PPAP - Sealing Your Ride

Have you ever opened the trunk of the car and seen this paint smeared without any precision? It might make you think if the dealership sold you an accidental vehicle. And you will not be alone if you think so, because a lot of people make this mistake.

You see, this is a sealant smeared to prevent leakages in your car and also to prevent water from hitting the wheels coming into your car through microscopic cracks in the welding. More importantly, it prevents rusting where there is welding or where two sheets of metal are joined.

Now, cars use sealant and sealing rings, and gaskets in a large number of places. You see them in CAR doors, a rubber line running through to keep noise and water away. You see a gasket when you lift up your hood like this.

One of the most important sealing gaskets is the head gasket of the engine, which seals the combustion gases in and does not allow them to escape. Any leakages can lead to a blast.

Anyways, you get the gist. Sealing components or materials are very important and all car manufacturers need. And generally, they do not manufacture it themselves but provide specifications to manufacturers specializing in making them.

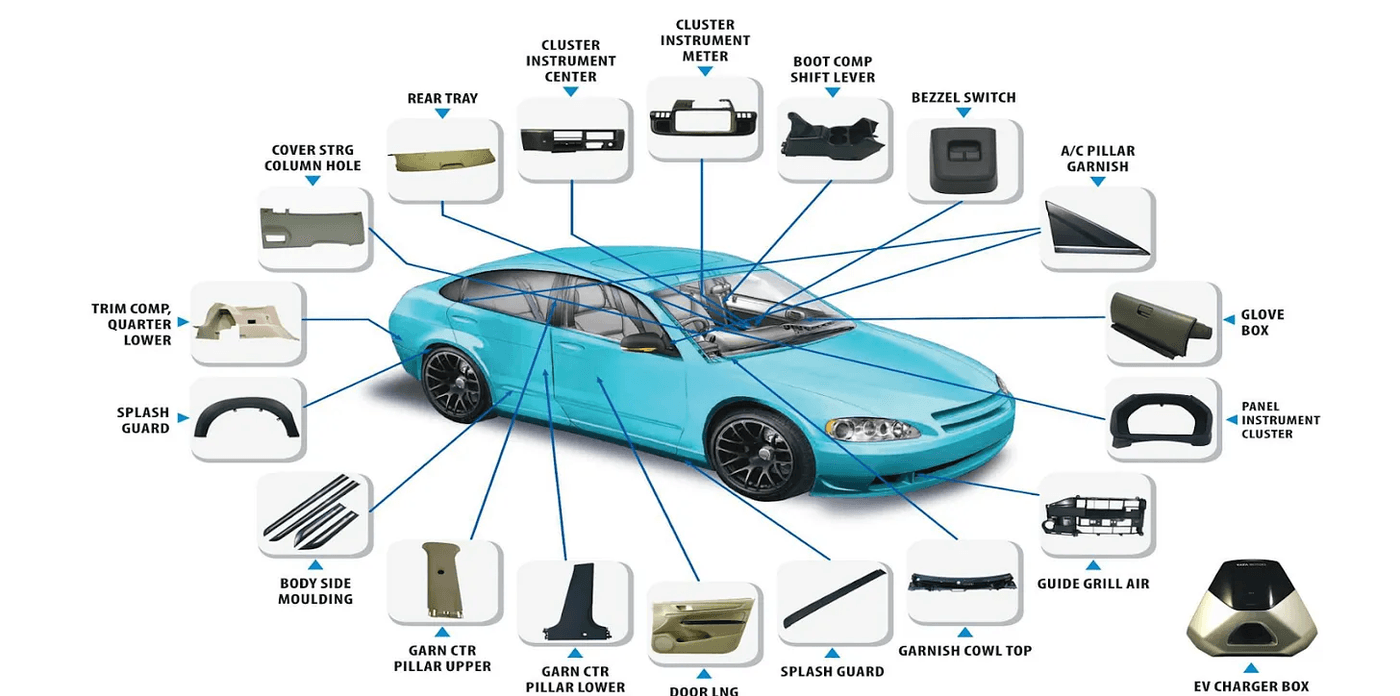

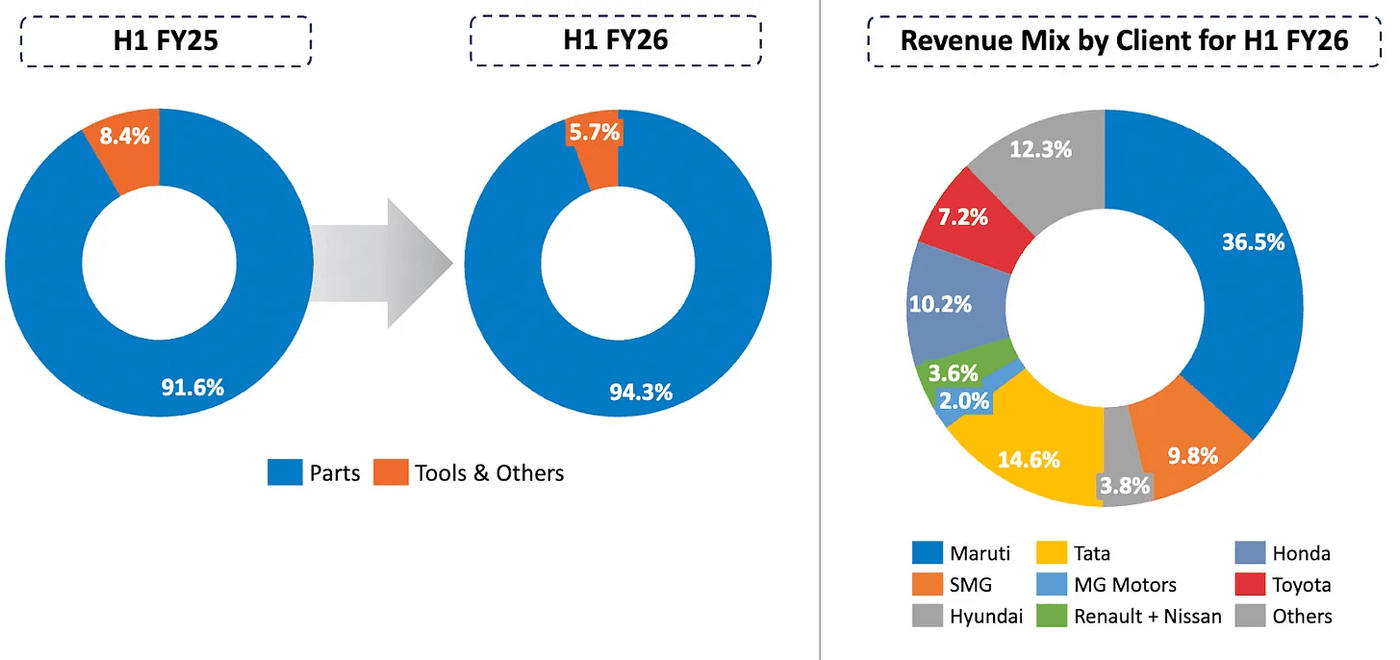

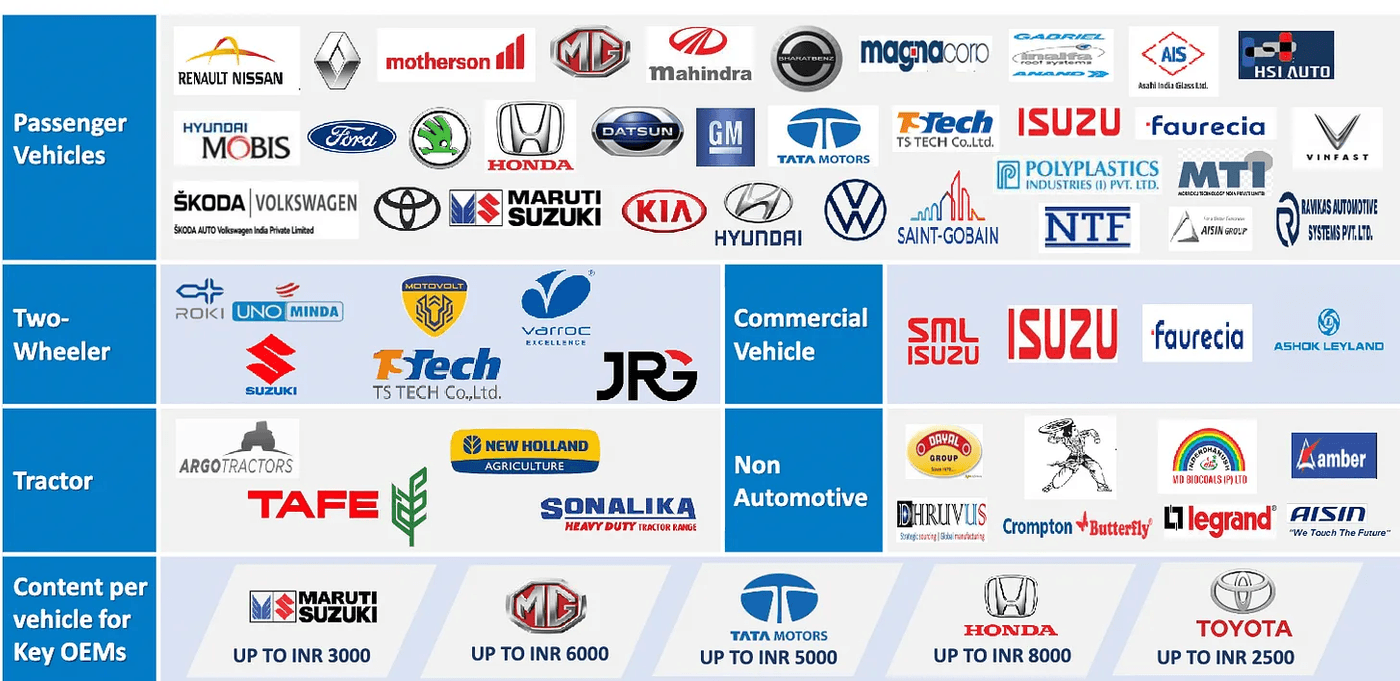

PPAP is one of those manufacturers and has different business verticals, but most of its revenue comes from Automotive parts. Automotive Parts (PPAP Tokai India Rubber Private Ltd), which makes advanced automotive body sealing systems and high-quality interior and exterior injection-molded parts. This is the main business and accounts for 94.3% of the total revenues based on the latest results.

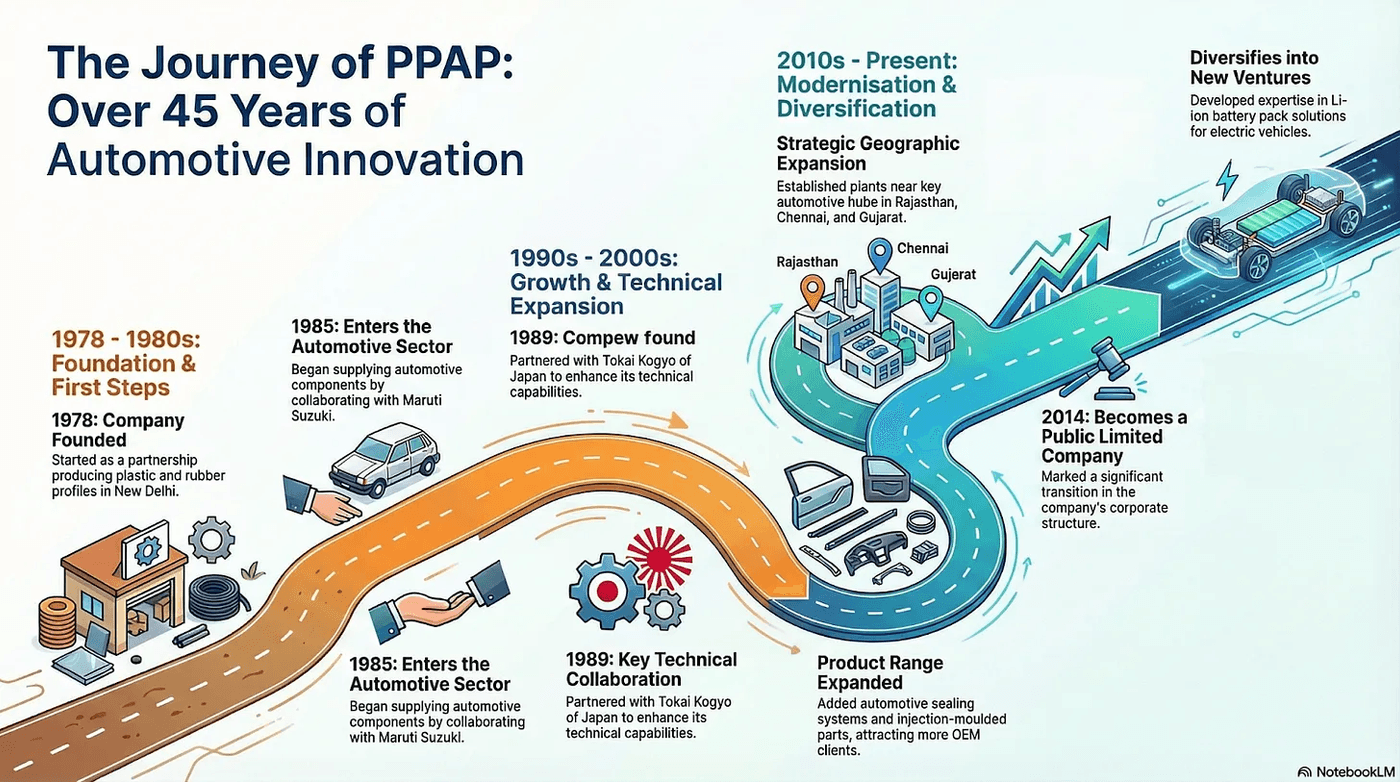

History:

PPAP has been in operation for the past 45 years and has been catering to the Indian Automakers. Major Milestones can be attributed to inflexion points in its history:

Early Days & Foundation (1978-1980s) -

Started as a partnership firm, “M/s Precision Pipes and Profiles Company in New Delhi, focusing on plastic and rubber profiles.\

- 1980: Started manufacturing unit in Delhi’s Mayapuri Industrial Area.

- 1985: Started supplying automotive components for the first time by collaborating with Maruti Suzuki

Growth & Expansion (1990s - 2000s)

- 1989: Entered a technical collaboration with “Tokai Kogyo Company Limited, Japan and expanded its product range to include automotive sealing systems and injection-moulded interior/exterior parts, adding more OEMs as clients.

Modern Era & Diversification (2010s - Present)

- Strategic Reshift and Expansion: Moved the centre of gravity from Noida to establish plants closer to automotive hubs (Rajasthan, Chennai, Gujarat) for better service.

- 2014: Converted into a public limited company.

- New Ventures: Developed expertise in high-precision plastic tooling and, more recently, Li-Ion battery pack solutions for electric two and three-wheelers.

- Focus: Continues to serve automotive & industrial sectors, emphasising quality, innovation (ESG, electrification), and customer-specific solutions.

The automotive parts division has nearly 3500 different types of products that it sells, catering to a wide variety of parts for car/bike OEMs. In addition, it has nearly 300 products under development which should help in growth.

While the major focus and revenue source is the automotive division, PPAP has other divisions which are likely to help in future growth and diversify its revenue sources. These include:

- Commercial Tool Room - which makes plastic injection molds for automotive and other industries.

- Li-ion Battery Business - makes batteries for electric vehicles and other industries.

Clientele-Major Indian Automakers

The client distribution for PPAP is similar to how market share for car OEMs in India is. SMG here is also a division of Maruti, and the total share of Maruti is around 42%-45%. Similarly, the market share of Toyota is around 8%. This indicates PPAP’s destiny is highly correlated with the Indian automotive market.

Financials:

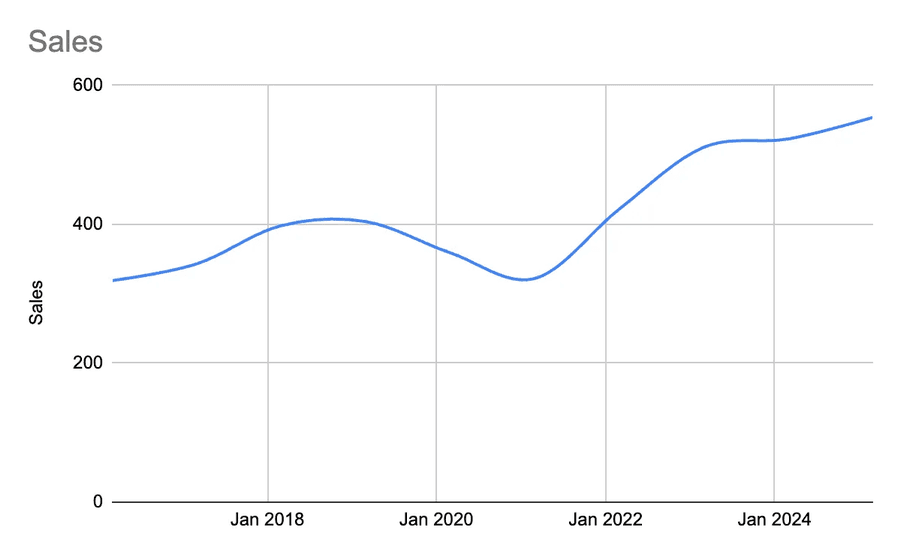

The company has been able to remain in operation for nearly half a century now and is growing stronger. This is an indication of the stability and performance of the company. We start off with how it does on the revenue front.

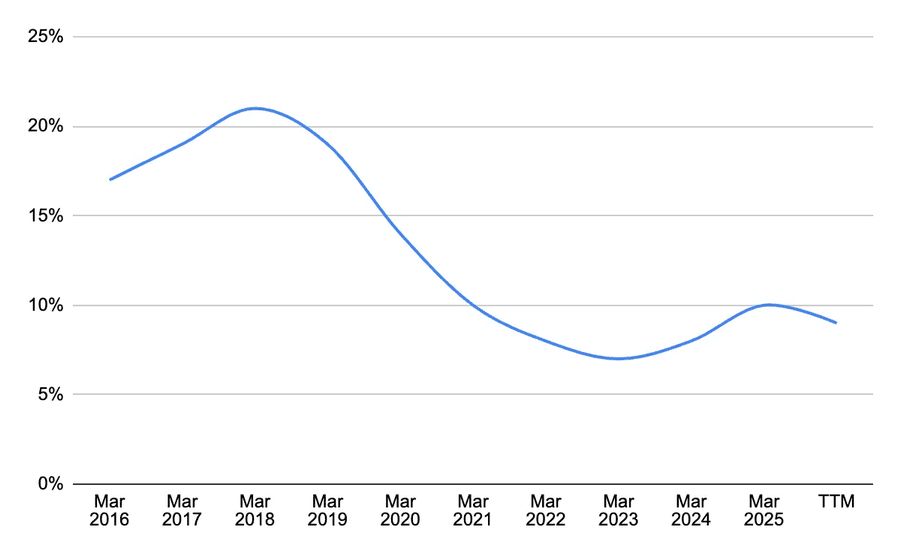

The operating margins have been decreasing, which can be improved. However, it is still near the average of the industry. But we still need to keep this in consideration.

Operating Margin

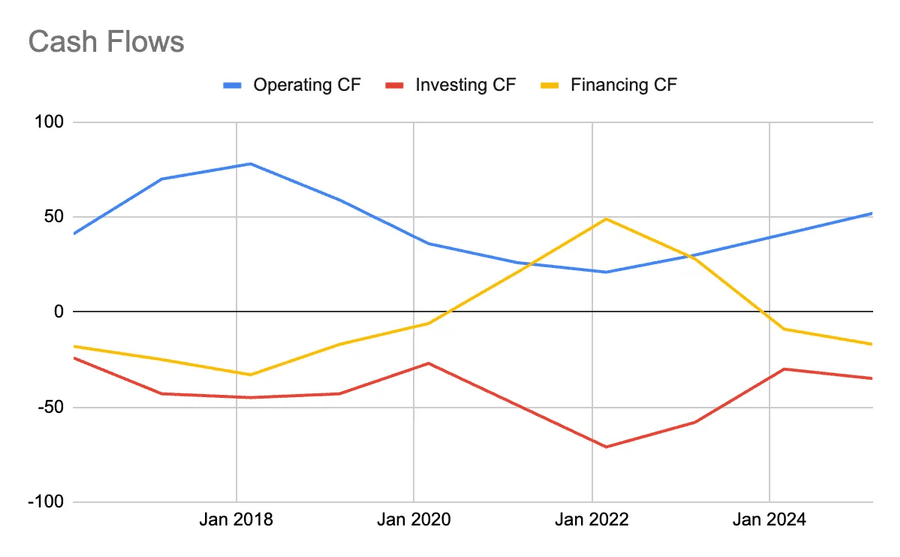

The cash flows have been good, and operating cash flows seem to have improved lately, which is a good sign.

The return on capital employed has decreased over the years. Has picked up in the last year but still remains subdued. It is still significantly below the industry average. The company has been investing in new ventures, and that is one of the reasons, but until they yield good sales, especially in the battery sector, the return on capital is likely to be subdued.

Indian Auto Industry and The Macroeconomic Condition

We have already established that PPAP and indian automakers are linked to a considerable extent. It is therefore imperative that we discuss the indian auto industry and the macroeconomic opportunities and constraints. Let’s begin with the macroeconomic basis.

The recent quarter GDP shows a real GDP growth of 8.2% which is the highest in the major economies. The nominal GDP growth is 8.7% which indicates an inflation of approximately 0.5% for the quarter. The most recent monthly inflation rate is around 0.25%. Now the statistics might not tell the complete story. GDP growth is good, but subdued inflation, for a growing economy like India, is not necessarily good. It can signal low demand, and since GDP can lag the actual economic condition, we need to look at the numbers holistically.

The nominal GDP, when the economy grew 8-10% consistently, was around 15% and this, coupled with an inflation of 5%-6% is something of a sweet spot for India. Inflation at either extreme does not bode well. Other indicators, such as foreign investments, job creation and private investments, are not up to the mark.

For example, GST collection in October increased only 4.6% YoY, while in November it grew only 0.7% YoY. This number during the last quarter, July to September, grew 7.5%, 6.5% and 9.1% which is similar to the reported GST figures. So if this is the case, the next quarter can be worse.

The auto industry is expected to grow 7-8% for the next decade or so. This growth is not extraordinary if not subdued. This is when considering that the expected growth materialises.

What’s keeping PPAP interesting: The growth story:

We have discussed how the macroeconomics may not be very exciting but PPAP shows promise and is not easy to write off due to a number of industrial and macroeconomic factors. The company has a good history of working with large OEMs and is ingrained in the industry. Large OEMs depend on it for their needs, and it is not easy to move to a different supplier. The recent quarter has seen mixed results. Some of the factors to consider include:

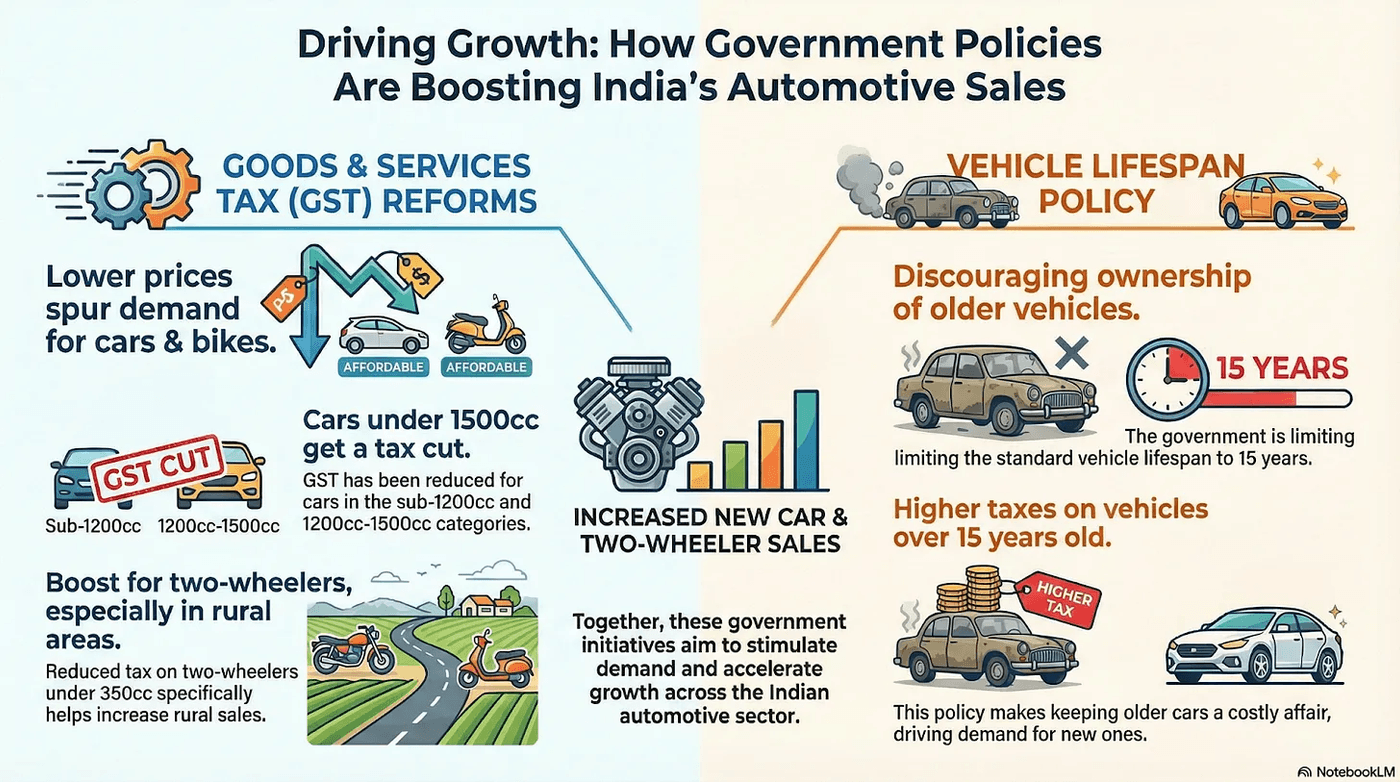

- Indian Automotive sector is rebounding with structural changes due to the new GST regime. As a result, Q3 shows a lot of promise. The most recent festive season saw 78% of the cars sold being sub 10 lakh rupees, with total sales up 40.5% YoY.

One reason can be that the buyers might have been putting off their purchase to the new, lower GST norms come into place, but still this is a high growth. This is the positivity that is needed, as this should translate into a revenue rise of a similar kind for PPAP. However, a caveat here is that this increase should continue for at least 2-3 quarters to be sustainable

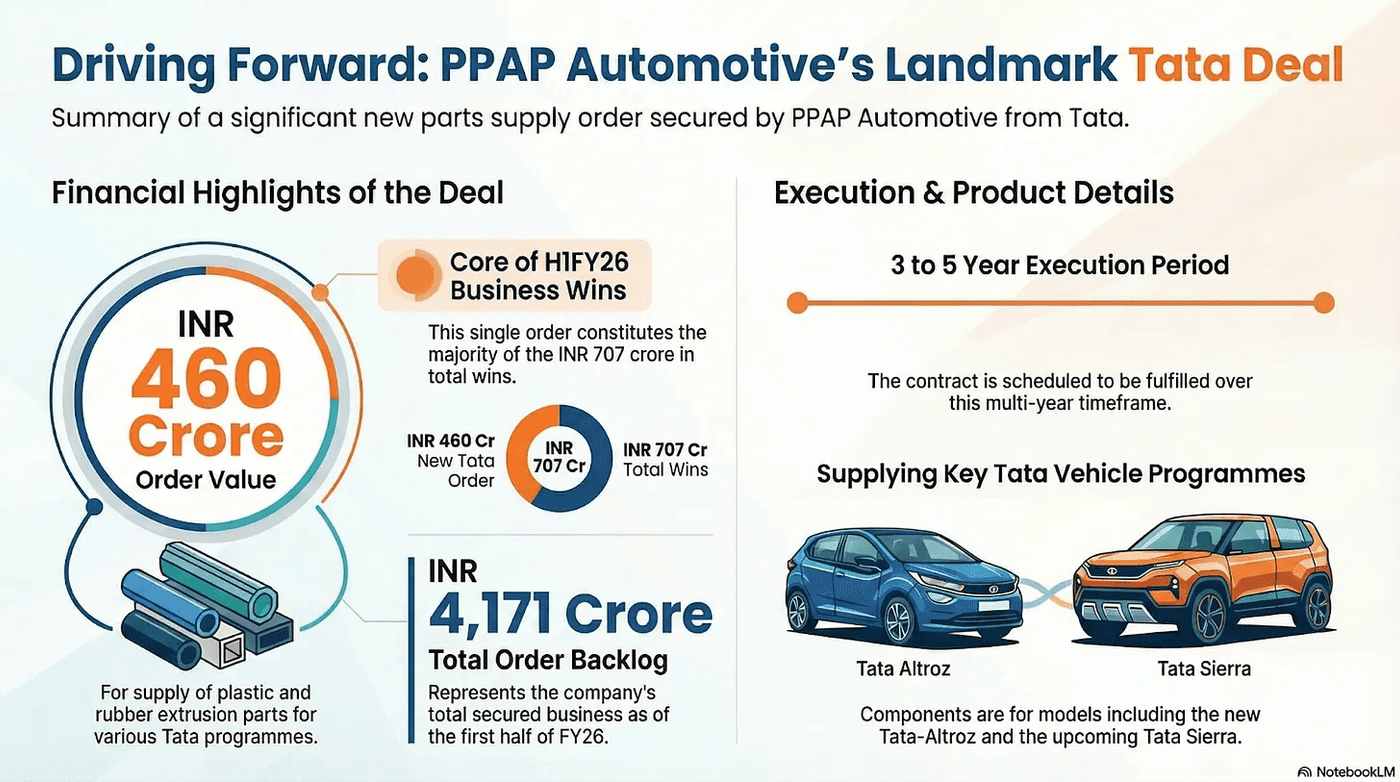

- Order from TATA: New order from Tata worth INR 460 crores signed for the supply of both plastic and rubber extrusion parts. The company booked a lifetime order of ~INR 707 Crore in Q2FY26. So the sales might have been muted, but new orders scaled greater heights. TATA Sierra is expected to start production in November, and it has also started supplying components for other new programs, including the Tata Altroz. All in on the order front, the company has expanded its order book.

- GST Reforms: The GoI reduced GST on sub-1200cc and 1200cc-1500cc cars, which is likely to enhance sales volume, in turn leading to higher business volume for PPAP. GST for 2-wheelers below 350cc has also been reduced.

Now this does two things: it reduces prices to a large extent and enhances the demand and sales of cars and bikes. Reduced GST on smaller cc categories 100-125 of two wheelers also help and increases sales for rural customers too.

On the policy front, the government has been limiting the life span to 15 years. Beyond this, higher rates of taxation apply, making older cars a costly affair. This increases demand for new cars.

- Revenue Guidance: The management seems very confident about the INR 575 crores to INR 600 crores revenue guidance for the financial year. This means that H2 is expected to yield somewhere around INR 320-370 crores in sales, which is good performance. The management summarised this with FY 26 expected EBITDA around INR 60 crores to INR 65 crores and PAT in the range of INR 10 crores to INR 12 crores. This will be a significant leap from the current financial position, which indicates a TTM PAT of only INR 2 crores.

Valuation Metrics:

P/E Ratio

The P/E ratio is very high, at around 179, which would indicate a very overvalued stock, more so when the industry P/E ratio is around 30, but the thing to consider is the fact that the earnings are subdued due to the factors considered before. As per management estimates, if the PAT of INR 10 crores materialises, this should bring down P/E by around 5 times, since the TTM PE is around 2. At this earnings level P/E ratio should go down to approximately 35, which brings it in the home stretch of the industry.

Market to Book Value

Another metric which shows a completely different story than the P/E ratio is that the market-to-book value is low, at around 1.1. This indicates that the stock is not overvalued, and with good industry tailwinds, it should do better. Book value also increased because the company invested in new verticals, especially tooling and the new battery business.

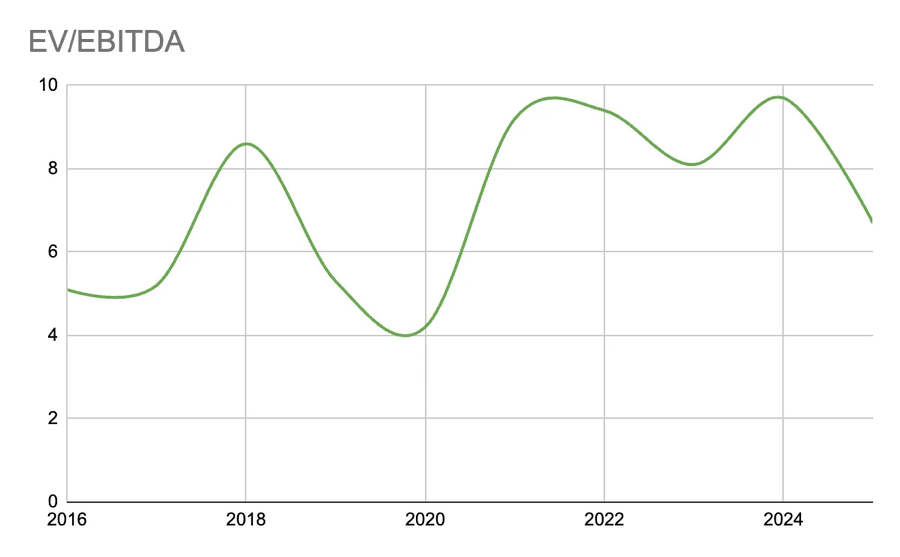

EV/EBITDA

EV/EBITDA has fallen recently. One of the reasons is that some of the operational costs would go into new ventures which did not yield significant revenue. Additionally, the auto sector has provided mixed results. While the car sales have increased, total auto sales have not reached the pre-COVID numbers yet.

A lower ratio would also indicate undervaluation. For PPAP, a good metric is that since car sales have increased, it should do well. But it has not been able to do so. Sales have increased in correlation with the sales of cars, but as we have seen earlier, the operating margins have decreased substantially, from above 20% to nearly 10% now.

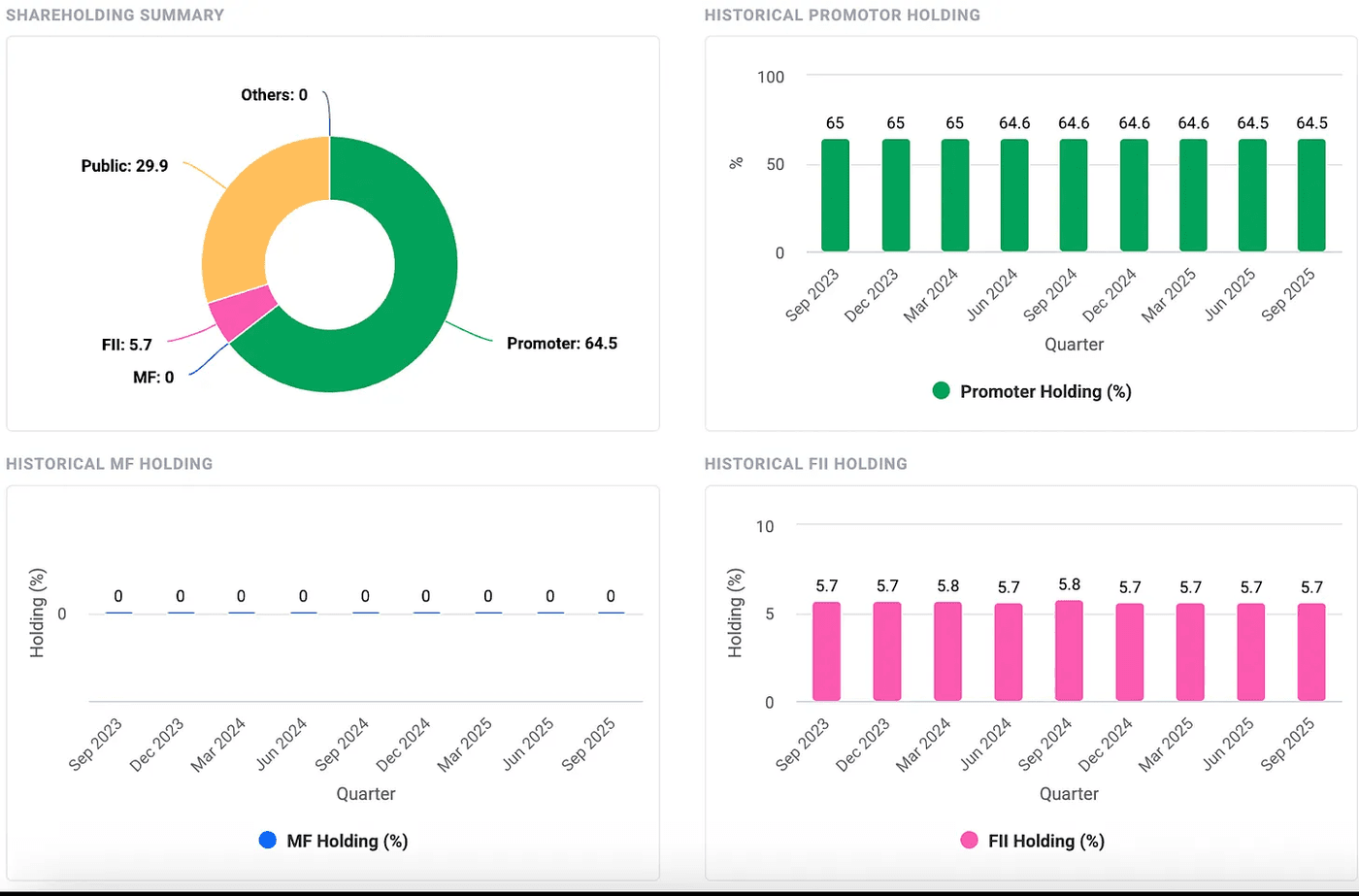

Shareholding Summary:

Shareholding patterns show that promoters have not decreased their holdings, which means that they are working hard to make the company more profitable. FII have also maintained their holdings which provides a vote of confidence.

Sailing the Automotive Tempest:

One thing that hits PPAP is the costs. It has not been able to cover the costs. Sales have increased on an annual basis, but so have costs, which have seen a higher rate of increase over the past few years. Now the company stares at how to revamp itself. Costs are not in its control to a large extent. But it can grow other verticals, especially the battery and the tools verticals.

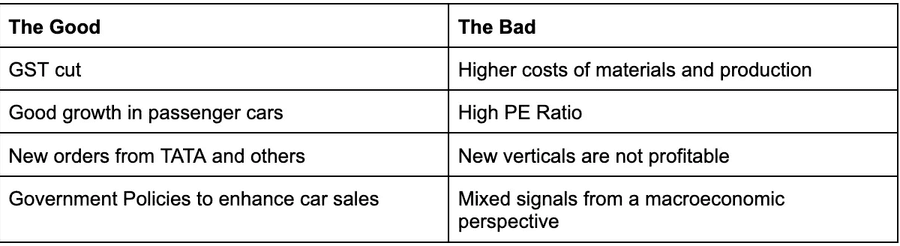

With the GST decrease, there is likely to be increased demand, but we need to see how long it lasts. Car sales have been increasing in India, which is good. Let’s sum up the positives and the negatives.

General Disclaimer and Release Nothing contained herein constitutes tax, legal, insurance or investment advice, or the recommendation of or an offer to sell, or the solicitation of an offer to buy or invest in any investment product, vehicle, service or instrument.