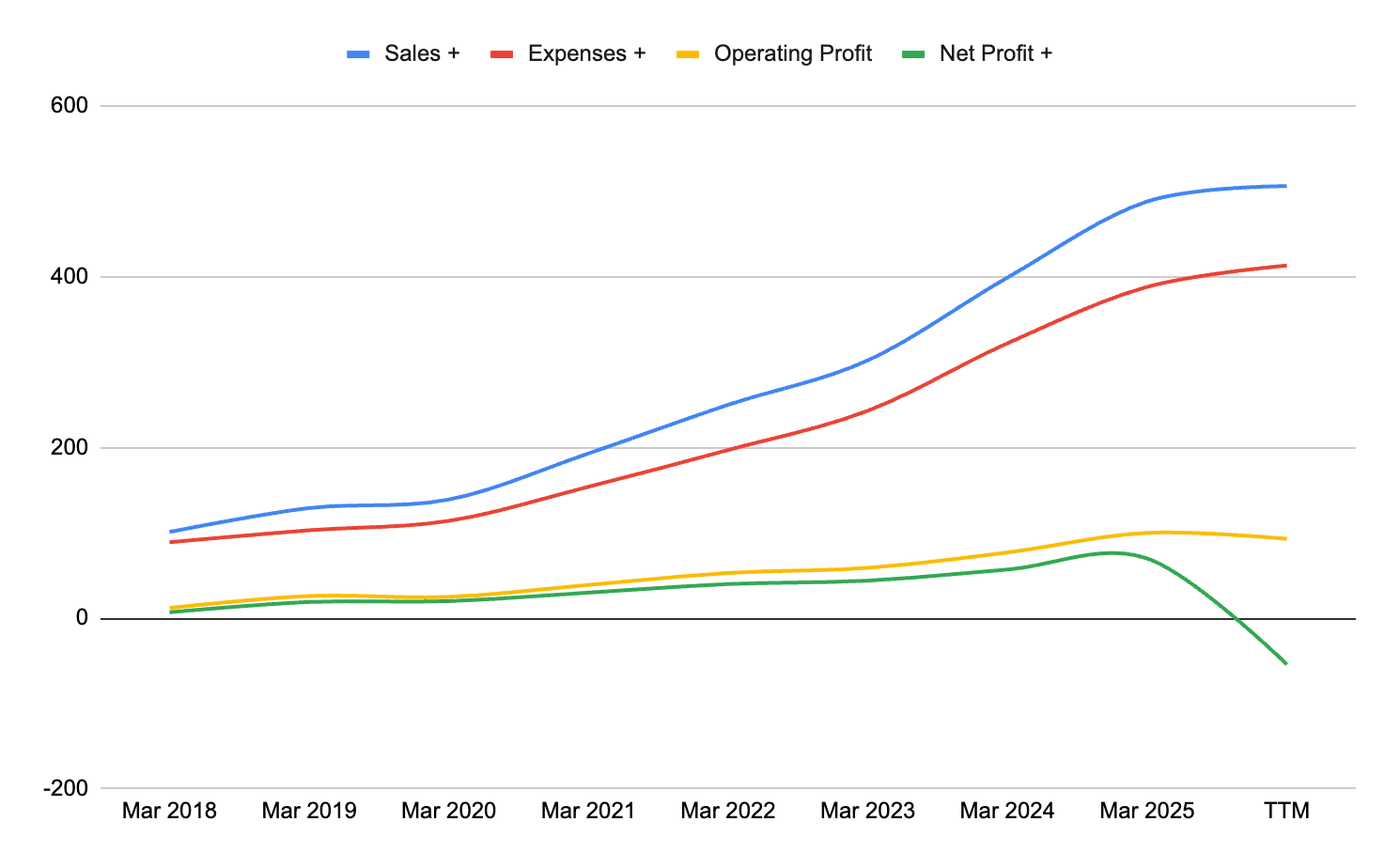

Annual Snapshot

Let’s put this in a graph

We have used the TTM figures to assess the immediate impact of the loss due to the blast at Hyderabad. Even after taking a loss of 121 crores, the profits have not been affected much on an annual basis. The revenues have seen a slight increase, which is good. Expenses have also gone up slightly, but not steeply. Operating profit is still positive, which is a good sign.

Balance Sheet

Reserves have been increasing and show that the company has been reinvesting its earnings. This is a good sign and shows that promoters and managers are confident about the company’s future. This also means dividends being paid are less, which we will see later on. This also affects ROA, ROE, and ROCE, which we will also discuss later. Investments in fixed assets have been increasing, and hence, the value of fixed assets is increasing even after accounting for depreciation.

Looking at September 2025 figures, Reserves as well as Fixed assets have decreased. Reserves from 563 crores to 470 crores, and Fixed assets from 370 to 327 crores. In addition, other liabilities have increased from 103 crores to 198 crores. A decrease in fixed assets can be attributed to write-offs from the Hyderabad incident. Increase in other liabilities includes nearly 60 crores of compensation to the casualties of the incident.

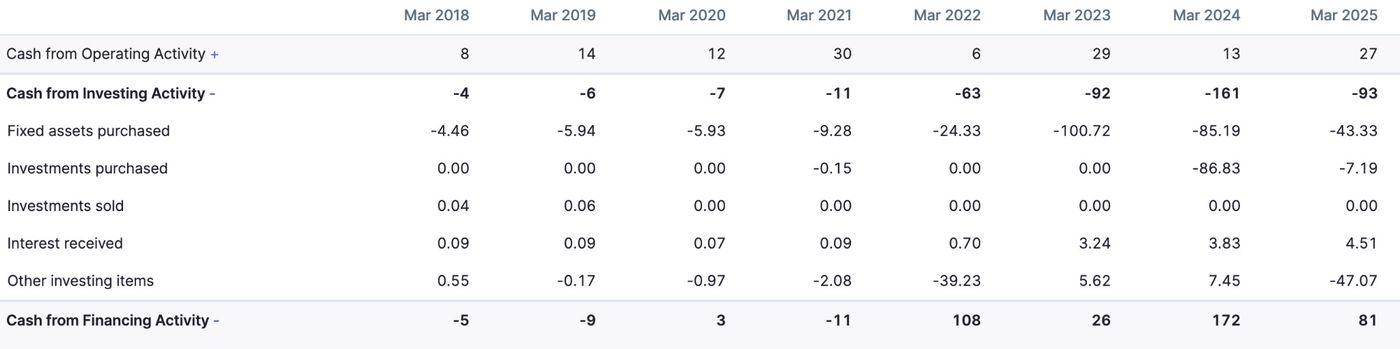

Cash Flows

Total cash flows have been generally positive. Any negative cash flows stem mainly from investment in fixed assets such as plants and machinery. With a new plant coming up at Dahej, Gujarat, significant outflows have been recorded.

Investment purchases in FY 2024 seem to be financed mainly by financing cash flows, which included INR 106 crores as other financing items.

Efficiency Ratios

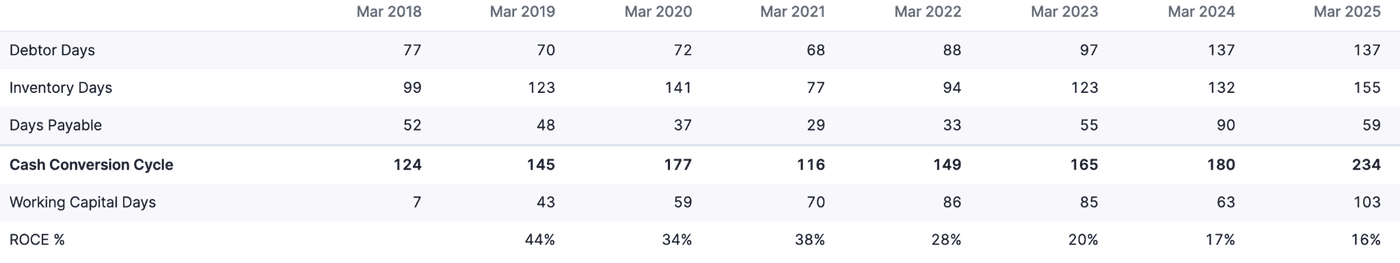

Debtor and inventory days have seen an ever-increasing trend, which is not good. The cash conversion cycle of 234 days is on the higher side, but not unseen in the industry. Glenmark has a cycle that is similar to Sigachi, but the sweet spot for the industry lies in the range of 100 to 130 days.

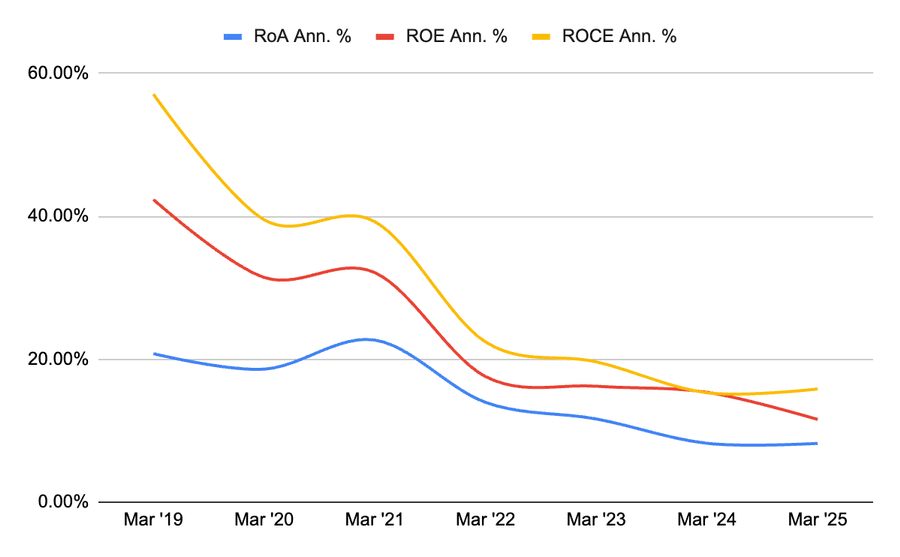

Book value per share has decreased because shares have increased. ROA, ROE, and ROCE have seen a declining trend. While this is not a good indicator, this is primarily a result of the increased asset base. As we have seen earlier, reserves as well as equity capital have increased significantly due to reinvestment of earnings. Therefore, these ratios have been hit.

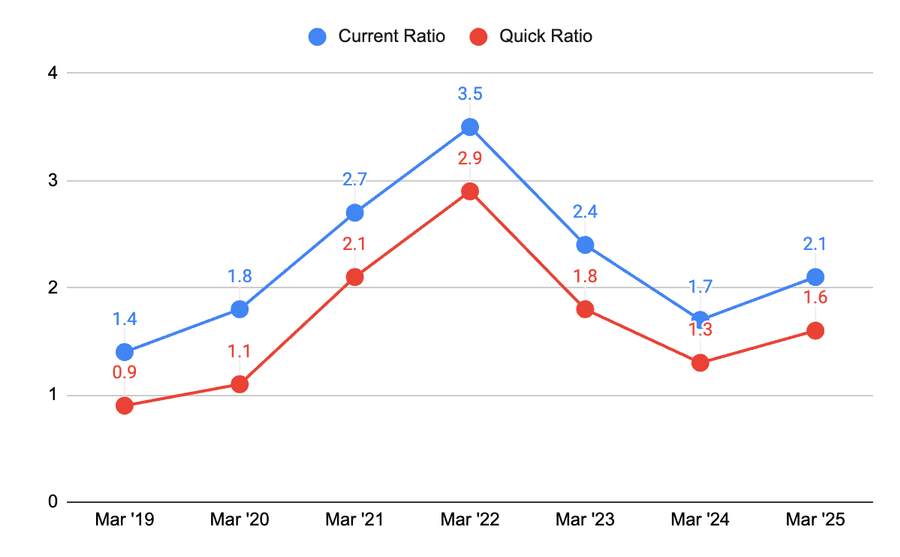

Liquidity Ratios

Liquidity ratios have decreased in the past but have picked up recently. They are similar to the average of the pharma industry and are affected by cyclicality.

Earnings retention is more than 95% over the past years and again shows confidence in the management and the promoters.

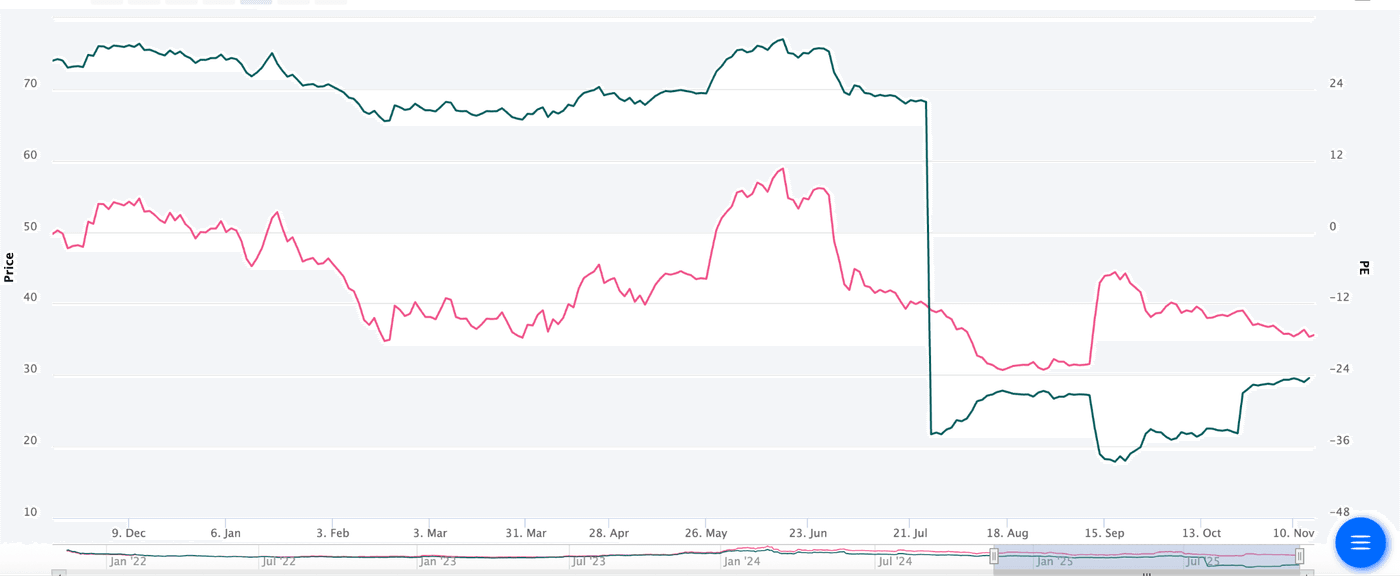

Current Stock Price

Let’s see how the prices have evolved since the Hyderabad incident.

Before the incident happened, the stock was trading at around INR 55 with a P/E of 30. This PE is near to industry average for pharma in India, so one indication that the stock was fairly priced. A week post-incident, the stock was trading at an average PE of around 24, which accounted for the estimated loss.

We have also seen that somewhere around 70 crores worth of recoveries is expected and should go into the Q3 or Q4 profits as they are realized. And again, markets would have somewhat accounted for it, but not all until they are actually received as Income. While estimating stock price is hard, some juice is left in the stock, and macroeconomic tailwinds should set it sailing.

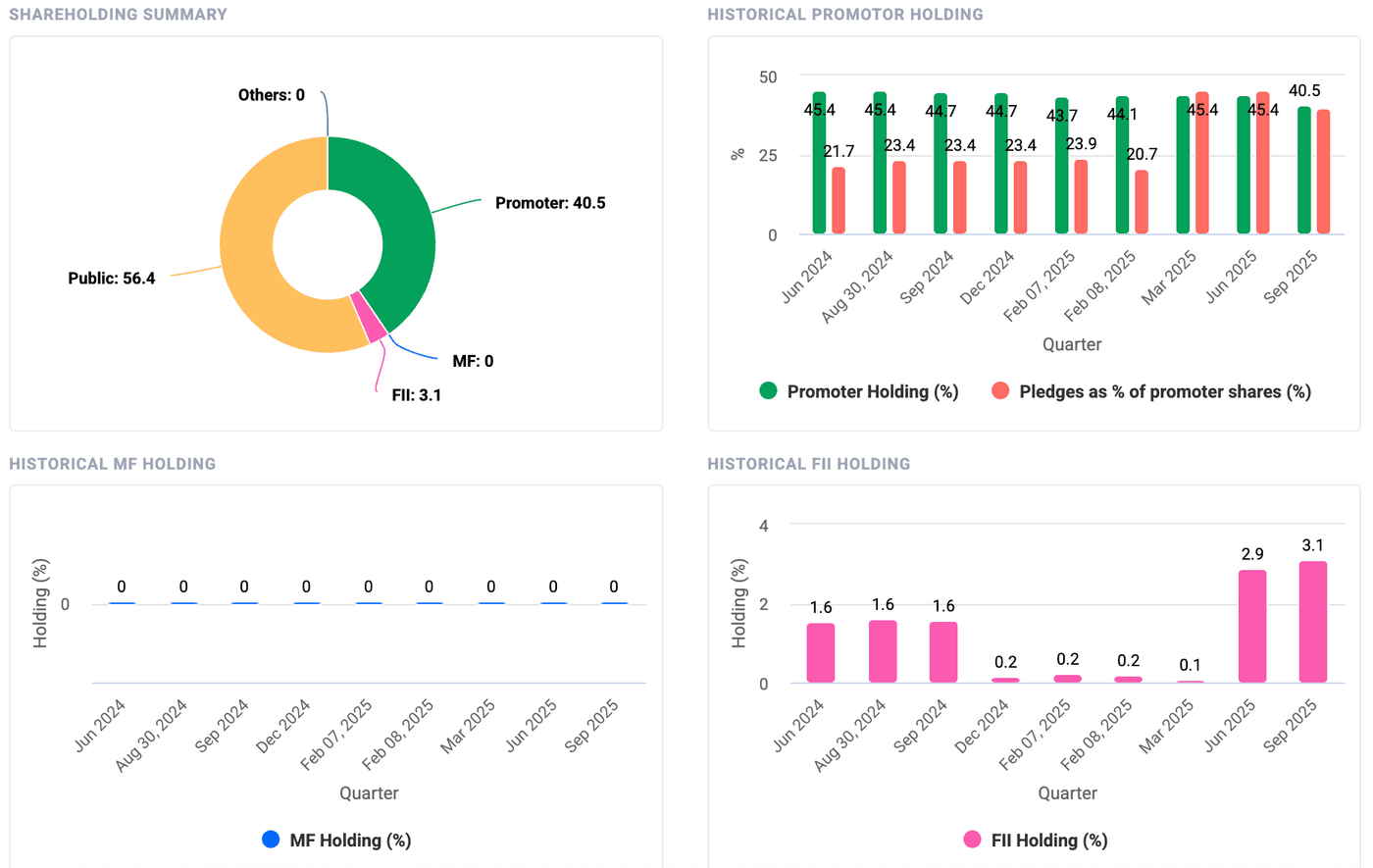

Shareholding Summary

Over the past 17-18 months, promoters have decreased their holdings by nearly 5% which is a cause for concern but needs to be investigated. Shares pledged as a percentage of total shares for promoters has risen to 45.4% but has recently fallen back to 40.5% which is still high. This happened because nearly 4% of the shares of promoters were repaid under loan-against-shares (LAS) renewal, and is not related to the incident. Promoters insisted during the conference call that they will increase shareholding in the long run and have no plans currently to pledge more shares, but a requirement may arise in the future.

FIIs seem to have found interest in the stock and have lapped up nearly 3% of the shares in the past six months or so. Some of this is likely to come from pledged shares coming into the market. Institutional investor increasing their holdings is a good sign since they have better resources to analyse the stock and would make sound financial decisions.

Filling the Pills

Sigachi has been a resilient company and has seen its revenue not take a bit hit. Companies of this size can see high volatility in quarterly revenues, which is not the case with Sigachi. The Hyderabad plant explosion was a major setback, and the stock price seems to have accounted for it. However, the company still has positives, which include:

- High MCC demand across the pharma sector

- Growing Indian pharmaceutical industry (projected to reach $120–130 billion by 2030.

- Expansion of R&D, patent additions, and a new API R&D facility

- Annual revenue remains stable, and operating profit remains positive despite the Q1 hit.

- Cash flows remain generally healthy; heavy capex is tied to new plants.

- Earnings retention is high (>95%)

- FIIs have increased their stake by ~3%, signalling renewed interest.

The risks faced by the company include:

- Reserves and fixed assets fell in Sept 2025 due to write-offs and compensation.

- Efficiency ratios have weakened, with rising inventory and debtor days.

- ROA, ROE, and ROCE declined due to a larger asset base.

- Promoter shareholding dropped ~5% in 18 months, and pledged shares remain high (~40%).

The stock seems to have juice left, and with high revenue growth and capacity expansion, the company can enhance its market share in the near future. Production has shifted to Gujarat, but full capacity utilization may still take time. The new plant is likely to be operational in FY 2027, which seems far away. We continue to track developments closely.